Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

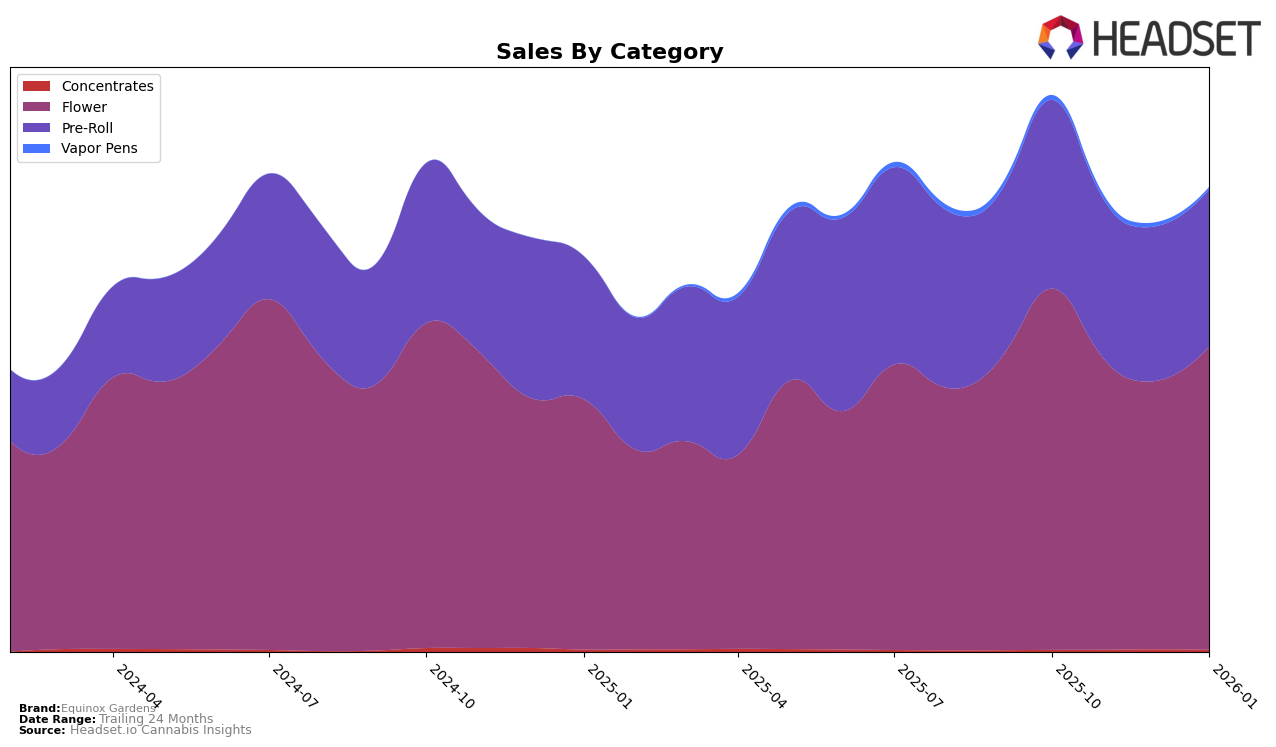

Equinox Gardens has demonstrated a notable performance within the Colorado market, particularly in the Flower category. Despite experiencing a dip in their ranking from 9th in October 2025 to 12th in December 2025, they managed to recover by January 2026, climbing back to the 9th position. This fluctuation suggests a resilient brand presence and adaptability in a competitive market. However, the sales figures reveal a downward trend from October to December, with a slight rebound in January, indicating potential seasonal influences or shifts in consumer preferences. The absence of Equinox Gardens in the top 30 brands in the Flower category in Washington highlights a significant challenge or opportunity for growth within that state.

On the other hand, Equinox Gardens has maintained a consistent presence in the Pre-Roll category within Washington. They started at the 7th position in October 2025 and, despite a slight drop to 11th in December, stabilized at 10th by January 2026. This stability in ranking, coupled with relatively steady sales figures, suggests a loyal customer base and effective market strategies in this category. The brand's absence from the top rankings in the Flower category in Washington, contrasted with their steady performance in Pre-Rolls, might indicate a strategic focus or consumer preference that could be further explored for potential expansion or reinforcement in other categories.

