Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

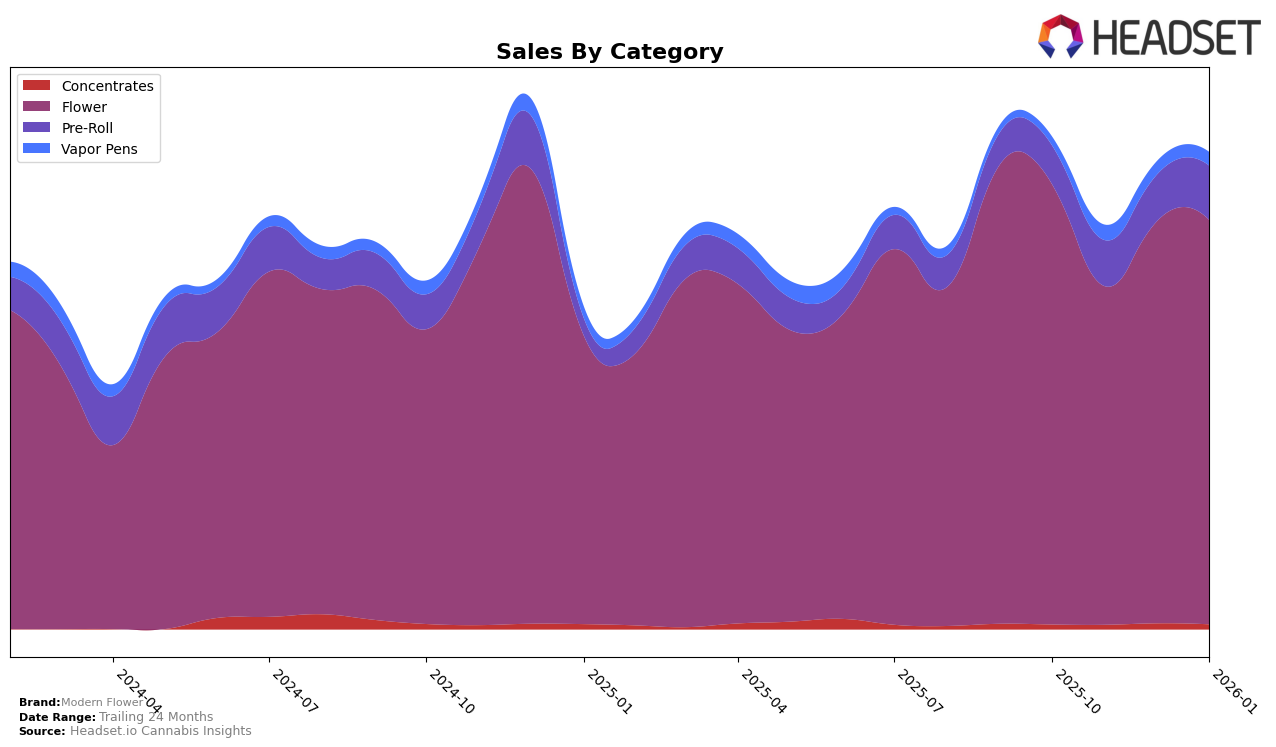

Modern Flower has shown a promising upward trajectory in the Maryland market, particularly in the Flower category. Starting at the 14th position in October 2025, the brand improved its ranking to 12th by January 2026. This positive movement is indicative of a strengthening presence in the state, supported by a notable increase in sales from November to December 2025. In the Pre-Roll category, Modern Flower maintained a consistent performance, holding the 18th position for three consecutive months before climbing to 16th in January. However, the Vapor Pens category presents a different scenario, as the brand did not make it into the top 30 rankings in October 2025 and continued to struggle to break into higher ranks in the following months, indicating a potential area for improvement.

In Ohio, Modern Flower's performance in the Flower category has been more volatile. The brand's ranking fell from 25th in October 2025 to 50th in December, before making a partial recovery to 31st in January 2026. This fluctuation suggests challenges in maintaining a steady market share, possibly due to competitive pressures or shifts in consumer preferences. Interestingly, Modern Flower entered the Ohio Pre-Roll category rankings in January 2026, securing the 18th position, which marks a significant entry into this segment. The absence of prior rankings in this category could be seen as a strategic entry or a response to market opportunities. Overall, while Modern Flower has shown resilience in some areas, there are clear opportunities for growth and stabilization across different categories and states.

Competitive Landscape

In the competitive landscape of the flower category in Maryland, Modern Flower has shown a notable upward trajectory in its rankings over the past few months. Starting at 14th place in October 2025, Modern Flower improved to 12th by January 2026, indicating a positive trend in market presence. This rise in rank is particularly significant when compared to competitors like Roll One / R.O., which fluctuated between 13th and 15th place, and CULTA, which saw a decline from 6th to 13th place over the same period. Despite a dip in sales in November, Modern Flower's recovery and growth in December and January suggest resilience and an effective market strategy. Meanwhile, Curio Wellness and Evermore Cannabis Company maintained higher ranks, with Evermore consistently in the top 10, highlighting the competitive challenge for Modern Flower to break into the upper echelon of the market.

Notable Products

In January 2026, the top-performing product from Modern Flower was Motorbreath (3.5g), which climbed to the first rank with a notable sales figure of 6542. Gush Mints (3.5g) maintained a strong position at rank two, showing consistent popularity. The Gush Mints Pre-Roll 2-Pack (1g) made an impressive entry into the rankings at third place. Cold Snap (3.5g) saw a decline from previous months, dropping to fourth place despite strong sales in December 2025. Skunk Hero (3.5g) entered the rankings at fifth place, demonstrating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.