Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

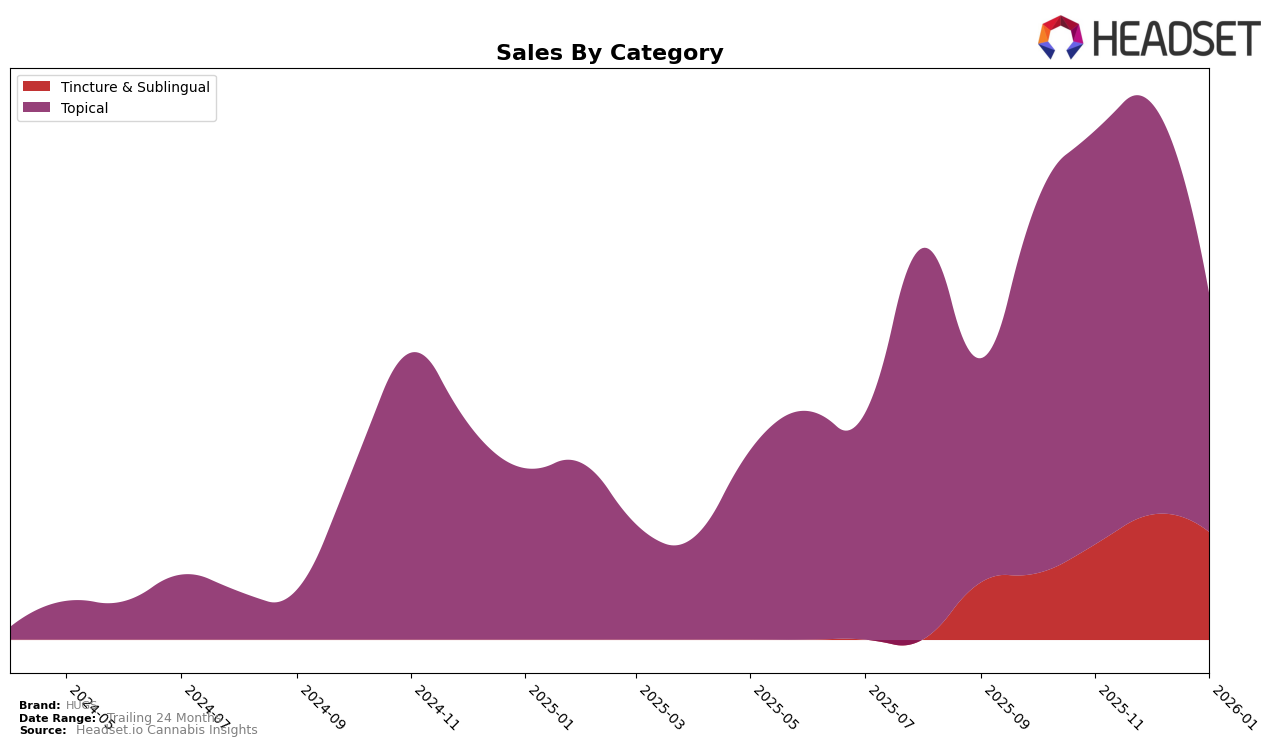

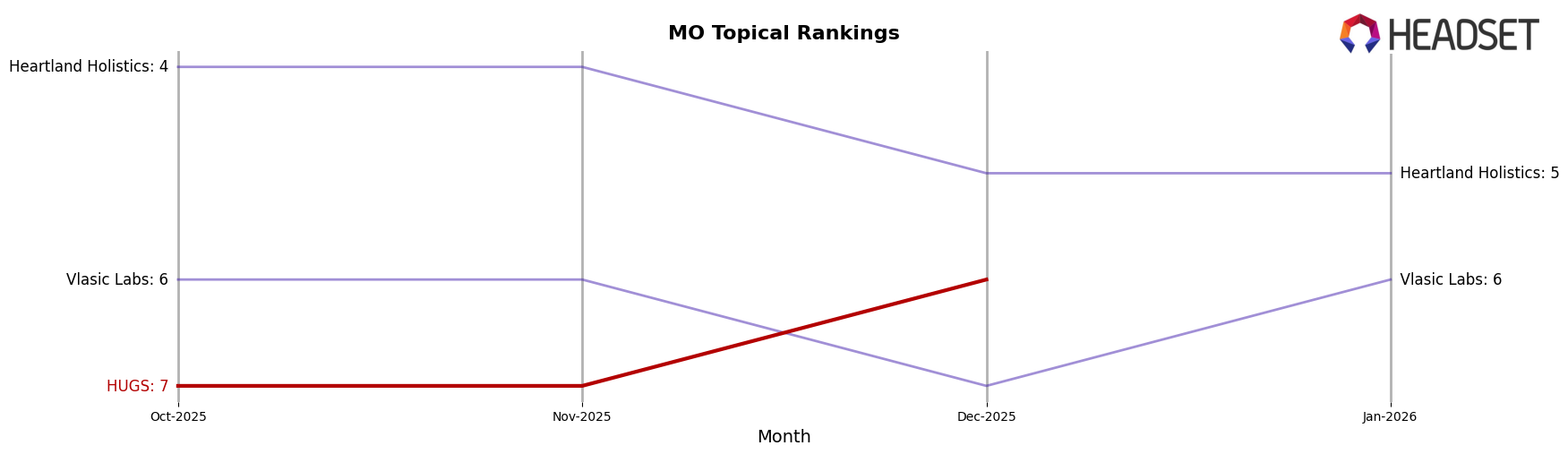

HUGS has shown notable performance in the Topical category within the state of Missouri. Over the months from October 2025 to January 2026, the brand maintained a consistent presence in the top 10 rankings, starting at the 7th position in October and November 2025, and improving to the 6th position in December 2025. However, it's important to note that by January 2026, HUGS did not appear within the top 30 rankings, which could indicate a significant drop in market presence or a strategic shift. Despite this, the sales figures reflect a relatively stable performance, with a notable increase from $14,831 in October to $16,532 in November, before slightly dipping in December.

The absence of HUGS from the top 30 rankings in January 2026 in Missouri's Topical category could suggest either increased competition or a potential decline in consumer interest. This change is significant as it marks a departure from the brand's previous upward trend in rankings. While the sales data from October to December 2025 shows a positive trajectory, the lack of a January sales figure makes it difficult to assess the full impact of the ranking drop. This development could be a point of concern or an opportunity for HUGS to reassess its market strategy in Missouri.

Competitive Landscape

