Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

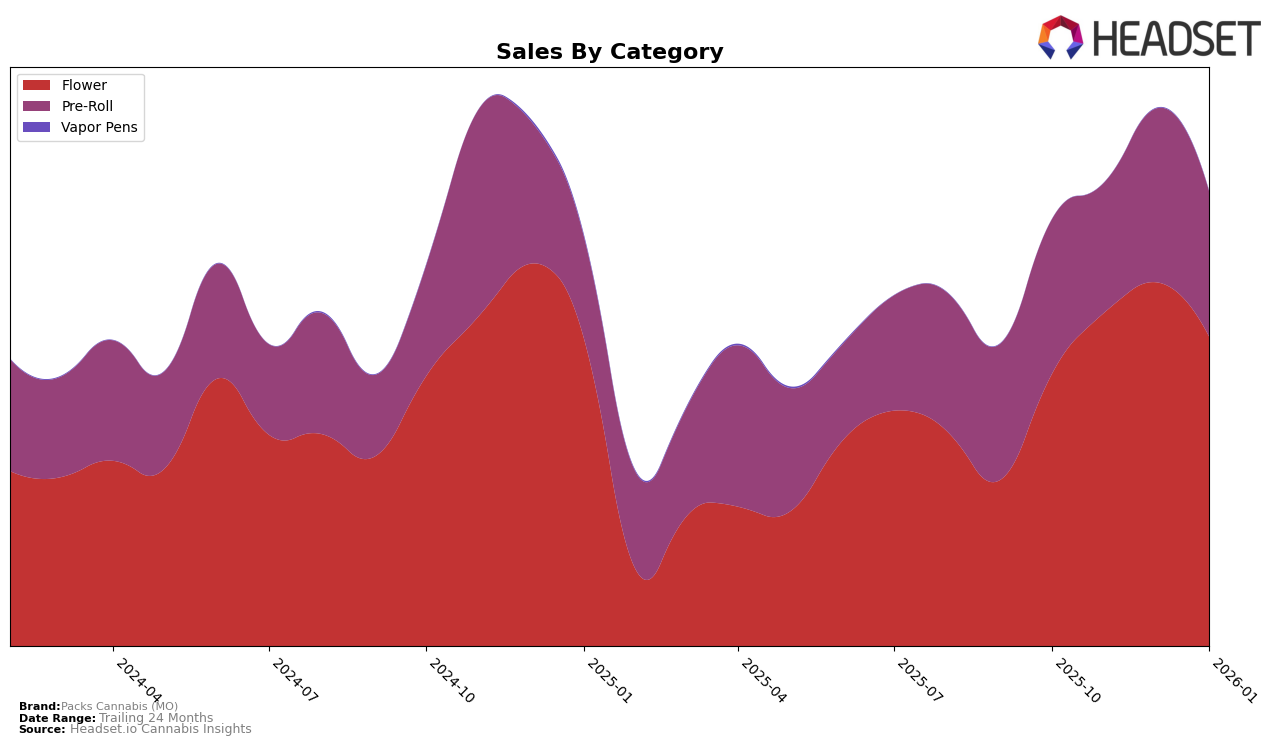

Packs Cannabis (MO) has shown varying performance across different product categories in Missouri. In the Flower category, the brand experienced a notable shift in rankings, moving from 21st place in October 2025 to 16th in both November and December, before slightly dropping back to 20th in January 2026. This fluctuation suggests some instability in their market position, although the initial climb indicates an ability to capture increased consumer interest during the holiday season. Despite the drop in January, the brand's ability to consistently remain within the top 20 demonstrates a solid foothold in the Missouri Flower market.

In contrast, the Pre-Roll category has seen Packs Cannabis (MO) maintain a more stable presence, with rankings oscillating between 12th and 16th place over the same period. The brand achieved its highest ranking of 12th in December 2025, which could reflect a successful marketing push or seasonal demand for pre-rolls. However, the subsequent dip to 14th in January 2026 indicates potential challenges in sustaining momentum. Notably, Packs Cannabis (MO) was able to stay within the top 30 in both categories throughout the months analyzed, underscoring its competitive edge in the Missouri cannabis market. This consistency across categories suggests a well-rounded product offering that resonates with a diverse consumer base.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Packs Cannabis (MO) has demonstrated notable fluctuations in its market position, reflecting both challenges and opportunities. Over the four-month period from October 2025 to January 2026, Packs Cannabis (MO) experienced a rise in rank from 21st to 16th in November and December, before dropping to 20th in January. This indicates a temporary surge in sales performance during the holiday season, likely driven by strategic marketing or product launches. In contrast, competitors such as Elevate and Greenlight maintained relatively stable rankings, with Greenlight consistently outperforming Packs Cannabis (MO) by holding the 19th position in October and January. Meanwhile, Galactic showed a positive trajectory, improving from 22nd to 18th, suggesting a competitive edge in sales growth. These dynamics highlight the competitive pressure Packs Cannabis (MO) faces, emphasizing the need for sustained innovation and customer engagement to improve its market standing in Missouri's flower sector.

Notable Products

In January 2026, the top-performing product from Packs Cannabis (MO) was the Apples & Oranges Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, which climbed to the first position with sales of 1745 units. The Magic Marker Pre-Roll 2-Pack (1g) made a strong debut, securing the second spot. California Raisins Pre-Roll 2-Pack (1g) slipped from its consistent second-place ranking in previous months to third place. California Raspberries Pre-Roll 2-Pack (1g) entered the rankings at fourth, while Sangria Pre-Roll 2-Pack (1g) completed the top five. Notably, the Apples & Oranges product showed a steady rise from third place in December 2025 to the top spot in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.