Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

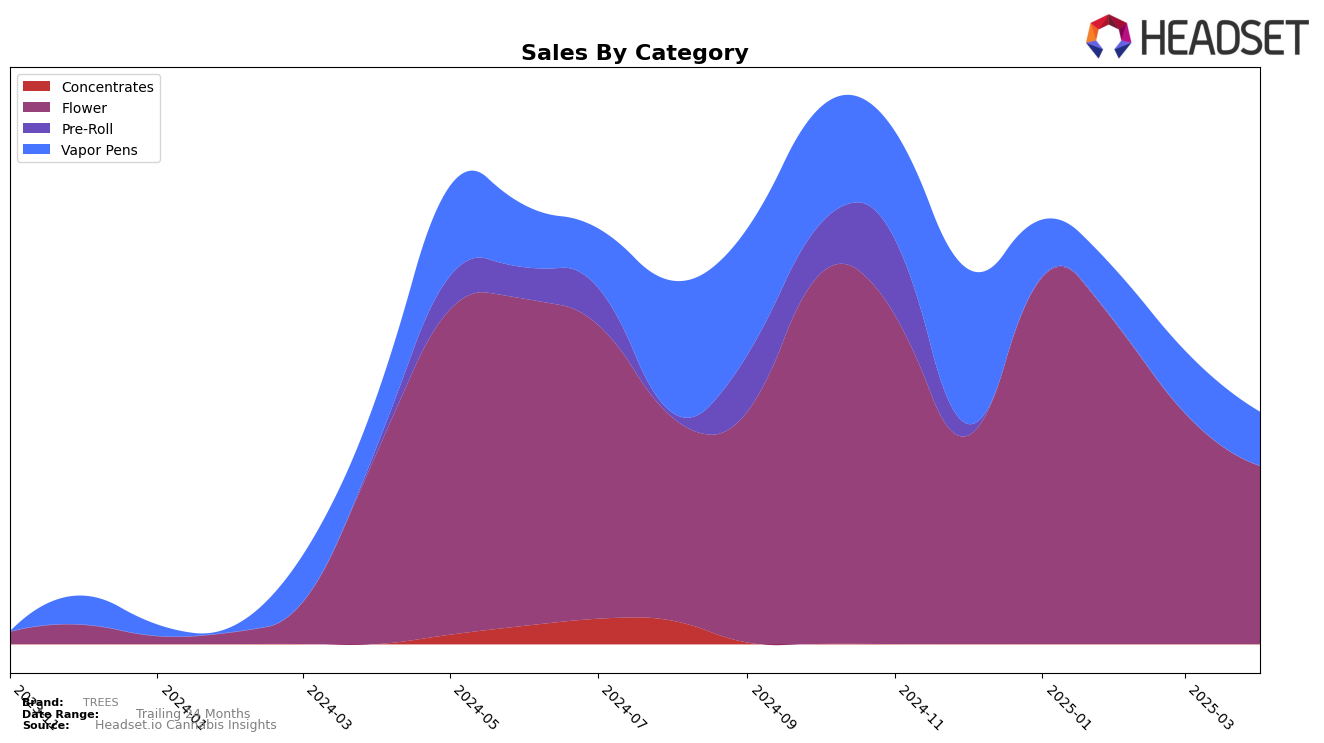

In the state of Colorado, TREES has experienced noticeable shifts in its performance across different product categories. In the Flower category, TREES began the year 2025 with a strong position, ranking 7th in January. However, over the subsequent months, there was a decline in their ranking, reaching 16th by April. This downward trend is mirrored by the sales figures, which show a steady decrease from January to April. On the other hand, in the Vapor Pens category, TREES has not managed to break into the top 30, with rankings hovering around the 47th and 51st positions. This consistent lower ranking suggests challenges in gaining a competitive edge in the Vapor Pens market within Colorado.

The decline in TREES' Flower category ranking in Colorado from 7th to 16th over four months could be indicative of increased competition or shifts in consumer preferences. The Vapor Pens category presents a more concerning picture, as TREES never reached the top 30, indicating a potential area for improvement or strategic reevaluation. The sales trend in Vapor Pens, despite an initial increase in March, ultimately declined again in April, reinforcing the need for TREES to reassess their market strategy in this category. While the data highlights some challenges, it also opens up discussions on potential opportunities for TREES to innovate and capture more market share.

Competitive Landscape

In the competitive landscape of the Colorado flower category, TREES has experienced notable fluctuations in its market position from January to April 2025. Starting strong in January with a rank of 7, TREES saw a decline to 16 by April. This shift in rank is significant, especially when compared to competitors like Billo, which maintained a relatively stable position, ranking 12 in January and only dropping to 14 by April. Meanwhile, Shift Cannabis made an impressive leap from 29 in January to 9 in March, although it settled at 15 in April. This indicates a dynamic market where TREES faces stiff competition, particularly from brands that have shown the ability to quickly ascend the ranks. The sales trajectory for TREES also reflects this competitive pressure, with a noticeable decrease from January's peak, suggesting a need for strategic adjustments to regain its earlier standing and bolster sales against these agile competitors.

Notable Products

In April 2025, the top-performing product for TREES was the Lucky Leprechaun Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 3083 units. Following closely was the Guptilla Kush Distillate Cartridge (1g), also in the Vapor Pens category, which achieved the second rank. Caked Up Cherries in the Flower category improved its position, moving up from fourth in March to third in April, with a notable increase in sales. Golden Goat Popcorn also in the Flower category maintained a strong presence, holding the fourth position consistently from March to April. Cherry Slimeade Popcorn, another Flower product, entered the top five in April, showcasing a steady performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.