Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

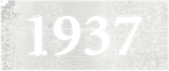

The cannabis brand 1937 has shown varying performance across different states and product categories. In Maryland, they have made notable progress in the Flower category, climbing from a rank of 39 in November 2025 to breaking into the top 30 by February 2026. This upward trend suggests a strengthening presence in the Maryland market. However, their performance in Vapor Pens experienced a decline, dropping from rank 31 in November to 49 by February. This indicates potential challenges or increased competition in that category. Notably, 1937 did not rank in the top 30 for Pre-Rolls in Maryland, which could be a point of concern or an opportunity for growth in that segment.

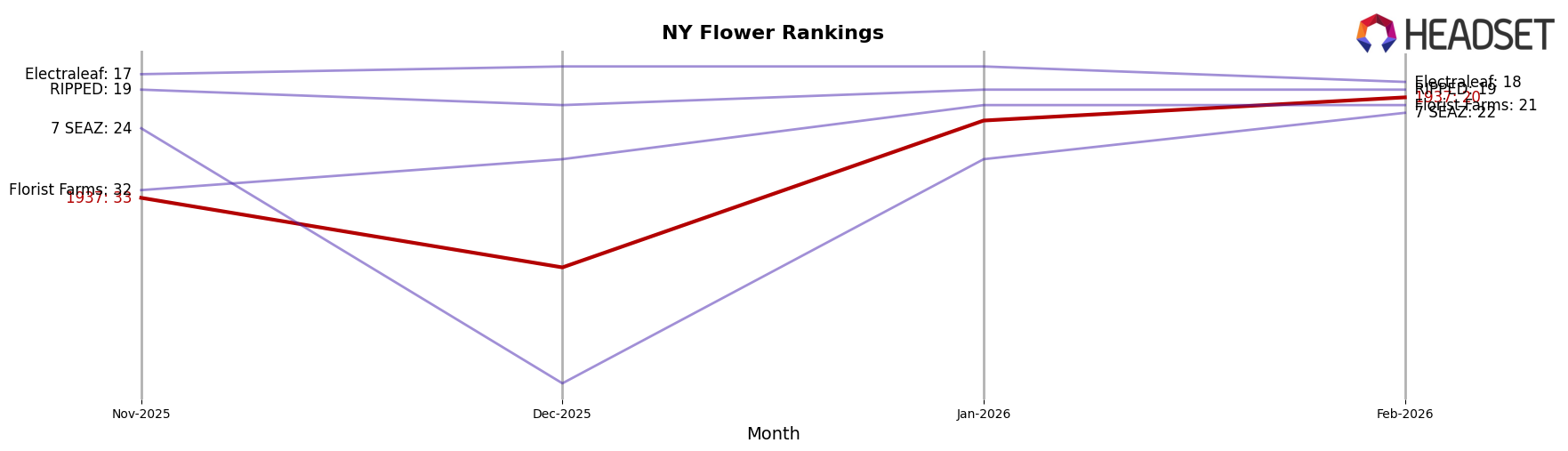

In New York, 1937 has demonstrated a robust presence in the Flower category, improving significantly from rank 33 in November 2025 to rank 20 by February 2026. This consistent rise suggests a growing consumer preference for their Flower products in the state. On the other hand, their Vapor Pens category has shown an improvement but remains outside the top 30, with ranks hovering in the 60s. This indicates that while there is some positive movement, there is still considerable ground to cover to become a leading player in the Vapor Pens market in New York. Overall, 1937's performance across these states and categories highlights both achievements and areas for potential strategic focus.

Competitive Landscape

In the competitive landscape of the New York Flower category, 1937 has demonstrated a notable upward trajectory in recent months. Starting from a rank of 33 in November 2025, 1937 climbed to rank 20 by February 2026, showcasing a significant improvement in market positioning. This upward movement is indicative of a robust sales growth trend, as evidenced by a substantial increase in sales from November 2025 to February 2026. In contrast, brands like RIPPED maintained a relatively stable rank around 19, while Florist Farms experienced fluctuations, peaking at rank 21 in January 2026. Electraleaf consistently outperformed 1937 in terms of rank, although it saw a slight dip from 16 to 18 over the same period. Meanwhile, 7 SEAZ showed a volatile pattern, with ranks ranging from 24 to 57, before stabilizing at 22. The competitive dynamics suggest that 1937's strategic initiatives are effectively enhancing its market presence, potentially positioning it for continued growth against its competitors.

Notable Products

In February 2026, Georgia Pie (3.5g) emerged as the top-performing product for 1937, securing the number one rank with sales reaching 1919. Fried Ice Cream (3.5g) followed closely as the second-highest seller. Kabuki Sour (3.5g) saw a significant rise, climbing from a fifth place in December 2025 to third place in February 2026. Princess Haze (3.5g) maintained its position within the top five, moving from fifth in January 2026 to fourth in February 2026. Wedding Cake (3.5g) entered the top five for the first time in February 2026, indicating a positive trend in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.