Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

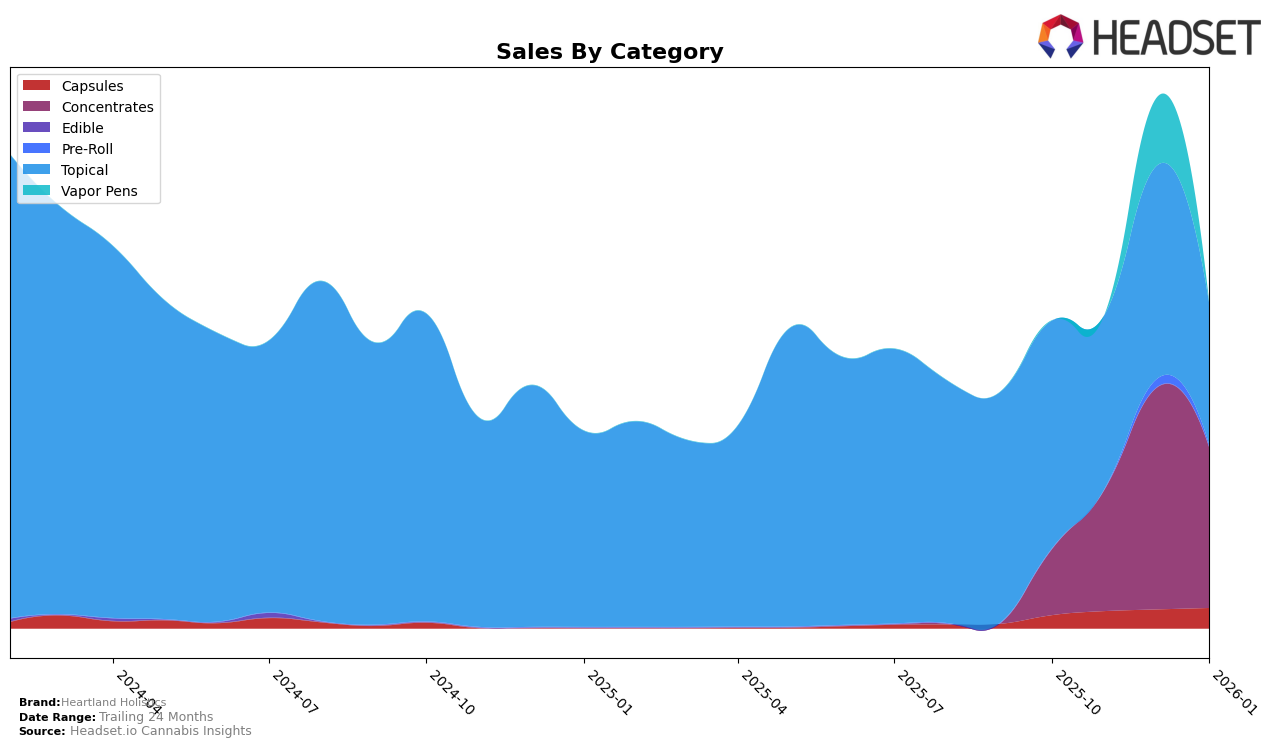

Heartland Holistics has shown varied performance across different product categories and states. In the Concentrates category in Missouri, the brand has struggled to break into the top 30, with rankings hovering just outside at 41st in November 2025 and improving slightly to 37th in December before falling back to 40th in January 2026. This fluctuation suggests a challenge in maintaining consistent momentum in this category, despite a notable increase in sales from October to November 2025. In contrast, the Topical category in Missouri has been a stronghold for Heartland Holistics, maintaining a steady position in the top 5 from October 2025 through January 2026, indicating a stable consumer base and consistent demand for their topical products.

The brand's performance in Missouri underscores an interesting dynamic between different product categories. While Concentrates have seen some sales growth, the inability to secure a top 30 spot indicates potential areas for improvement or increased competition. On the other hand, the sustained top 5 ranking in the Topical category suggests that Heartland Holistics has successfully captured a significant share of this market segment. This contrast highlights the importance of category-specific strategies and consumer preferences that can vary widely even within the same state. Further analysis could explore how these trends compare to Heartland Holistics' performance in other states and whether similar patterns emerge across different markets.

Competitive Landscape

In the Missouri concentrates market, Heartland Holistics has faced significant challenges in maintaining a competitive rank, with notable fluctuations in its positioning from November 2025 to January 2026. Initially absent from the top 20 in October 2025, Heartland Holistics entered the rankings at 41st in November, improved slightly to 37th in December, and then slipped to 40th by January 2026. This performance contrasts sharply with competitors like Cloud Cover (C3), which, despite a downward trend, maintained a strong presence in the top 20, and Plume Cannabis (MO), which consistently hovered around the mid-30s. The sales figures reflect these rankings, with Heartland Holistics experiencing modest sales growth, yet still trailing behind brands like Hermit's Delight and LiRO, which have shown more stable or higher sales volumes. This competitive landscape highlights the challenges Heartland Holistics faces in gaining a stronger foothold in the Missouri concentrates market.

Notable Products

In January 2026, the top-performing product for Heartland Holistics was the 12hr Extended Release FECO Transdermal Patch (50mg), maintaining its first-place rank consistently from October 2025 through January 2026 with a notable sales figure of 612 units. The Sativa Blend FECO (1g) experienced a significant rise, moving to the second position from being unranked in December 2025. The CBD/THC 3:4 High Dose Transdermal Patch (30mg CBD, 40mg THC) made an impressive re-entry into the rankings at third place. The CBD/CBN/THC 1:1:1 Night Time Transdermal Patch (25mg CBD, 25mg CBN, 25mg THC) saw a slight drop, moving from second to fourth place. The FECO Transdermal Patch (60mg) rounded out the top five, having slipped from third to fifth place since December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.