Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

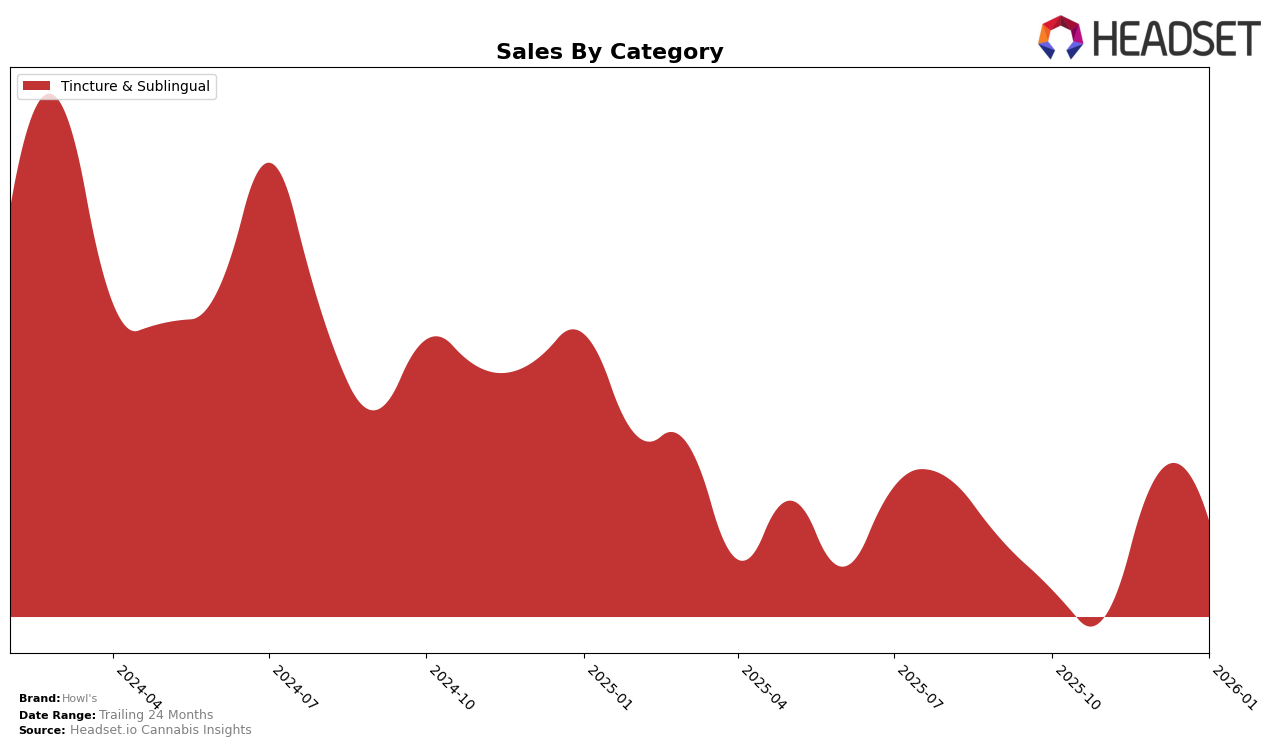

Howl's has demonstrated a consistent and notable presence in the Tincture & Sublingual category in Massachusetts. Over the last four months, the brand has maintained a strong position, starting at rank 5 in October 2025 and improving to rank 4 by December 2025, where it held steady into January 2026. This upward movement in rankings suggests a positive reception and growing popularity among consumers in the state. The sales figures for December 2025 reflect a significant increase compared to the previous months, indicating a successful period for Howl's in Massachusetts. However, it is worth noting that the brand's absence from the top 30 in other states or provinces could either suggest a focused market strategy or highlight areas for potential growth.

The performance of Howl's in the Tincture & Sublingual category in Massachusetts is indicative of a strong foothold in a competitive market. The brand's ability to climb the ranks and sustain its position reflects effective market strategies and possibly a loyal customer base. While the data shows a robust performance in Massachusetts, the lack of similar rankings in other regions may point to untapped opportunities for expansion. This trend presents an interesting scenario for industry watchers and stakeholders, as it raises questions about the brand's strategic focus and potential for future growth in other markets.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, Howl's has shown a promising upward trend in its market position, moving from 5th place in November 2025 to 4th place by December 2025 and maintaining this rank through January 2026. This improvement in rank is indicative of Howl's growing influence and effectiveness in capturing consumer interest, as evidenced by a significant increase in sales from November to December 2025. However, Howl's still faces stiff competition from brands like Levia and Treeworks, which consistently hold the top ranks with significantly higher sales figures. Meanwhile, Doctor Solomon's and Chill Medicated have experienced fluctuations in their rankings, with Doctor Solomon's slightly ahead of Howl's in November but falling behind by December. This competitive landscape suggests that while Howl's is on an upward trajectory, maintaining this momentum will require strategic efforts to further differentiate its offerings and capture a larger share of the market.

Notable Products

In January 2026, Howl's Nighttime Tincture (500mg) maintained its position as the top-performing product in the Tincture & Sublingual category, continuing its lead from December with sales of 85 units. The Daytime Max Tincture (500mg) followed closely at the second position, consistent with its December ranking. The Anytime Tincture (210mg THC, 1oz) rose to the third spot, improving from fifth place in December. Nighttime 2x Double Strength Tincture (500mg THC, 10ml) remained steady in fourth place for four consecutive months. Meanwhile, the Anytime Max Temple Kush Tincture (500mg) dropped to fifth place from third in December, indicating a decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.