Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

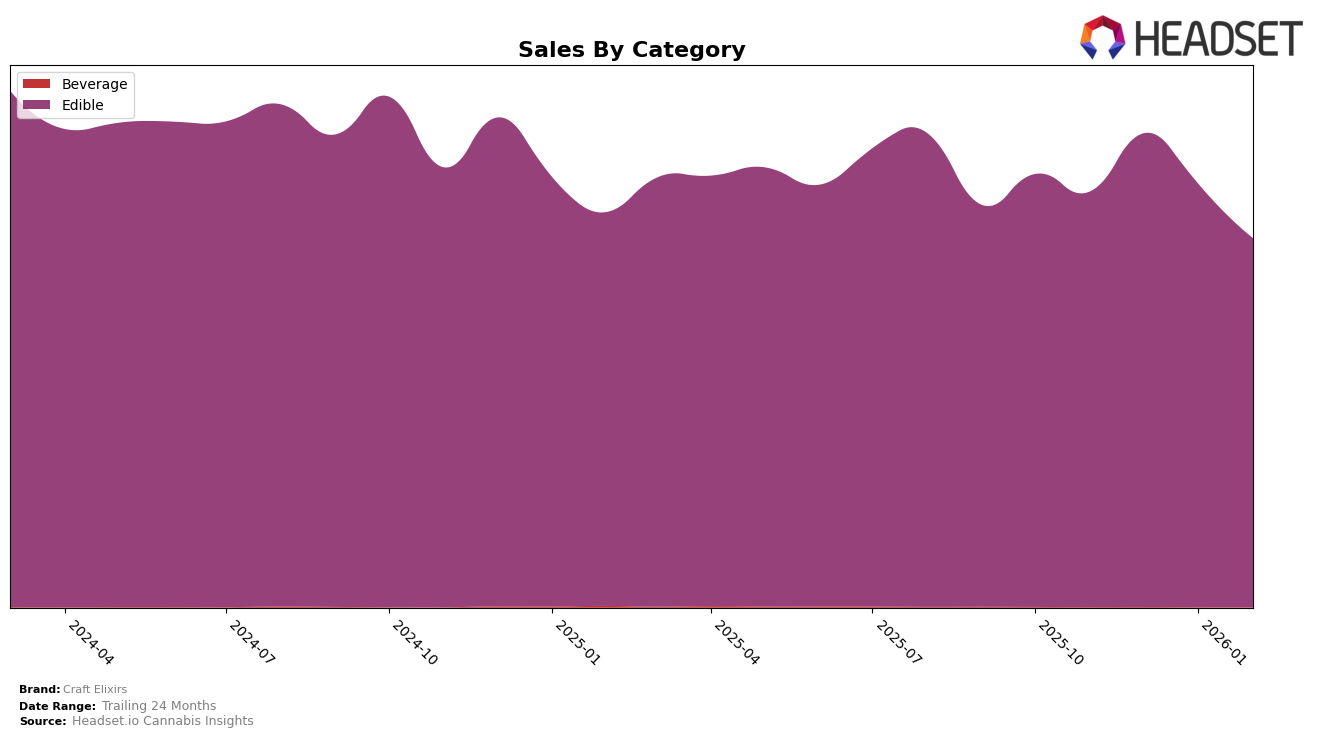

Craft Elixirs has consistently maintained a strong presence in the Washington market, particularly in the Edible category. Over the months from November 2025 to February 2026, the brand has held steady at the 5th rank, indicating a robust and stable performance. This consistent ranking suggests a strong consumer base and a reliable product line that resonates well with the local market. Despite fluctuations in sales figures, with a noticeable decrease from December 2025 to February 2026, Craft Elixirs' ability to maintain its ranking highlights its competitive edge and brand loyalty among consumers in Washington.

Interestingly, Craft Elixirs does not appear in the top 30 rankings in other states or provinces, which could be a point of concern or an opportunity for expansion. The absence of rankings in other regions may suggest limited distribution or market penetration outside of Washington. This could be interpreted as a strategic focus on their home market or potentially a lack of brand recognition elsewhere. For a brand with such a strong foothold in the Washington Edibles category, exploring opportunities to replicate this success in other states could be a significant growth avenue. However, the brand's current strategy might be ensuring they maintain a stronghold in their primary market before expanding further.

Competitive Landscape

In the competitive landscape of the Edible category in Washington, Craft Elixirs consistently maintained its position at rank 5 from November 2025 through February 2026. Despite a slight decline in sales from December 2025 to February 2026, Craft Elixirs held its ground against competitors like Swifts Edibles and Good Tide, which remained at ranks 7 and 6 respectively. Notably, Journeyman and Hot Sugar consistently outperformed Craft Elixirs, securing ranks 4 and 3, with higher sales figures throughout the observed months. This stability in rank suggests that while Craft Elixirs faces strong competition, particularly from Journeyman and Hot Sugar, it has successfully maintained its market position, indicating a loyal customer base and effective brand strategy in the Washington Edible market.

Notable Products

In February 2026, the top-performing product for Craft Elixirs was the Pioneer Squares - Black & Blueberry Fruit Nom Chews 10-Pack, maintaining its number one rank consistently from November 2025 through February 2026, with sales reaching 4752 units. The Pioneer Squares - Pineapple Crush Fruit Nom Chews 10-Pack rose to the second position from third in January 2026, showing a strong performance trend. The Pioneer Squares - Watermelon Kiwi Fruit Nom Chews 10-Pack secured the third spot, having swapped rankings with the Pink Lemonade variant, which dropped to fourth. Notably, all top products belong to the Edible category, emphasizing the popularity of fruit-flavored chews. Despite fluctuations in sales figures, the top products have shown remarkable consistency in their rankings over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.