Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

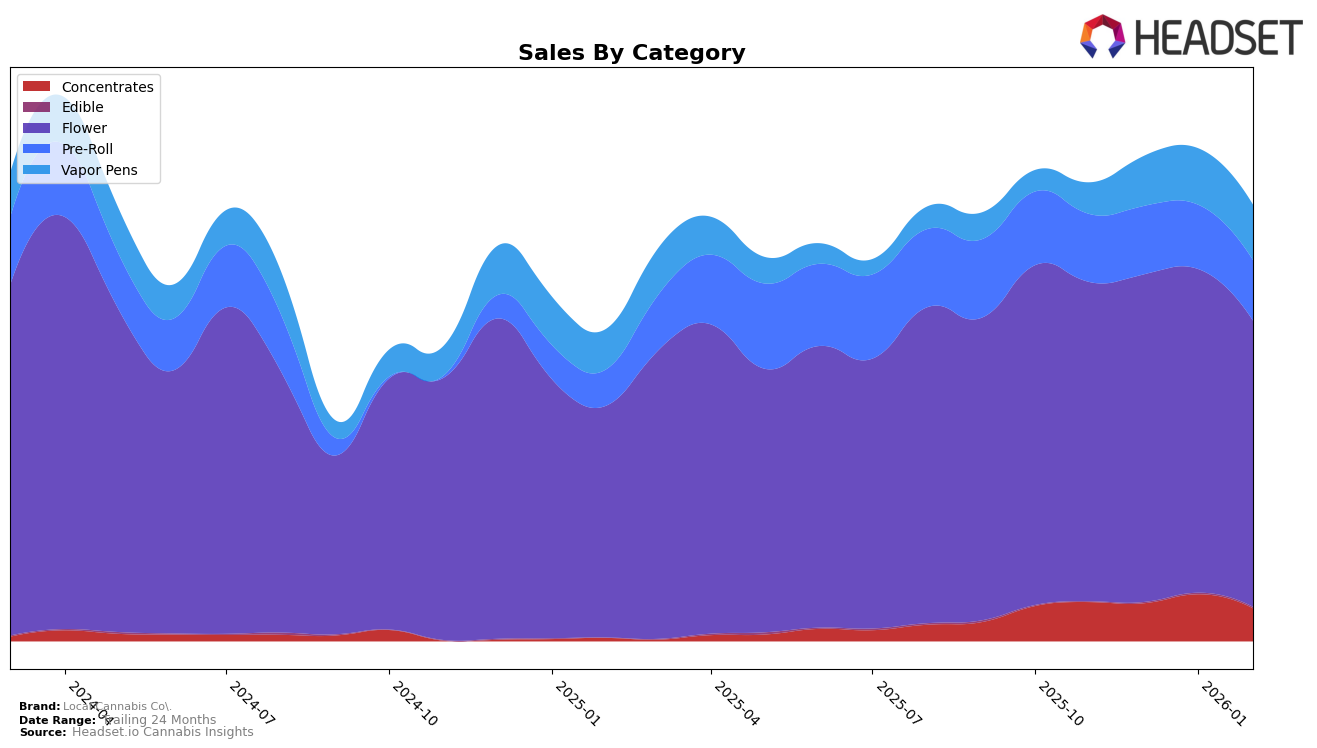

Local Cannabis Co. has demonstrated noteworthy performance across various categories in Missouri. In the concentrates category, the brand maintained a steady presence, ranking 11th in both November and December 2025, before climbing to 8th in January 2026, and then slipping slightly to 12th in February. This indicates a strong but slightly fluctuating market position. In the flower category, Local Cannabis Co. consistently ranked within the top ten, holding 9th place in November 2025, improving to 8th in December and January, and then returning to 9th in February. This stability suggests a solid consumer base and consistent demand for their flower products.

In the pre-roll category, Local Cannabis Co. experienced a stable ranking, consistently placing 15th from December 2025 to February 2026 after a slight drop from 13th in November. This consistency, albeit outside the top ten, indicates a moderate but steady market presence. The most significant movement was seen in the vapor pens category, where the brand improved from 39th in November 2025 to 28th by February 2026. This upward trend in vapor pens suggests growing consumer interest and potential for further market penetration. However, the absence from the top 30 in certain months and categories highlights areas for potential growth and improvement.