Competitive Landscape

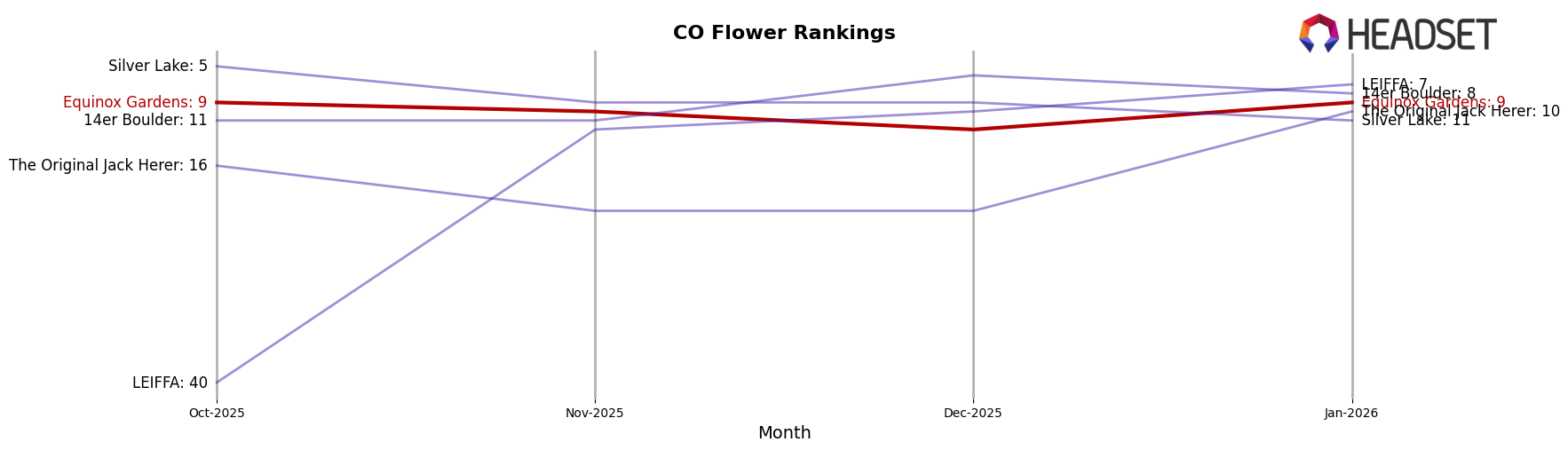

In the competitive landscape of the Colorado Flower category, Equinox Gardens experienced fluctuating rankings from October 2025 to January 2026, reflecting a dynamic market environment. Starting at 9th place in October 2025, Equinox Gardens saw a dip to 12th in December before rebounding to 9th in January 2026. This volatility is noteworthy given the performance of competitors like LEIFFA, which climbed from 40th in October to an impressive 7th by January, indicating a significant upward trajectory in sales. Meanwhile, Silver Lake maintained a relatively stable presence, though it slipped from 5th to 11th over the same period, suggesting potential challenges in sustaining its earlier momentum. 14er Boulder also demonstrated resilience, improving its rank from 11th to 8th by January. These shifts highlight the competitive pressures Equinox Gardens faces, emphasizing the need for strategic adjustments to maintain and improve its market position amidst evolving consumer preferences and competitive dynamics.

Notable Products

In January 2026, Gelato Cake (14g) maintained its top position as the leading product for Equinox Gardens, with sales reaching 1764 units. Following closely, Cookies & Chem Shake (14g) debuted impressively at the second position. White 99 (14g) climbed to third place, marking a significant rise from its previous absence in rankings. Cookies & Chem Popcorn (14g) secured the fourth spot, showing strong market entry performance. Notably, Lucinda Williams (14g) experienced a drop to fifth place after consistently being in the top three in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.