Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

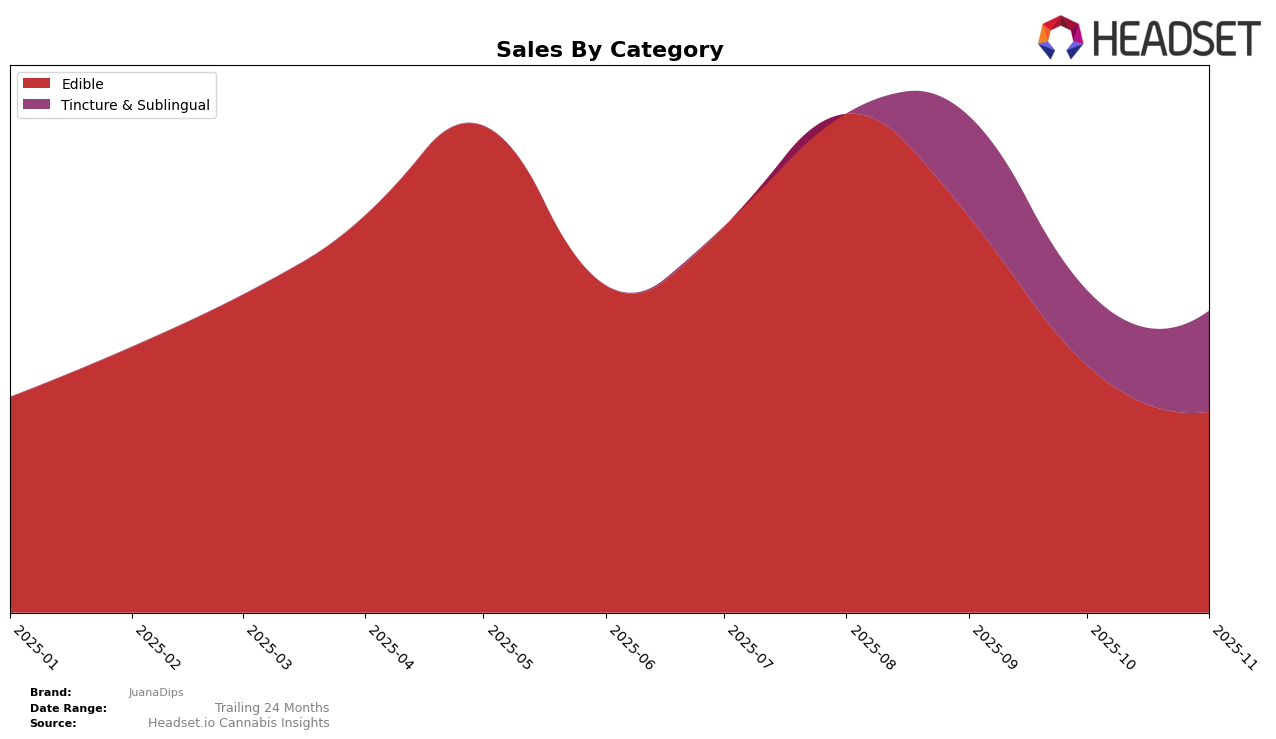

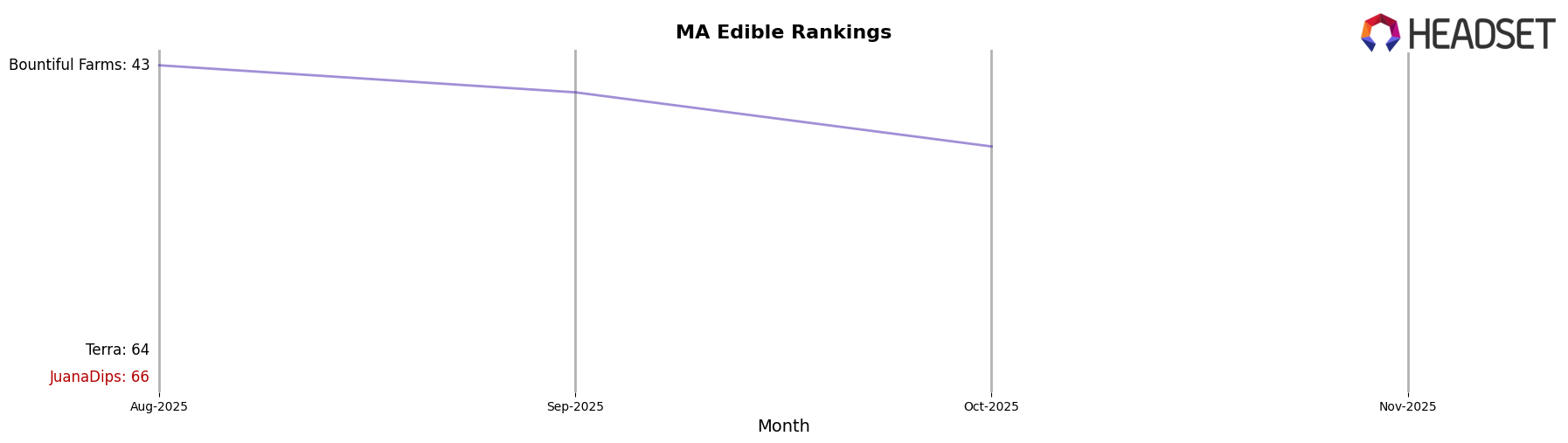

In the state of Massachusetts, JuanaDips has faced challenges in the Edible category. As of August 2025, the brand ranked 66th and did not appear in the top 30 for the subsequent months, indicating a struggle to maintain a competitive edge in the market. This absence from the top rankings could suggest that JuanaDips is either losing market share to competitors or not effectively capitalizing on consumer trends within the state. The lack of ranking in later months highlights a potential need for strategic adjustments to regain visibility and competitiveness in Massachusetts.

While JuanaDips' performance in Massachusetts raises concerns, it also presents an opportunity for the brand to analyze and address the factors contributing to its current position. The sales data from August 2025 shows a baseline from which the brand can measure future growth or decline. By focusing on consumer preferences and perhaps innovating their product offerings, JuanaDips could potentially improve its standing in the Edible category. However, without more detailed insights into their strategies or consumer feedback, it remains to be seen how the brand will navigate these challenges in the coming months.

Competitive Landscape