In the Missouri Topical category, HUGS has demonstrated a notable competitive performance over the last few months. Starting in October 2025, HUGS held the 7th rank, maintaining this position into November. By December, HUGS improved to the 6th rank, surpassing Vlasic Labs, which dropped to 7th. This upward trend for HUGS indicates a positive shift in market presence, although it did not maintain a top 20 position by January 2026, suggesting a potential challenge in sustaining momentum. Meanwhile, Heartland Holistics consistently outperformed HUGS, holding the 4th and 5th ranks throughout the period, which could imply a strong brand loyalty or superior market strategy. These dynamics highlight the competitive landscape in Missouri's Topical market, where HUGS is gaining traction but faces stiff competition from established brands.

Notable Products

In January 2026, the top-performing product from HUGS was Cannabis Salve (500mg) in the Topical category, maintaining its number one rank consistently since October 2025, despite a drop in sales to 171 units. Peppermint Oral Spray (150mg) in the Tincture & Sublingual category held onto the second position for the second consecutive month with sales increasing to 165 units. The Daytime Tincture (200mg THC), also in the Tincture & Sublingual category, remained steady in third place throughout the observed months, though its sales decreased to 36 units. Notably, the Stress Relief Tincture (200mg), which was fourth in the previous months, did not appear in the January 2026 rankings. This data shows a consistent preference for the top three products, with some fluctuations in sales volumes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.