Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

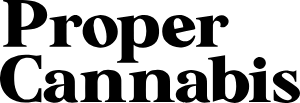

Proper Cannabis has shown a consistent performance in the Missouri market, particularly in the Concentrates category where it has maintained a steady rank of 2nd place from October 2025 to January 2026. This suggests a strong foothold and customer loyalty within this segment. In the Flower category, Proper Cannabis has seen a gradual improvement in rankings, moving from 15th in October to 12th in December and January, indicating growing popularity and possibly an expanding product line or improved quality. However, the Vapor Pens category presents a challenge, with the brand hovering around the 25th to 26th rank, which might suggest a need for strategic improvements or increased marketing efforts in this area to gain a stronger position.

In the Pre-Roll category, Proper Cannabis has demonstrated a positive trajectory, advancing from 12th place in October to 9th by January. This upward movement is indicative of successful product offerings or effective market strategies that resonate with consumers. It's noteworthy that Proper Cannabis does not appear in the top 30 rankings for other states or categories, which could imply a strategic focus on the Missouri market or potential areas for expansion. The sales figures in the Flower category, particularly in December, reflect a peak, which might correlate with seasonal demand or promotional activities, though further analysis would be required to pinpoint the exact drivers.

Competitive Landscape

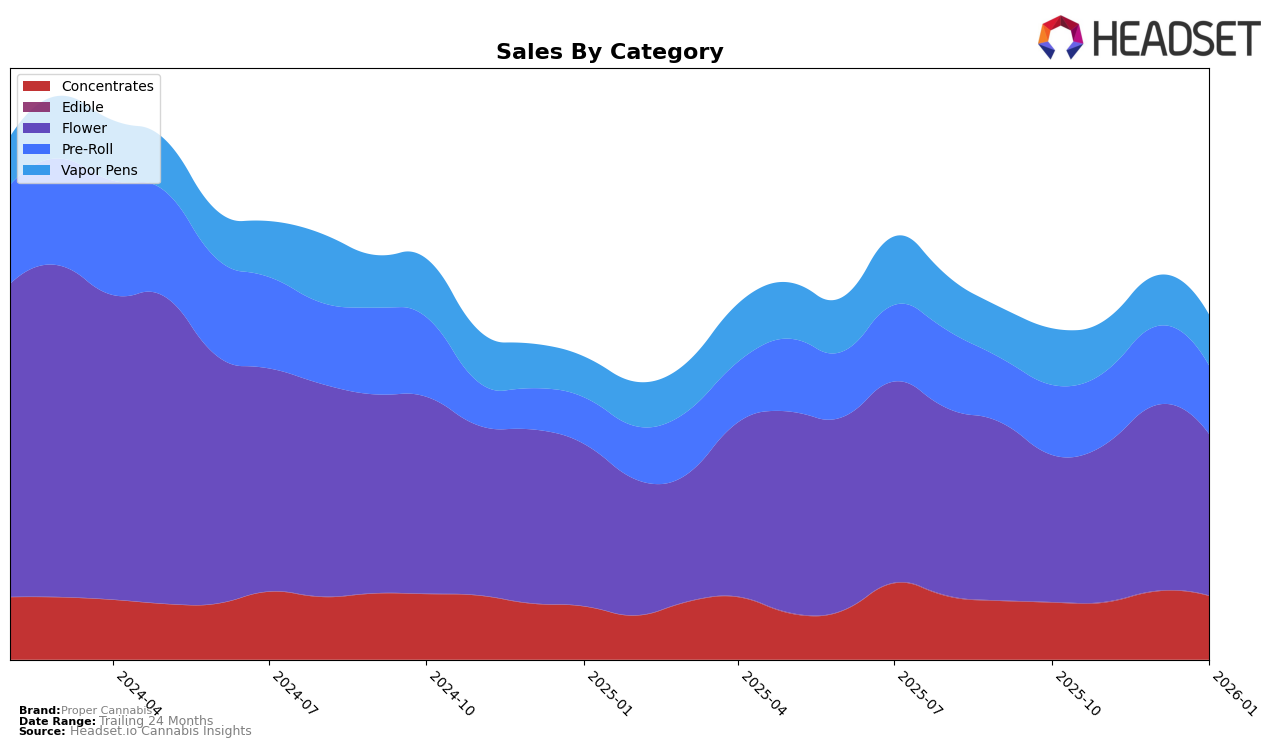

In the competitive landscape of the Missouri flower category, Proper Cannabis has shown a steady improvement in its ranking, moving from 15th place in October 2025 to 12th place by January 2026. This upward trend in rank is indicative of a positive momentum in sales, although it still trails behind competitors like Vibe Cannabis (MO), which consistently ranks higher, maintaining a position around 10th place with notably higher sales figures. Meanwhile, Curio Wellness has remained stable at 11th place, suggesting a competitive edge over Proper Cannabis in terms of market positioning. On the other hand, Farmer G has shown significant improvement, climbing from 24th to 14th place, which could pose a future threat if their growth continues. Proper Cannabis's consistent rise in rank signifies a strengthening market presence, but the brand must strategize effectively to close the gap with higher-ranking competitors and capitalize on its upward trajectory.

Notable Products

In January 2026, the top-performing product for Proper Cannabis was Butterberry Bliss Mix #97 Pre-Roll (0.5g), securing the number one rank with sales of 2444 units. Following closely was Black Maple 22 Pre-Roll (0.5g) at the second position, with Skywalker OG Pre-Roll (1g) taking the third spot, maintaining a consistent presence in the top five from November 2025. Banana OG Pre-Roll (0.5g) and Skywalker OG Pre-Roll (0.5g) rounded out the top five, ranking fourth and fifth, respectively. Notably, Skywalker OG Pre-Roll (1g) dropped from second place in November 2025 to fifth in December 2025, before slightly recovering to third place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.