Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

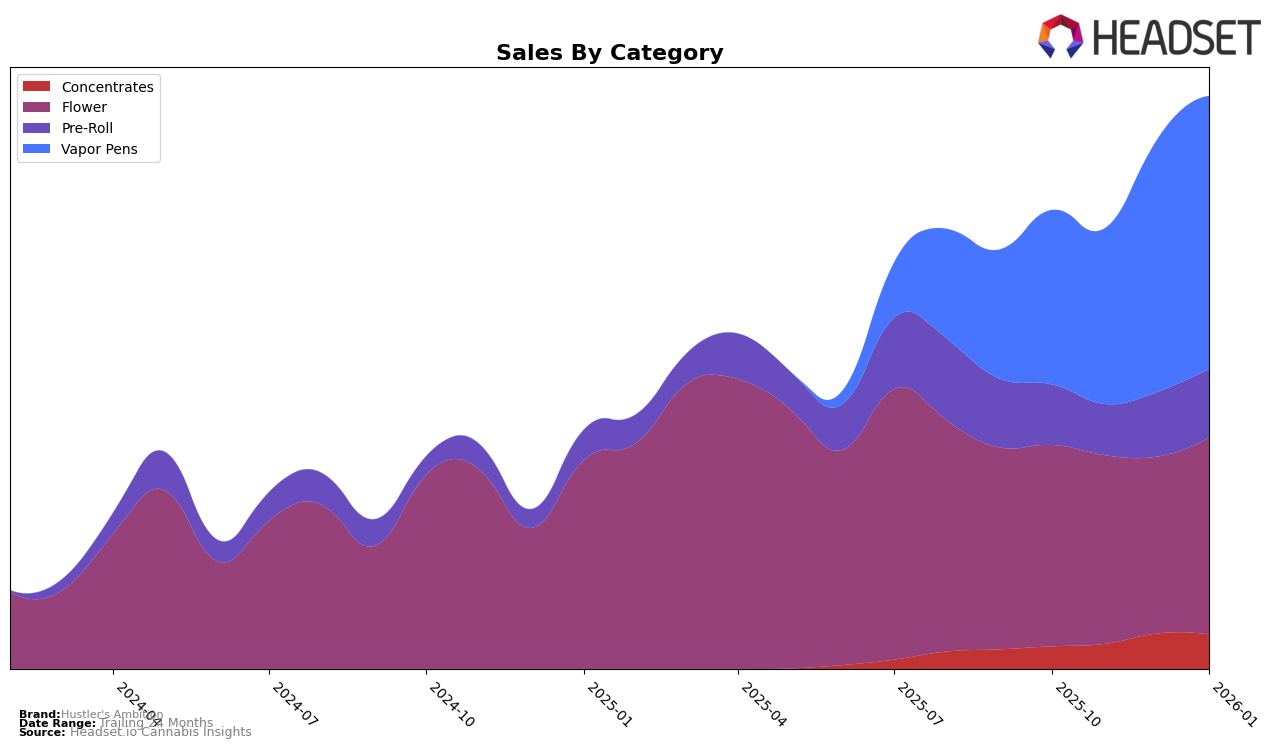

In Nevada, Hustler's Ambition showed mixed performance across different categories. The Flower category experienced a decline, moving from rank 14 in October 2025 to rank 19 by January 2026, indicating a loss of market momentum. However, in the Pre-Roll category, the brand maintained a relatively stable presence, with a slight improvement from rank 14 in October 2025 to rank 13 in January 2026. The Vapor Pens category saw significant fluctuations, with a notable drop to rank 29 in November 2025, but a strong recovery to rank 16 by January 2026, suggesting a volatile but potentially lucrative market segment.

In Washington, Hustler's Ambition demonstrated a more consistent performance, particularly in the Vapor Pens category, where it improved from rank 14 in October 2025 to rank 11 in January 2026. This upward trend highlights the brand's growing strength in this category. Conversely, the Pre-Roll category did not make it into the top 30, indicating a challenge in capturing market share in this segment. The Concentrates category showed positive momentum, climbing from rank 26 in October 2025 to rank 15 by January 2026, reflecting a successful strategy in this area. Meanwhile, the Flower category's rankings fluctuated slightly, suggesting a stable yet competitive environment.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Hustler's Ambition has shown a notable upward trajectory in its rankings from October 2025 to January 2026. Initially positioned at 14th place, the brand climbed to 11th by January, indicating a positive shift in market presence. This improvement is particularly significant when juxtaposed with competitors such as Ooowee, which experienced a consistent rise, moving from 12th to 10th place, and EZ Vape, which saw a decline from 10th to 12th. Despite Snickle Fritz maintaining a steady 9th place, Hustler's Ambition's sales growth trajectory suggests a robust potential to challenge higher-ranked brands. The brand's increasing sales figures, particularly the jump from November to December, underscore its growing consumer appeal and market competitiveness in Washington's vapor pen category.

Notable Products

In January 2026, the top-performing product for Hustler's Ambition was the Watermelon Sangria Distillate Cartridge (1g) from the Vapor Pens category, maintaining its first-place rank for four consecutive months with sales reaching 8,642 units. Following closely, the Bubble Gum Gelato Distillate Cartridge (1g) held steady in the second position, showing a consistent rise from its third-place ranking in November 2025. The Royal Blue Raspberry Cured Resin Cartridge (1g) retained its third position, mirroring its rank from December 2025. Banana OG Distillate Cartridge (1g) experienced a slight climb to fourth place after being ranked fifth in December 2025. Notably, the Tropicana Cookies Distillate Cartridge (1g) entered the rankings in January 2026, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.