Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

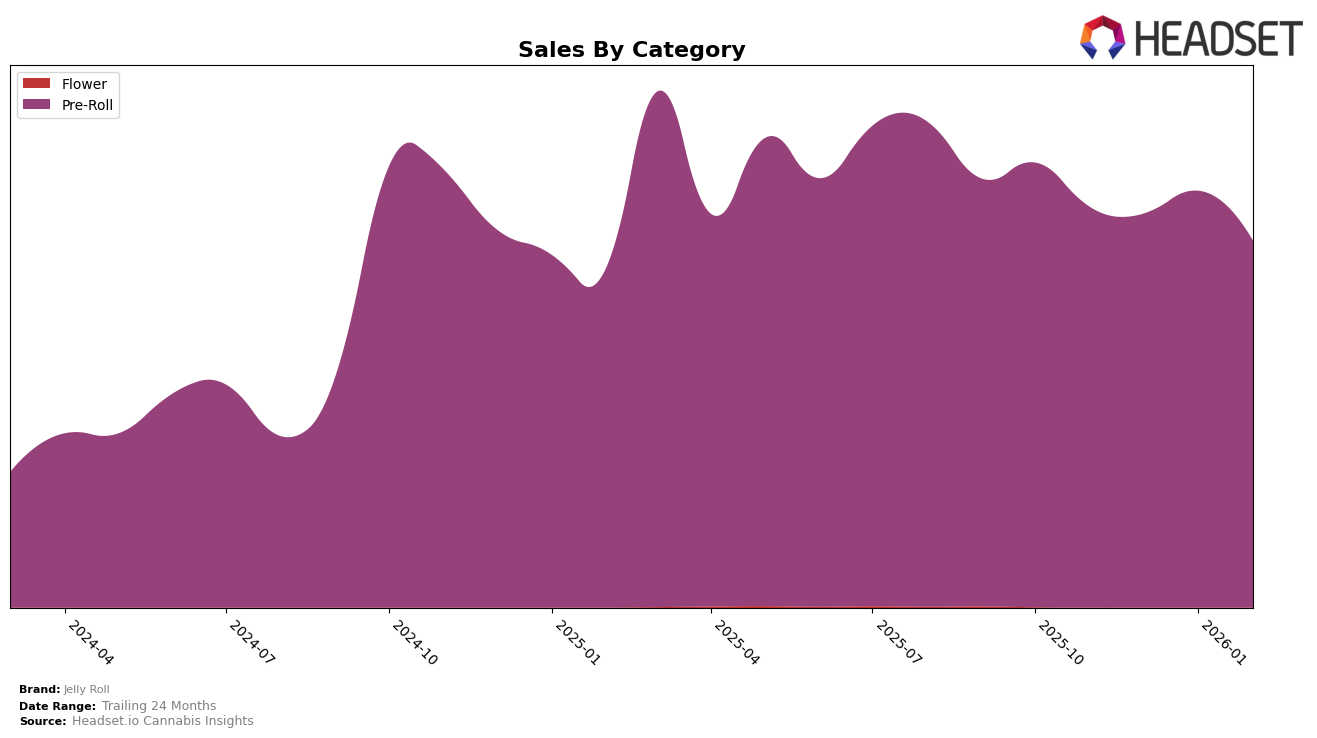

Jelly Roll has shown a consistent presence in the Pre-Roll category within Missouri, maintaining a solid ranking throughout the months from November 2025 to February 2026. The brand's performance saw some fluctuation, with a slight dip from 9th place in November to 11th in December, before climbing back to 8th in January and settling at 9th in February. This indicates a resilient market presence, even as sales figures slightly decreased from November to February. Notably, the brand was able to recover its position after the December decline, suggesting effective strategies in maintaining consumer interest and market share.

While Jelly Roll has managed to stay within the top 10 rankings in the Missouri Pre-Roll category, it is important to note that their absence from the top 30 in other states and categories could be seen as a point for potential growth or concern. The brand's ability to maintain a stable ranking and recover quickly in Missouri could serve as a model for expansion strategies in other regions. However, the lack of presence in additional markets might suggest either a strategic focus on Missouri or challenges in scaling their operations. Understanding the broader market dynamics and consumer preferences in these areas could provide insight into Jelly Roll's future opportunities for growth.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Jelly Roll has shown resilience amidst fluctuating market dynamics. Despite experiencing a dip in rank from 9th in November 2025 to 11th in December 2025, Jelly Roll rebounded to 8th place in January 2026, before settling at 9th in February 2026. This indicates a capacity to recover and maintain a competitive position. Notably, Rove consistently held a higher rank, although it dropped from 6th to 8th by February 2026, suggesting a potential opportunity for Jelly Roll to close the gap. Meanwhile, Vivid (MO) maintained a steady 7th rank, while Vibe Cannabis (MO) experienced more volatility, dropping to 12th in January 2026 before climbing back to 10th. Elevate showed consistent performance around the 10th and 11th ranks. These dynamics suggest that while Jelly Roll faces strong competition, particularly from Rove and Vivid (MO), its ability to regain rank positions it well for strategic growth in the Missouri pre-roll market.

Notable Products

In February 2026, Jelly Roll's top-performing product was the Strawberry Infused Pre-Roll (1.1g) in the Pre-Roll category, climbing to the number one position with sales of 3333 units. The Watermelon Infused Pre-Roll (1.1g), which held the top spot for the previous two months, dropped to second place. Peaches N Cream Infused Pre-Roll (1.1g) secured the third position, showing a consistent presence in the top five across recent months. Cherry Infused Pre-Roll (1.1g) made its debut in February, landing in fourth place. The Strawberry Infused Pre-Roll 5-Pack (3g) also entered the rankings, taking fifth place, indicating a growing interest in larger pack options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.