Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

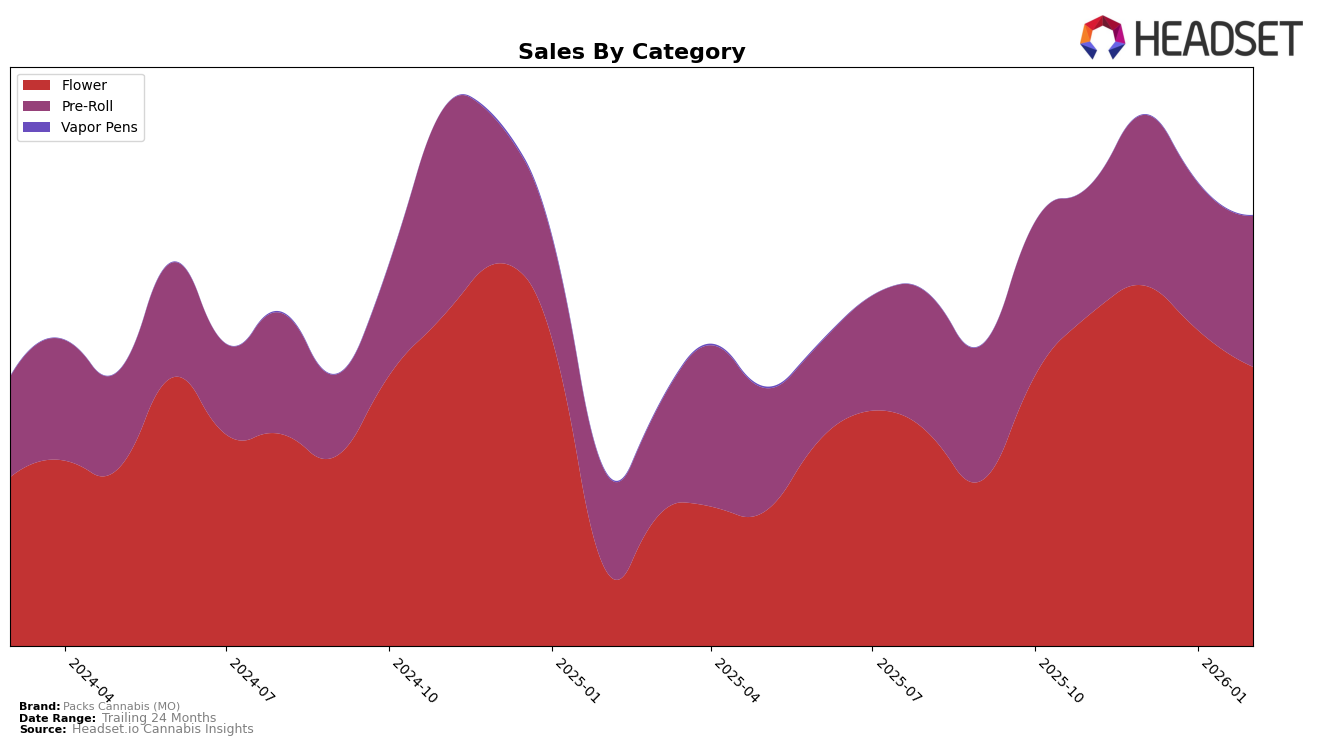

Packs Cannabis (MO) has shown a varied performance across different categories in the Missouri market. In the Flower category, the brand maintained a consistent presence in the rankings, although it slipped from 16th in November 2025 to 20th in January 2026, before recovering slightly to 17th in February 2026. This fluctuation suggests some volatility in their Flower sales, which saw a decline from December 2025 to February 2026. Despite this, the brand's ability to stay within the top 20 highlights its resilience in a competitive market segment.

In contrast, Packs Cannabis (MO) has demonstrated a more stable performance in the Pre-Roll category within Missouri. The brand improved its ranking from 16th in November 2025 to 12th in December 2025, before settling at 13th in February 2026. This upward trend in rankings is indicative of a strong market presence and consumer preference for their Pre-Roll products. The sales figures reflect this positive trajectory, with a noticeable increase from November to December 2025, despite a slight dip in January 2026. This consistency in the Pre-Roll category suggests that Packs Cannabis (MO) has successfully captured a niche within the Missouri market, potentially offering a more reliable revenue stream compared to their Flower offerings.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Packs Cannabis (MO) has experienced some fluctuations in its market position, reflecting broader market dynamics. Over the observed period from November 2025 to February 2026, Packs Cannabis (MO) maintained a relatively stable rank, starting at 16th in November and December, dropping to 20th in January, and slightly recovering to 17th in February. This indicates a challenge in maintaining a top-tier position amidst strong competition. Notably, Nugz (MO) consistently outperformed Packs Cannabis (MO), holding ranks between 12th and 15th, suggesting a stronger brand presence. Meanwhile, TwentyTwenty also remained ahead, with ranks ranging from 14th to 16th, despite a notable sales drop in February. Conversely, Atta showed significant improvement, climbing from 25th in November to 19th in February, potentially posing a future threat. The data suggests that while Packs Cannabis (MO) is a competitive player, it faces pressure from both established and emerging brands, necessitating strategic adjustments to enhance its market position.

Notable Products

In February 2026, Sangria Pre-Roll 2-Pack (1g) emerged as the top-performing product for Packs Cannabis (MO), climbing to the number one rank with impressive sales of $4,306. Burger Oasis Pre-Roll 2-Pack (1g) secured the second position, making a notable debut in the rankings. Gluetopia Pre-Roll 2-Pack (1g) followed closely at third, also appearing for the first time. California Raisins Pre-Roll 2-Pack (1g) maintained a consistent presence, holding the fourth position, though it experienced a slight drop from its previous ranks in November and December 2025. California Raspberries Pre-Roll 2-Pack (1g) rounded out the top five, slipping from the second position in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.