Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

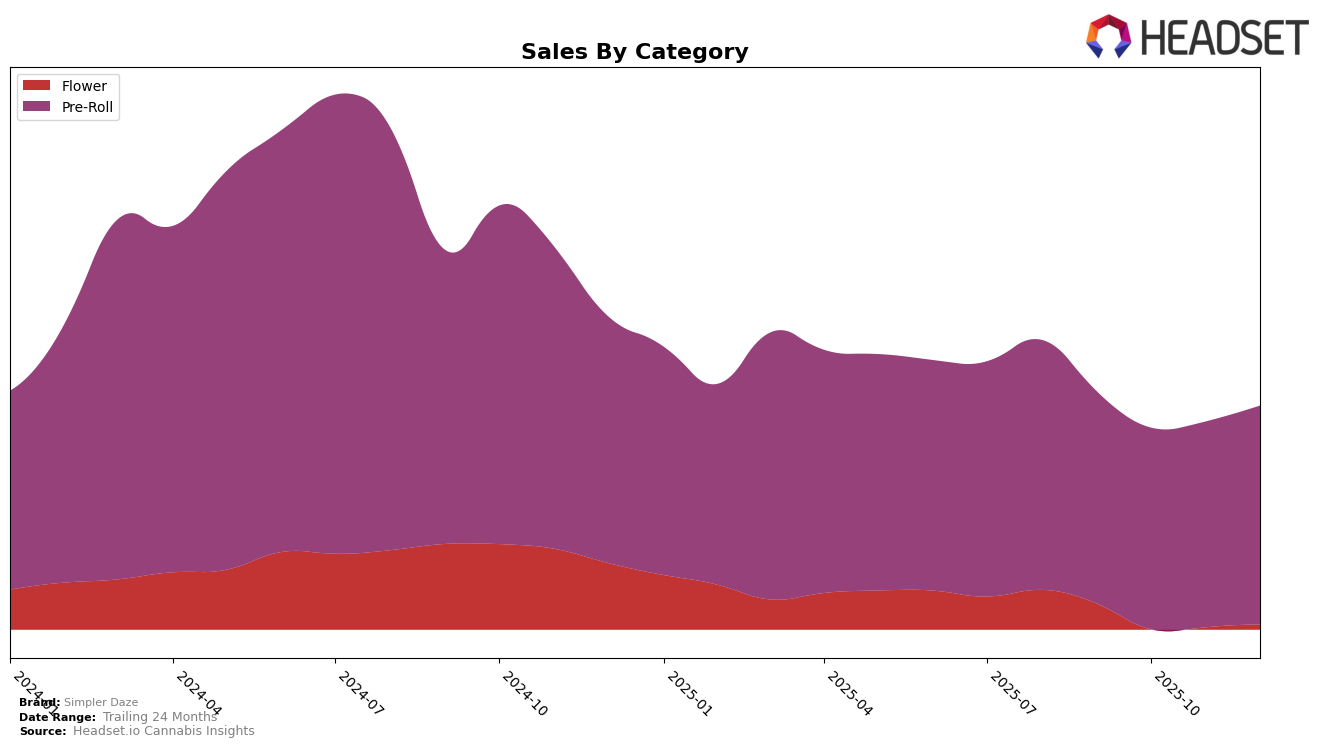

In the state of Massachusetts, Simpler Daze has exhibited fluctuating performance across different product categories. Notably, in the Flower category, the brand struggled to break into the top 30, with rankings of 48, 95, 80, and 78 from September to December 2025. This indicates a challenging market position in Flower, where they have not yet secured a strong foothold. However, their performance in the Pre-Roll category tells a different story, maintaining a strong presence with rankings of 8, 14, 9, and 10 over the same period. This consistency in Pre-Rolls suggests a stable consumer base and effective market strategies in this category.

Meanwhile, in Michigan, Simpler Daze has demonstrated robust performance in the Pre-Roll category. The brand consistently ranked within the top 10, maintaining positions of 7, 7, 6, and 7 from September to December 2025. This stability in rankings highlights their strong market presence and suggests effective brand recognition and customer loyalty in Michigan's Pre-Roll segment. The absence of rankings in other categories in Michigan suggests that while Simpler Daze is a key player in Pre-Rolls, there may be opportunities for expansion or increased focus in other product lines to diversify their market impact.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Simpler Daze has maintained a relatively stable position, with its rank fluctuating slightly between 6th and 7th place from September to December 2025. This stability is noteworthy given the dynamic shifts observed among competitors. For instance, Mitten Extracts consistently held the 5th rank, showcasing a strong market presence, while HY-R demonstrated significant upward mobility, climbing from 9th to 6th place by December. Meanwhile, Pro Gro and Glorious Cannabis Co. experienced more variability, with Pro Gro improving its rank slightly and Glorious Cannabis Co. dropping from 6th to 8th place. These shifts highlight the competitive pressure on Simpler Daze, which despite these challenges, managed to sustain its sales figures, indicating a resilient brand presence in the market.

Notable Products

In December 2025, the top-performing product from Simpler Daze was the Fire Styxx - Unicorn Tears THCA Infused Pre-Roll (1g), maintaining its first-place ranking consistently since September with an impressive sales figure of 68,916. The Fire Styxx - Midnight Berry THCA Infused Pre-Roll (1g) saw a notable improvement, climbing to the second position from fourth in November, with a significant increase in sales. The Fire Styxx - Grape Escape THCA Infused Pre-Roll (1g) dropped to third place after holding the second position in the two previous months. Fire Styxx - Tigers Breath Infused Pre-Roll (1g) remained stable in fourth place, while Fire Styxx - Razzberry Diesel Infused Pre-Roll (1g) consistently held the fifth position across all four months. This data highlights a strong performance in the Pre-Roll category, with minor fluctuations in rankings among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.