Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

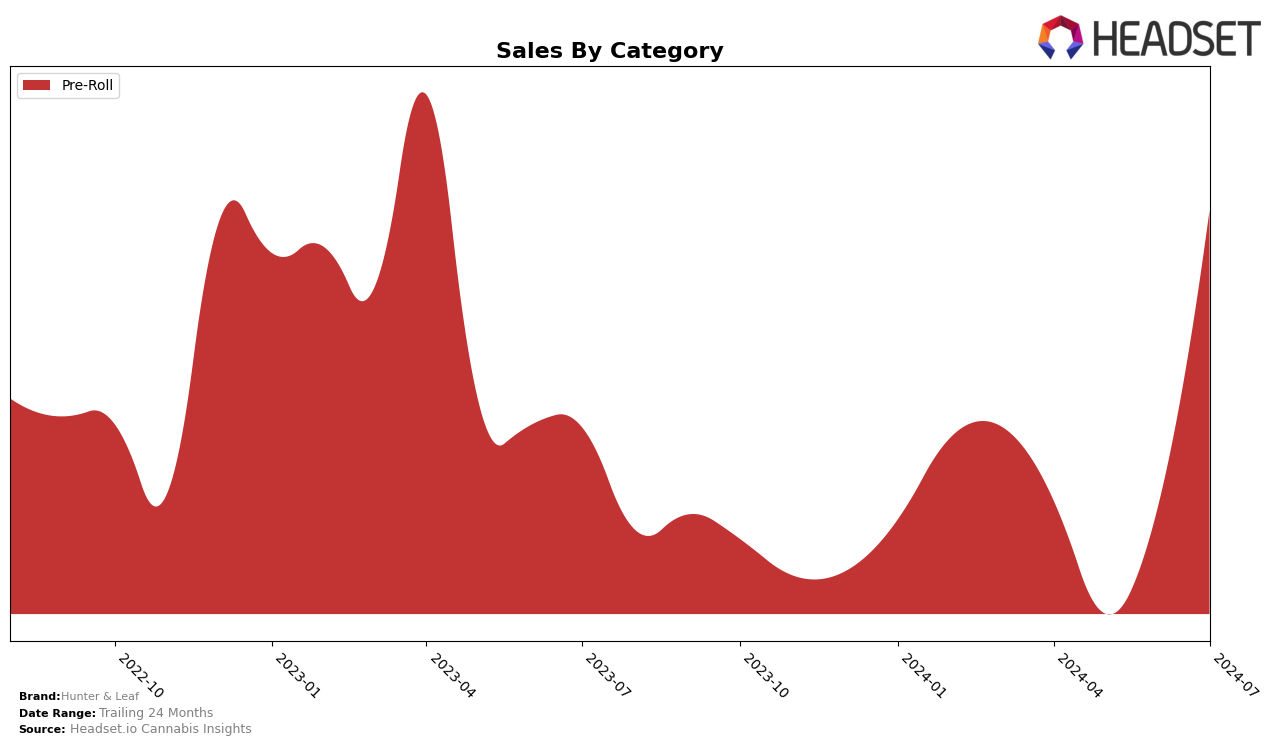

Hunter & Leaf has shown a notable performance in the Pre-Roll category within Nevada. In April 2024, the brand was ranked 59th, which indicated a relatively low market presence. However, by July 2024, the brand had made a significant leap to 28th place. This upward movement suggests a strong improvement in market penetration and consumer acceptance. The sales figures also reflect this positive trend, with July's sales reaching 61,207 units, a substantial increase from April's 18,064 units. This growth trajectory is indicative of Hunter & Leaf's strengthening foothold in the Nevada Pre-Roll market.

Despite the positive developments in Nevada, Hunter & Leaf's absence from the top 30 rankings in May 2024 could be seen as a temporary setback or a period of adjustment. This gap in the rankings may indicate challenges in maintaining consistent sales momentum or market share during that month. However, the rebound in June and July demonstrates the brand's resilience and capability to recover swiftly. Overall, Hunter & Leaf's performance in the Pre-Roll category in Nevada showcases a dynamic and evolving presence, with the potential for further growth in the coming months.

Competitive Landscape

In the competitive landscape of the Nevada pre-roll category, Hunter & Leaf has shown a remarkable improvement in its ranking and sales over the past few months. After not being in the top 20 in May 2024, Hunter & Leaf surged to the 28th position by July 2024, indicating a significant recovery and growth in market presence. This upward trend is particularly notable when compared to competitors like Fleur, which also improved its ranking but at a slower pace, moving from 46th in May to 29th in July 2024. Meanwhile, Stackhouse and Hustler's Ambition have maintained relatively stable positions, with minor fluctuations. The significant leap in Hunter & Leaf's rank and sales, especially the jump to 28th place in July, suggests a strong market response to their offerings, positioning them as a rising competitor in the Nevada pre-roll market.

Notable Products

In July 2024, Hunter & Leaf's top-performing product was Purple Haze Infused Pre-Roll (1g), which secured the first rank with notable sales of 1,562 units. Mango Cobbler Infused Pre-Roll (1g) followed closely in second place, maintaining its strong performance from previous months. Huckleberriez Infused Pre-Roll (1g) held the third position, showing a consistent ranking trend. Compared to previous months, Purple Haze Infused Pre-Roll (1g) climbed from the second spot to first, while Mango Cobbler Infused Pre-Roll (1g) dropped slightly from its previous top rank. Overall, the Pre-Roll category dominated the sales chart, showcasing Hunter & Leaf's strong market presence in this segment.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.