Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

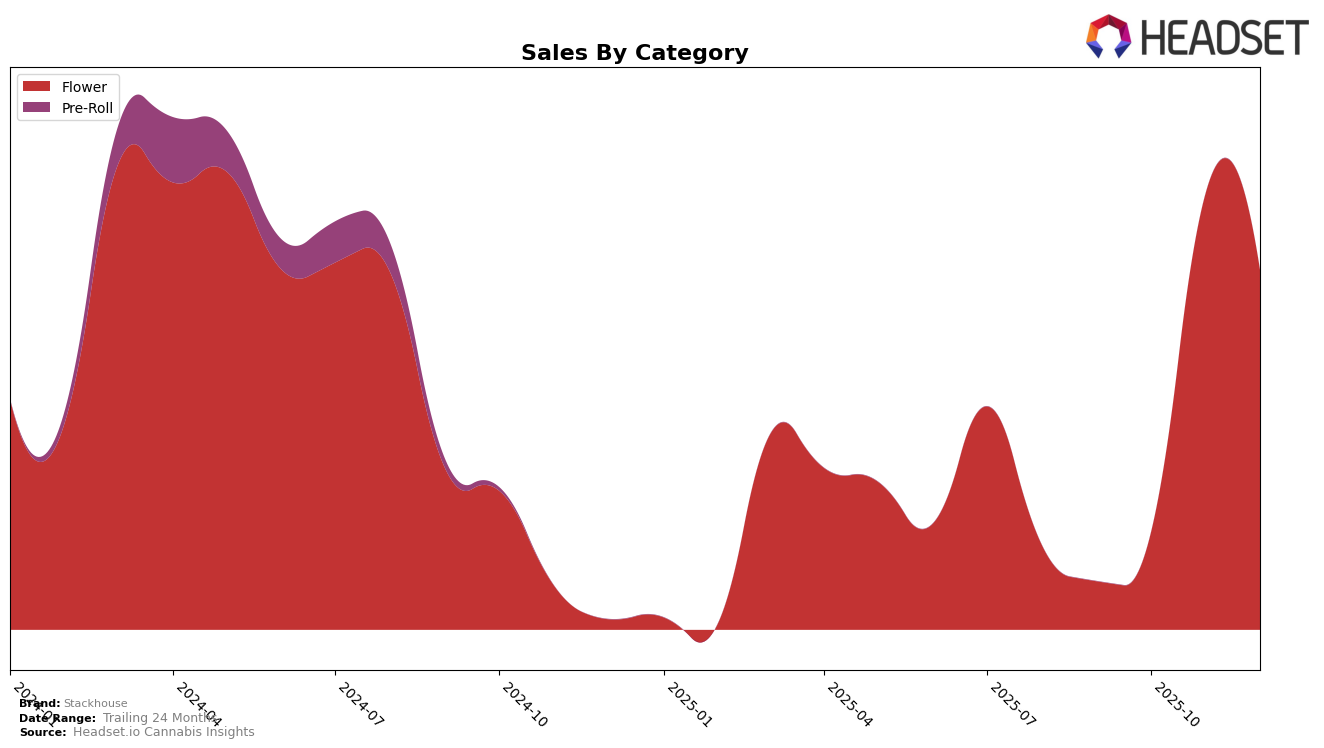

In the state of Nevada, Stackhouse demonstrated a notable upward trajectory in the Flower category throughout the final months of 2025. Starting in September at the 72nd position, the brand made significant strides, climbing to the 51st position in October and reaching a peak at 13th place in November. Although there was a slight dip to 21st place in December, the overall trend indicates a strong performance and growing consumer interest. This substantial movement within the rankings highlights Stackhouse's ability to capture market share and suggests an increasing demand for their products within this category in Nevada.

The sales figures for Stackhouse in Nevada corroborate this upward trend, with a remarkable increase from $45,961 in September to a peak in November, before slightly declining in December. While exact sales figures for the peak month are not disclosed, the directional movement in both sales and rankings suggests a successful strategy in the Flower category. The absence of Stackhouse from the top 30 in earlier months might have initially posed a challenge, but their subsequent rise showcases a successful turnaround. The brand's performance in Nevada could serve as a case study for potential expansion strategies in other states or provinces where they are not yet ranked or present.

Competitive Landscape

In the Nevada Flower category, Stackhouse has shown a remarkable improvement in its market position, climbing from a rank of 72 in September 2025 to a peak of 13 in November 2025, before settling at 21 in December 2025. This upward trajectory indicates a significant boost in sales performance, particularly in November, where Stackhouse outperformed several competitors. Notably, Deep Roots Harvest also demonstrated a strong performance, moving from rank 48 in September to 10 in November, suggesting a competitive environment. Meanwhile, FloraVega / Welleaf experienced a decline, dropping from rank 11 in October to 20 in December, which may have contributed to Stackhouse's improved standing. Additionally, Hustler's Ambition saw a decrease in rank from 15 in October to 23 in December, further highlighting Stackhouse's competitive edge during this period. These shifts underscore Stackhouse's strategic advancements and resilience in a dynamic market landscape.

Notable Products

In December 2025, Stackhouse's top-performing product was Animal Sherb Mints (3.5g) in the Flower category, achieving the number one rank with sales of 4001 units. Sundae Driver (3.5g) maintained its second-place position from November, reflecting consistent popularity. Permanent Marker (3.5g) entered the rankings at third place, indicating a strong debut. MJ Mints (3.5g) followed closely in fourth place, while Lemon Bubblegum (3.5g) dropped one position to fifth place compared to the previous month. This shift in rankings highlights Animal Sherb Mints' significant rise in popularity and Lemon Bubblegum's slight decline in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.