In the Massachusetts edible cannabis market, JuanaDips has experienced notable competitive dynamics in recent months. As of August 2025, JuanaDips was ranked 66th, trailing behind competitors such as Terra at 64th and Bountiful Farms at 43rd. However, while Terra and JuanaDips did not maintain their positions in the top 20 in subsequent months, Bountiful Farms continued to rank, although it showed a downward trend, slipping from 43rd in August to 49th by October. This suggests that while JuanaDips is currently positioned lower in the rankings, there may be opportunities to capitalize on the declining trajectory of Bountiful Farms, especially if JuanaDips can leverage strategic marketing and product innovation to boost its visibility and sales in the competitive Massachusetts market.

Notable Products

In November 2025, Spearmint Pouches 20-Pack (100mg) from JuanaDips maintained its top position in the Edible category with sales reaching 141 units. Watermelon Lime Dips Pouches 10-Pack (100mg) continued to hold the second rank, showing consistent performance despite a slight sales increase to 100 units. Orange Creamsicle Pouches 20-Pack (100mg) improved its ranking from fourth to third, indicating a growing consumer preference with sales rising to 64 units. Green Apple Pouches 20-Pack (100mg) dropped to fourth place in the Tincture & Sublingual category, reflecting a decrease in popularity from its previous third position. Spearmint Pouches 10-Pack (100mg) entered the rankings at fifth place, marking a new entry in the Tincture & Sublingual category for November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.