Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

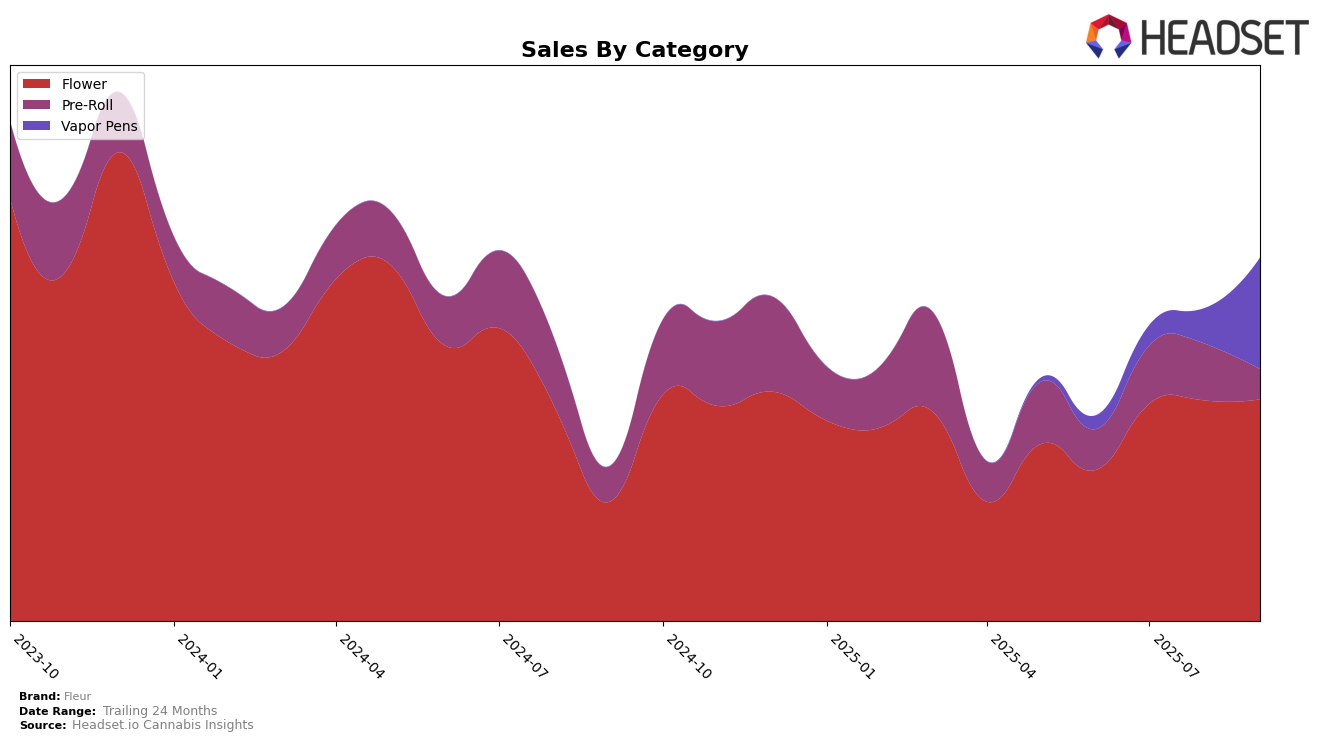

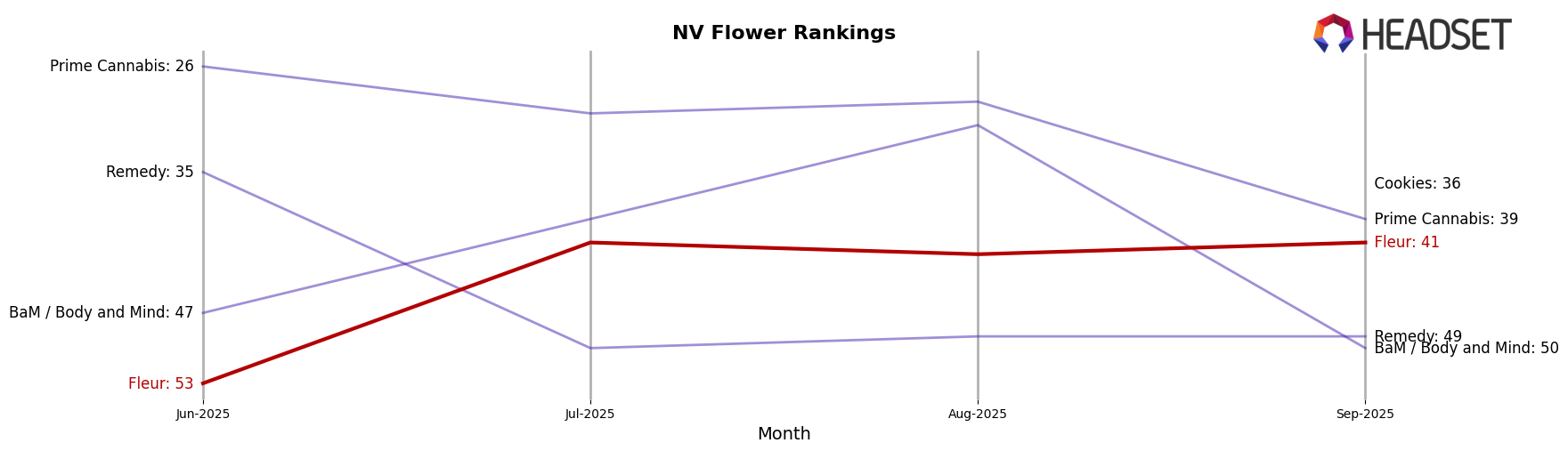

Fleur's performance in the Nevada market shows varied trends across different product categories. In the Flower category, Fleur has consistently maintained a steady presence, improving its rank from 53rd in June to 41st by September 2025. This upward movement suggests a positive reception in the market, supported by a notable increase in sales during this period. Conversely, the Pre-Roll category reflects a more volatile performance, with Fleur dropping to 54th place in September after a brief improvement to 43rd in August. This fluctuation indicates potential challenges in maintaining a stable market position for Pre-Rolls despite earlier gains.

In the Vapor Pens category, Fleur demonstrates significant growth, climbing from outside the top 30 in June to an impressive 28th rank by September. This leap suggests that the brand's vapor products are gaining traction among consumers in Nevada, potentially due to strategic shifts or consumer preference trends. The absence of a ranking in June highlights the brand's entry into the competitive landscape, followed by a rapid ascent, which could indicate effective brand positioning or product innovation. Such dynamic movements across categories provide insights into Fleur's strategic focus and adaptability in the ever-evolving cannabis market.

Competitive Landscape

In the Nevada flower category, Fleur has shown a consistent improvement in its ranking, moving from 53rd in June 2025 to 41st by September 2025. This upward trend in rank is indicative of a positive reception in the market, especially when compared to competitors like BaM / Body and Mind, which experienced fluctuations and ended September at 50th, and Remedy, which remained stagnant at 49th. Despite Prime Cannabis maintaining a higher rank than Fleur, their sales showed a downward trend from June to September, suggesting potential vulnerabilities. Meanwhile, Fleur's steady sales growth from July to September indicates a strengthening market position. Notably, Cookies re-entered the rankings in September at 36th, which could pose a future competitive challenge for Fleur as they continue to vie for market share.

Notable Products

In September 2025, the top-performing product from Fleur was Bushido OG (3.5g), maintaining its first-place ranking from previous months despite a sales decrease to 1011 units. Grape Monster (3.5g) saw a significant rise to second place, up from fifth in August, with notable sales growth. Sin CBD (3.5g) re-entered the rankings at third, having been absent in July and August. Better Than Yours OG (3.5g) held steady in fourth place, while LA Confidential (3.5g) made its debut in the rankings at fifth position. These shifts indicate a dynamic market where new entries and re-entries can significantly impact the standings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.