Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

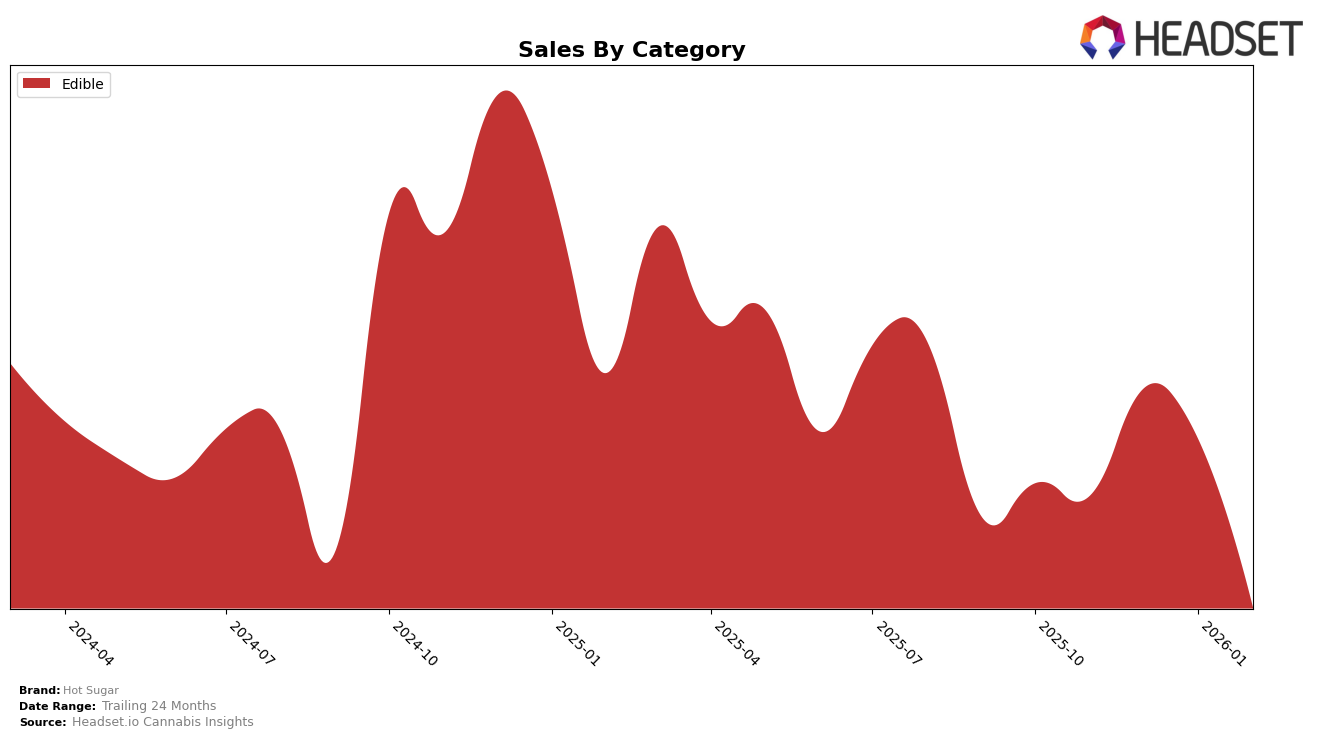

Hot Sugar has maintained a consistent performance in the Edible category in Washington, holding steady at the third position from November 2025 through February 2026. Despite a slight dip in sales from January to February, the brand's ability to sustain its rank over these months indicates a strong market presence and consumer loyalty. This consistent ranking in a competitive category highlights Hot Sugar's capability to maintain its appeal and market share, even amidst fluctuating sales figures.

Interestingly, while Hot Sugar has secured a solid position in Washington's Edible category, the absence of rankings in other states or categories suggests potential areas for growth or challenges in market penetration. The lack of a top 30 ranking in other regions or categories could be seen as a gap that the brand might want to address to expand its footprint. This presents an opportunity for strategic initiatives to boost visibility and sales performance in untapped markets, potentially replicating the success seen in Washington.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Washington, Hot Sugar has consistently maintained its position as the third-ranked brand from November 2025 through February 2026. Despite a slight dip in sales from January to February 2026, Hot Sugar has shown resilience in its ranking, indicating a stable market presence. Its competitors, such as Wyld, which holds the top spot, and Green Revolution, at second place, have significantly higher sales figures, suggesting a competitive gap that Hot Sugar might aim to close. Meanwhile, Journeyman and Craft Elixirs, ranked fourth and fifth respectively, have not posed a direct threat to Hot Sugar's position, as they trail behind in sales. This stability in ranking amidst fluctuating sales highlights Hot Sugar's strong brand loyalty and market strategy, yet underscores the need for strategic initiatives to increase market share against top competitors.

Notable Products

In February 2026, Sour Watermelon Fruit Drop 10-Pack (100mg) maintained its position as the top-performing product for Hot Sugar, continuing its streak as the number one ranked item with sales of 3892.0. The Peach Mango Fruit Drop 10-Pack (100mg) held onto the second spot, showing a consistent upward trend from fourth in December 2025. CBN/THC 1:1 Huckleberry Gummies 10-Pack (100mg CBN, 100mg THC) remained steady in third place, despite a slight decline in sales since November 2025. Green Apple Fruit Drop 10-Pack (100mg) improved its ranking slightly, moving up to fourth place from fifth in the previous months. Indica Blue Raspberry Live Resin Gummiez 10-Pack (100mg) re-entered the rankings at fifth place, indicating a resurgence in popularity after a period of no recorded sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.