Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

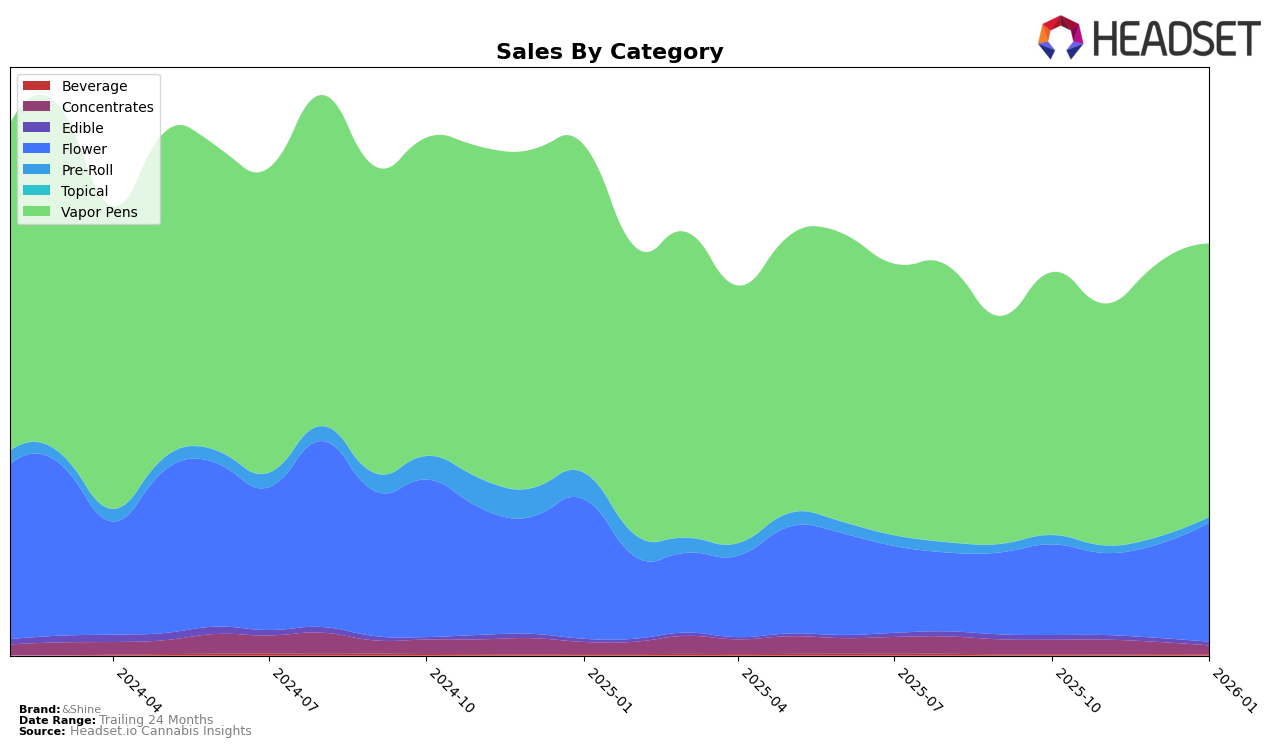

&Shine has shown a consistent performance in the Illinois market, maintaining a steady rank of 8th in the Flower category over the past four months. Their sales figures in this category have seen slight fluctuations, with a notable decrease from October to November, but they have managed to stabilize in the following months. In contrast, their presence in the Vapor Pens category in Illinois is particularly strong, holding the top rank consistently. This suggests a dominant position in the vapor segment, supported by a substantial increase in sales from November to December. Meanwhile, in Nevada, &Shine's Flower category ranking has seen some variance, with a peak at 12th in December before settling at 16th in January, indicating a competitive landscape.

In Maryland, &Shine has demonstrated a significant upward trend in the Flower category, jumping from being unranked to securing the 15th position by January, reflecting a growing market presence. Their Vapor Pens category has also performed well, maintaining a top 5 position throughout the months, which highlights their strong foothold in this category. However, in Massachusetts, their Vapor Pens were ranked 29th in October but did not appear in the top 30 in subsequent months, suggesting potential challenges in maintaining market share. In Ohio, &Shine has consistently held the 3rd position in the Vapor Pens category, indicating a stable and well-established presence in the state.

Competitive Landscape

In the Illinois vapor pens category, &Shine has consistently maintained its top rank from October 2025 through January 2026, showcasing its strong market presence and consumer preference. This stability in ranking is significant, especially when compared to competitors like Select, which held the second position throughout the same period. Despite Select's robust sales figures, &Shine's ability to outperform them indicates a strong brand loyalty or superior product offering. Meanwhile, Joos has shown notable improvement, climbing from fifth to third place by January 2026, which suggests a growing competitive pressure in the market. This competitive landscape highlights the importance for &Shine to continue innovating and maintaining its customer base to defend its leading position in the Illinois vapor pens market.

Notable Products

In January 2026, &Shine's top-performing product was Northern Lights CDT Distillate Cartridge (1g) in the Vapor Pens category, climbing from third place in December 2025 to secure the top spot with sales of 7,168 units. The Blackberry Gummies 10-Pack (100mg) in the Edible category maintained a strong performance, ranking second, consistent with its previous top position in November 2025. Northern Lights Distillate Disposable (2g) debuted in January 2026, securing the third position in the Vapor Pens category. The Granddaddy Purple Distillate Cartridge (1g) experienced a slight drop, moving from second in December 2025 to fourth in January 2026. Ghost Train Haze Distillate Cartridge (1g) maintained its position in the rankings, moving from fourth in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.