Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

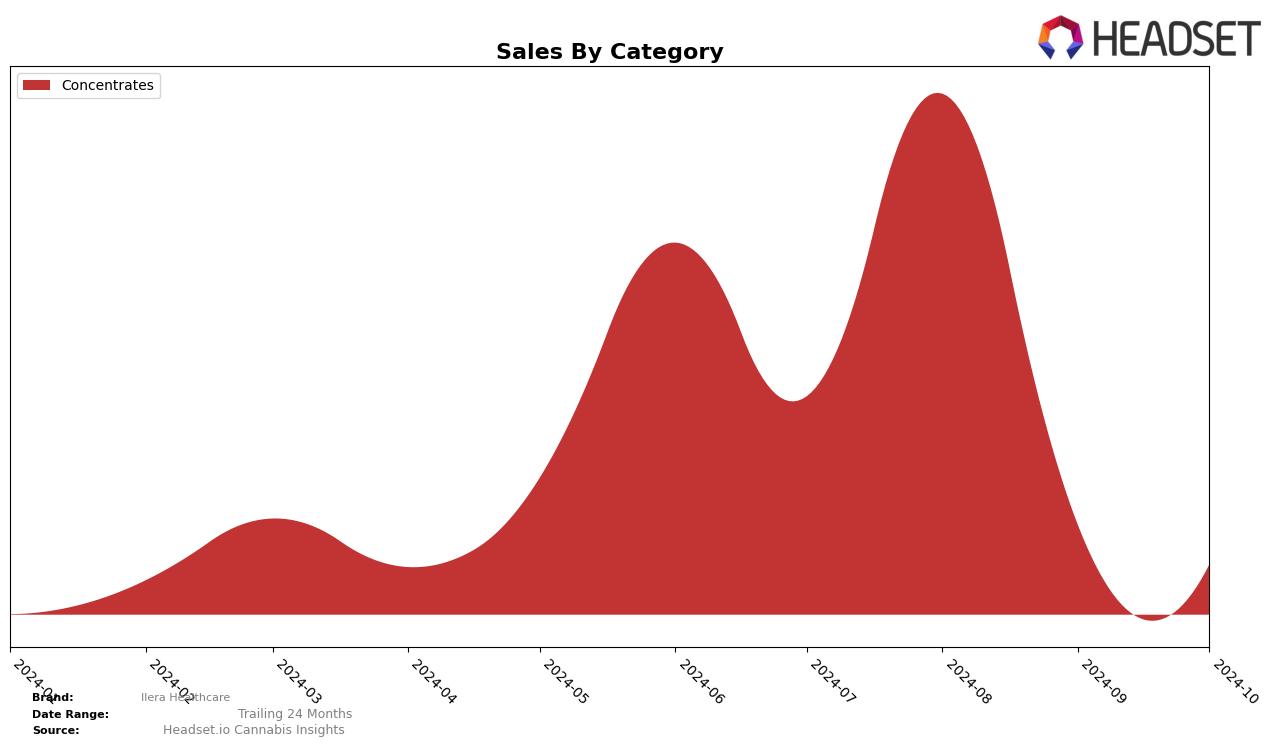

Ilera Healthcare's performance in the Maryland market has shown some interesting dynamics over the recent months, particularly within the Concentrates category. In August 2024, the brand managed to secure the 25th position, indicating a presence in the top 30 brands for that category. However, in the months of July, September, and October, the brand did not appear in the top 30, suggesting a fluctuation in its market standing. This inconsistency could point to either a highly competitive market environment or potential challenges in maintaining a consistent market share.

The absence of Ilera Healthcare from the top 30 rankings in three out of four months in Maryland might be seen as a concern, especially when considering its brief appearance in August. This indicates that while the brand has the capability to penetrate the market, sustaining that position remains a challenge. Such fluctuations are critical for stakeholders to monitor, as they can influence strategic decisions related to marketing, distribution, and product development. The sales figure for August provides a glimpse into the potential scale of operations during a successful month, but without consistent ranking, it may be difficult to predict long-term performance trends.

Competitive Landscape

In the Maryland concentrates market, Ilera Healthcare experienced a notable shift in its competitive positioning over recent months. In August 2024, Ilera Healthcare entered the top 25 brands, securing the 25th rank, but did not maintain this position in subsequent months, indicating a potential challenge in sustaining its market presence. In contrast, 1937 showed a consistent upward trajectory, moving from 26th in August to 24th by October, suggesting a strengthening brand presence. Meanwhile, Modern Flower demonstrated significant market strength, consistently improving its rank from 21st in July to 17th in September, although it did not rank in October, possibly due to market saturation or strategic shifts. These dynamics highlight the competitive pressures Ilera Healthcare faces, necessitating strategic adjustments to enhance its sales performance and market ranking in the Maryland concentrates category.

Notable Products

In October 2024, the top-performing product for Ilera Healthcare was Butter Mintz RSO Dablicator (1g) in the Concentrates category, securing the number one rank with consistent sales of 27 units. This product maintained its strong performance from previous months, climbing from the second position it held from July to September. Butter Mintz Dablicator (1g), also in the Concentrates category, ranked second, showing a steady presence at the same rank for four consecutive months. Indica Blend RSO Dablicator (1g) experienced a notable drop, falling to third place from its previous top position. The shifting dynamics indicate a growing preference for Butter Mintz variants over other offerings in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.