Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

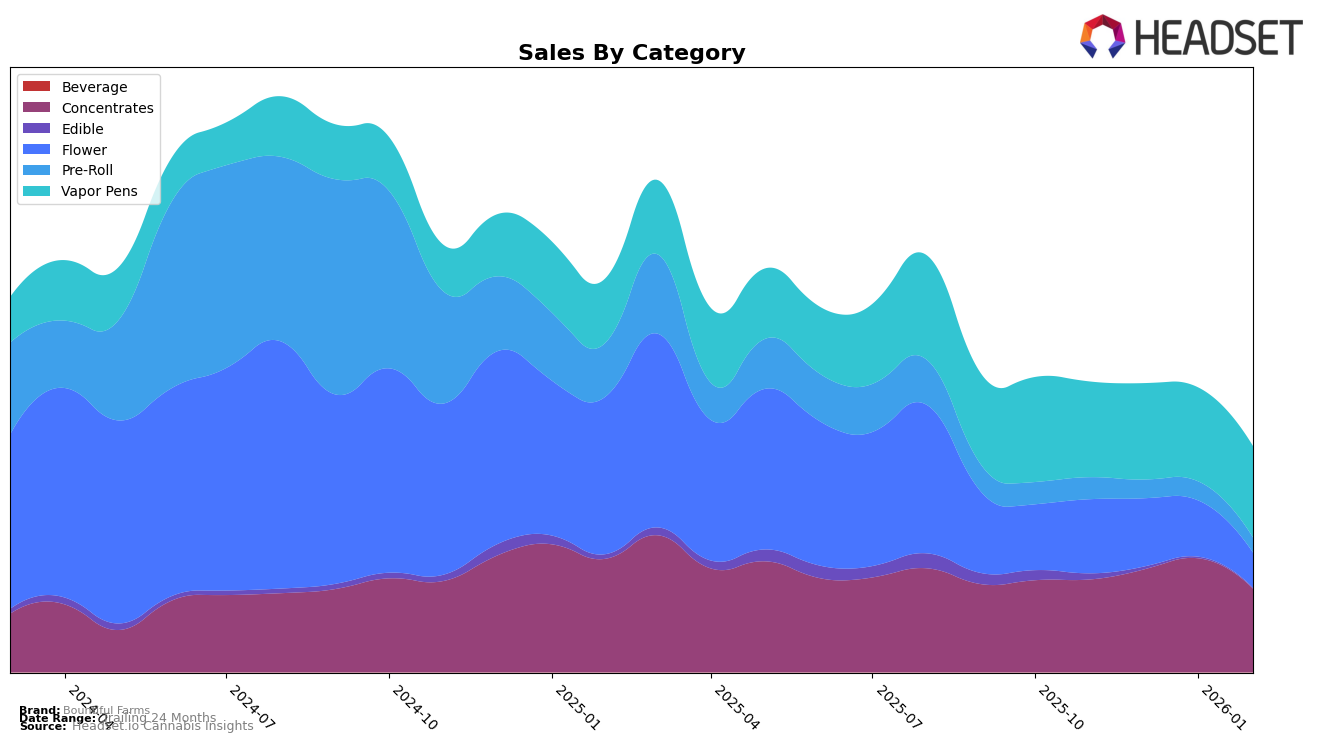

Bountiful Farms has demonstrated a consistent presence in the Massachusetts cannabis market, particularly within the Concentrates category. Over the months from November 2025 to February 2026, the brand maintained a strong position, ranking 5th consistently before a slight dip to 6th in February. This stability in the top ranks, despite fluctuations in sales figures, signifies a robust market presence in this category. In contrast, the brand's performance in the Edible category was less prominent, with a rank of 60 in November 2025, and no further top 30 placements in subsequent months, indicating potential areas for growth or reevaluation of strategy.

In the Flower category, Bountiful Farms experienced a downward trend, moving from 65th in November 2025 to 87th by February 2026. This decline suggests challenges in maintaining competitive sales volumes or market share in this segment. On a more positive note, the Vapor Pens category saw a noteworthy improvement, with the brand climbing from 32nd in December 2025 to 27th in February 2026. This upward movement in rankings highlights a potential area of strength and growth for Bountiful Farms. Overall, while the brand shows strong performance in specific categories, there are opportunities for improvement and strategic adjustments in others.

Competitive Landscape

In the Massachusetts vapor pens category, Bountiful Farms has shown a consistent presence, maintaining a rank in the 30s before improving to 27th in February 2026. This improvement is notable when compared to competitors like Liquid Gold, which started at 43rd and moved up to 29th, and Nature's Heritage, which fluctuated but ultimately surpassed Bountiful Farms in February. Despite this, Bountiful Farms has experienced stable sales, with a slight decline in February, contrasting with Nectar, which consistently improved its rank and sales, ending at 25th. Meanwhile, Good Chemistry Nurseries maintained a higher rank throughout, although their sales dipped in February. These dynamics suggest that while Bountiful Farms is holding its ground, there is competitive pressure from brands like Nectar and Good Chemistry Nurseries, which could impact future market positioning and sales performance.

Notable Products

In February 2026, Bountiful Farms' top-performing product was Burberriez Pre-Roll (1g), securing the number one rank with notable sales of 553 units. Mac And Cheese Pre-Roll (1g) maintained its position at rank two, showing consistent performance from January 2026. Southern Hashpitality Pre-Roll (1g) climbed to the third position, improving from its fourth position in January 2026. Runtz Banger (3.5g) entered the rankings at number four, indicating a strong debut in the Flower category. Lastly, Guava Now N Later x Purple Lambo Live Hash Rosin Disposable (0.5g) rounded out the top five, marking its presence in the Vapor Pens category with consistent entry into the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.