Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

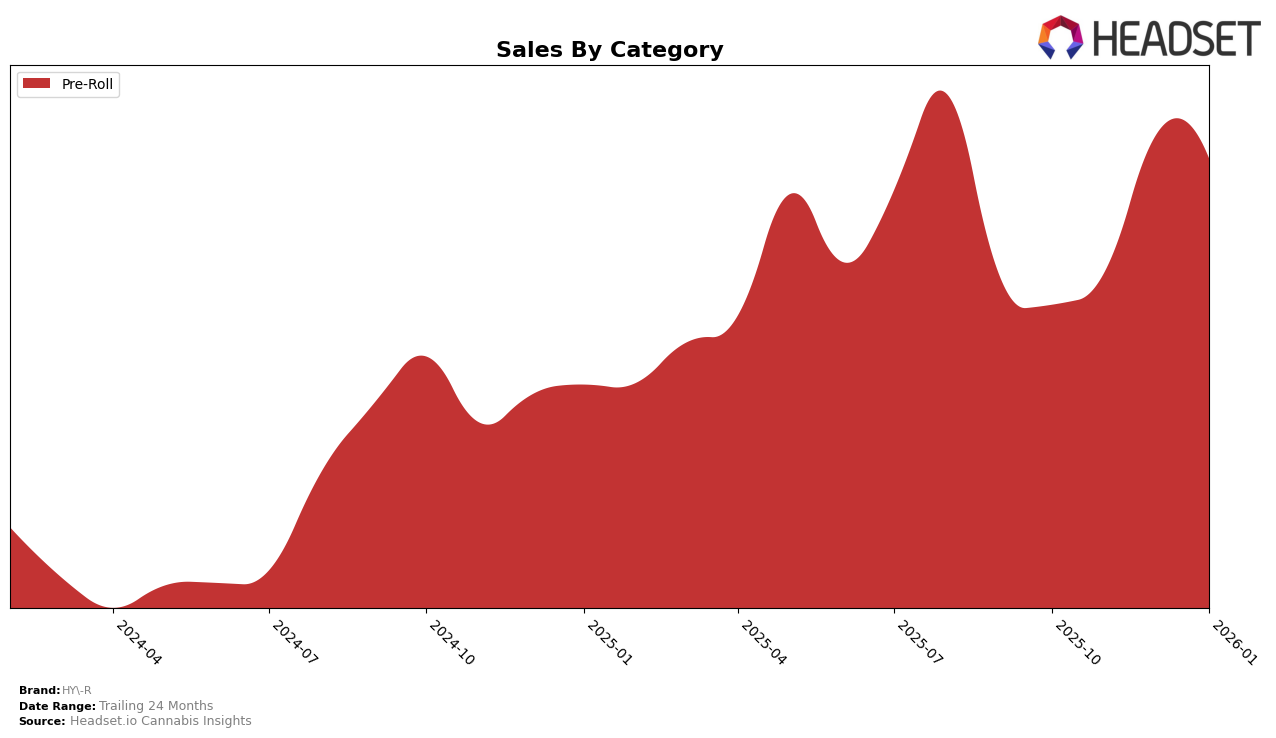

HY-R has demonstrated a notable upward trajectory in the Pre-Roll category within the state of Michigan. Over the span from October 2025 to January 2026, the brand improved its ranking from 8th to 6th position, indicating a strong performance and growing consumer preference. The steady climb in ranks is further supported by a significant increase in sales, particularly evident in December 2025. This suggests that HY-R is not only maintaining its market presence but also effectively capturing a larger share of the Pre-Roll market in Michigan.

While HY-R's performance in Michigan's Pre-Roll category is commendable, the absence of rankings in other states or categories indicates potential areas for expansion or improvement. The lack of top 30 placements in other regions or product lines might suggest either a strategic focus on Michigan or challenges in penetrating other markets. This presents an opportunity for HY-R to explore diversification strategies or enhance marketing efforts to replicate its Michigan success elsewhere.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, HY-R has shown a promising upward trajectory in recent months. Starting from the 8th position in October 2025, HY-R climbed to the 6th spot by December 2025 and maintained this rank into January 2026. This improvement in rank is accompanied by a notable increase in sales, particularly from November to December 2025, where sales surged significantly. This growth positions HY-R ahead of Simpler Daze, which remained stable at the 8th position, and Glorious Cannabis Co., which dropped from 6th to 7th place by December 2025. However, HY-R still trails behind Mitten Extracts and Goodlyfe Farms, which consistently held the 5th and 4th ranks, respectively. The consistent performance of these competitors suggests that while HY-R is gaining momentum, there is still a significant gap to close to reach the top tier of the market.

Notable Products

In January 2026, the top-performing product for HY-R was the Blueberry Crumble Liquid Diamonds Infused Pre-Roll, maintaining its consistent rank at number one with sales reaching 19,566 units. The Laughing Grape Liquid Diamonds Infused Pre-Roll also held steady at the second position, continuing its strong performance from previous months. Peach Infused Pre-Roll showed a notable improvement, climbing from fifth place in December 2025 to third place in January 2026. Strawberry Shortcake Infused Pre-Roll, which was previously unranked in December, secured the fourth position. Banana Candy Liquid Diamonds Infused Pre-Roll rounded out the top five, although it experienced a drop from fourth place in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.