Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

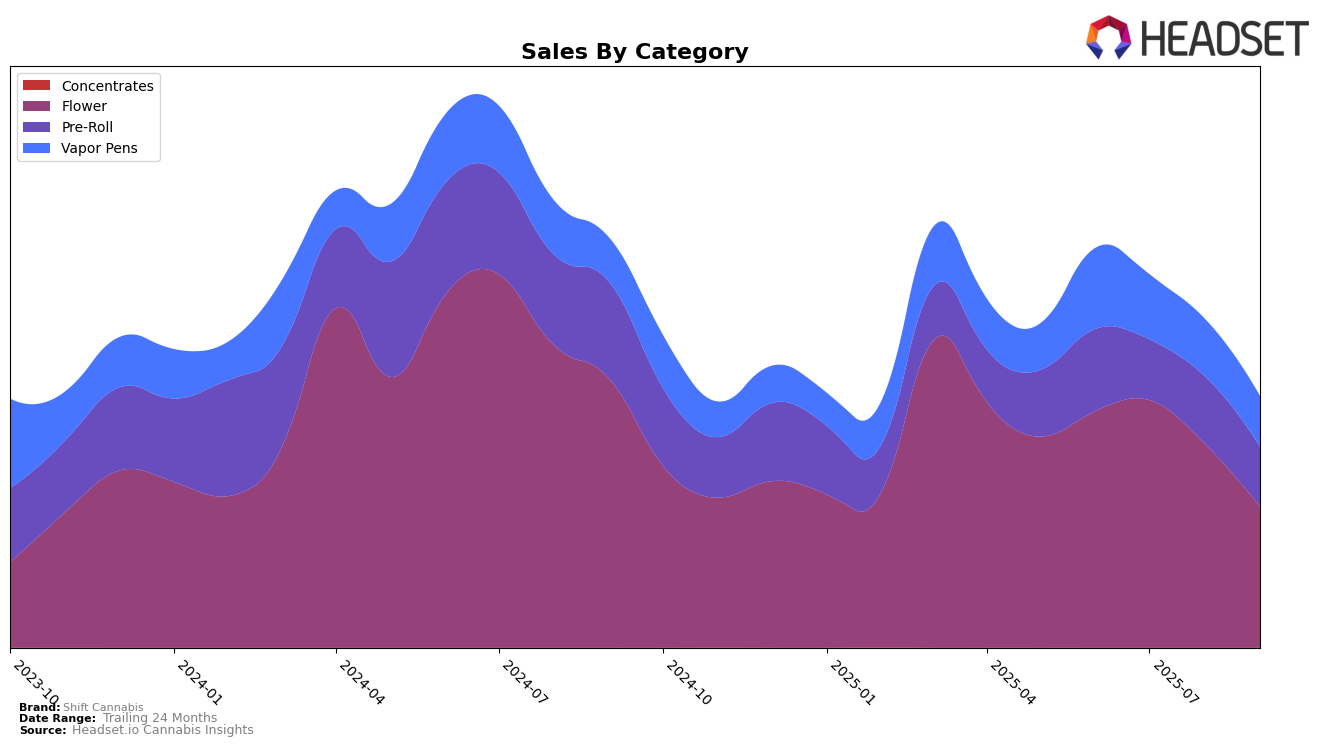

Shift Cannabis has shown varying performance across different product categories in Colorado. In the Flower category, there has been a noticeable decline, with the brand dropping from the 16th rank in June 2025 to falling out of the top 30 by September 2025. This downward trend is accompanied by a decrease in sales, indicating potential challenges in maintaining competitiveness in this segment. Conversely, in the Pre-Roll category, Shift Cannabis has demonstrated more stability. Despite a brief dip in July 2025, where they ranked 35th, they managed to regain their position to 27th by September. This suggests a resilience in their Pre-Roll offerings, maintaining consistent sales figures even amidst fluctuating rankings.

In the Vapor Pens category, Shift Cannabis has experienced a steady decline in rankings, starting from 41st in June 2025 and slipping to 50th by September. This trend reflects a broader challenge in capturing market share within this competitive segment. The sales figures mirror this downward trajectory, hinting at potential areas for strategic improvement. Interestingly, the absence of a top 30 ranking in September for the Flower category highlights a significant gap that Shift Cannabis may need to address to regain its foothold. These movements across categories and rankings provide a snapshot of the brand's current positioning and potential areas for growth and focus within the Colorado market.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Shift Cannabis has experienced notable fluctuations in its ranking over the past few months. Starting strong in June 2025 with a rank of 16, Shift Cannabis maintained its position in July but saw a decline to 23 in August and further to 33 in September. This downward trend in rank suggests a competitive pressure from brands like Bloom County, which, despite a significant drop from 10 in June to 36 in September, still managed to impact Shift Cannabis's standing. Meanwhile, LEIFFA showed a positive trajectory, climbing from 52 in June to 30 in September, potentially capturing market share that might have otherwise gone to Shift Cannabis. Similarly, NOBO improved its rank from 38 in June to 31 in September, indicating a competitive edge in the market. These shifts highlight the dynamic nature of the Colorado flower market and underscore the importance for Shift Cannabis to strategize effectively to regain and sustain its competitive position.

Notable Products

In September 2025, Juicee J (Bulk) from the Flower category maintained its position as the top-performing product for Shift Cannabis, with sales reaching 5,350. Following closely, First Class Funk (Bulk) climbed to the second position, improving from its fifth-place ranking in July 2025. Oreoz (Bulk) held steady in third place, although its sales figures have decreased since its peak in July. Dankarooz Pre-Roll (1g) entered the top five for the first time, securing the fourth spot. Sour Chillz #7 Pre-Roll (1g) also made its debut in the rankings, coming in fifth for September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.