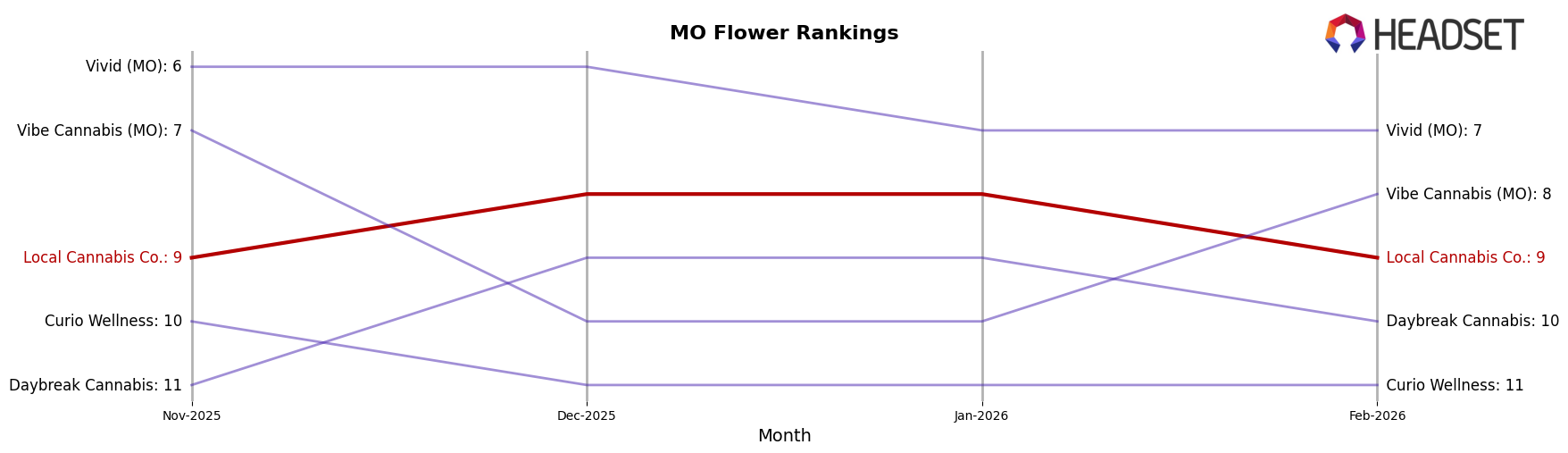

Competitive Landscape

In the competitive landscape of the Missouri flower category, Local Cannabis Co. has maintained a relatively stable position, ranking 9th in November 2025, improving to 8th in December 2025 and January 2026, before slipping back to 9th in February 2026. This performance is notable given the dynamic shifts among competitors. For instance, Vivid (MO) consistently held a higher rank, fluctuating between 6th and 7th, indicating stronger sales performance. Meanwhile, Vibe Cannabis (MO) experienced more volatility, dropping from 7th to 10th before recovering to 8th, suggesting a potential opportunity for Local Cannabis Co. to capitalize on Vibe's inconsistent performance. Additionally, Daybreak Cannabis showed a competitive edge, climbing from 11th to 9th in December, aligning closely with Local Cannabis Co.'s rank. Despite these fluctuations, Local Cannabis Co.'s sales figures indicate a robust presence, though slightly trailing behind top performers like Vivid (MO), highlighting the need for strategic initiatives to enhance market share and climb the rankings.

Notable Products

In February 2026, Orange 43 (3.5g) maintained its position as the top-performing product for Local Cannabis Co., with a notable sales figure of $6,888. Hash Burger (3.5g) emerged as the second-ranked product, a new entrant in the rankings. Orange 43 Pre-Roll 2-Pack (1g) secured the third position, marking its debut in the top rankings. Lemon Slushee (3.5g) followed closely in fourth place, also appearing for the first time. Ice Cream Cake (3.5g) experienced a slight drop from January, moving from third to fifth place, indicating a shift in consumer preference within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.