Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

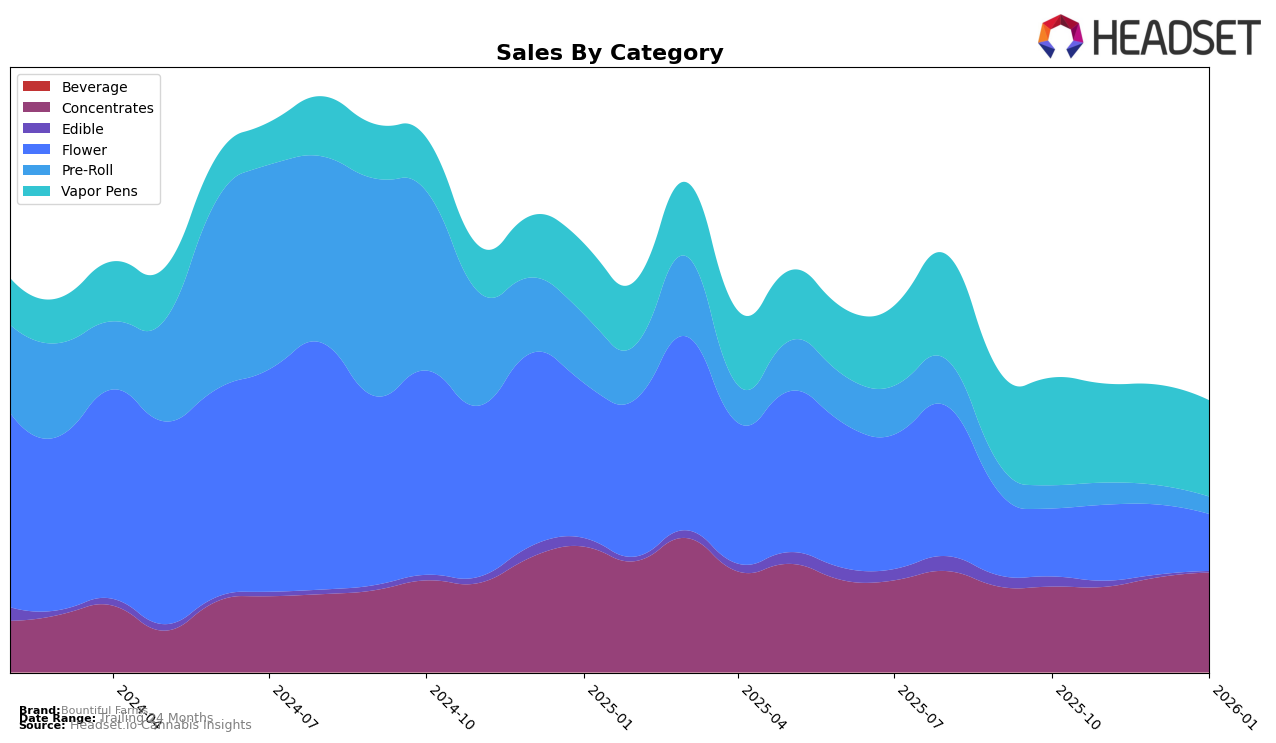

Bountiful Farms has shown a consistent performance in the Concentrates category in Massachusetts, maintaining a strong presence with a steady rank of 5 from November 2025 to January 2026. This consistency is indicative of a stable market share in this category, which is further supported by a rising sales trend, peaking at $239,673 in January 2026. Conversely, the Edible category reflects a different story, where Bountiful Farms did not make it to the top 30 brands in December 2025 and January 2026, suggesting challenges in maintaining competitive traction in this segment.

In the Flower category, Bountiful Farms experienced fluctuations in its rankings, starting at 71 in October 2025, improving to 64 in November, but then slipping back to 73 by January 2026. This volatile performance might suggest a competitive market environment or potential shifts in consumer preferences. The Vapor Pens category, meanwhile, shows a relatively stable ranking, hovering around the 30th position, though it experienced a slight dip to 32 in December 2025. This stability, despite minor fluctuations, indicates a resilient market presence, although a decline in sales from October 2025 to January 2026 could be a point of concern for future strategy adjustments.

Competitive Landscape

In the Massachusetts concentrates market, Bountiful Farms has maintained a consistent presence, ranking 5th from November 2025 through January 2026, after a slight dip from 4th place in October 2025. This stability in ranking is noteworthy given the competitive landscape, where brands like Nature's Heritage consistently hold the 3rd position with significantly higher sales figures. Meanwhile, Cultivators Classic has seen a rise, overtaking Bountiful Farms in November 2025, moving from 5th to 4th place, indicating a competitive edge in sales growth. Despite these challenges, Bountiful Farms has shown a positive sales trend, with a steady increase from November 2025 to January 2026, suggesting resilience and potential for upward mobility in the rankings. Competitors like Resinate and Harbor House Collective have maintained stable rankings but with lower sales figures compared to Bountiful Farms, highlighting its strong market position amidst fluctuating competition.

Notable Products

In January 2026, the top-performing product from Bountiful Farms was Pina Grande (3.5g) in the Flower category, which climbed to the number one position with sales reaching 906 units. The Pina Grande Pre-Roll (1g) maintained its strong performance, ranking second, while the Burberriez Live Hash Rosin Cartridge (0.5g) entered the rankings at third place. Mac And Cheese Pre-Roll (1g) and NYC Vapor + Zote Live Hash Rosin Cartridge (0.5g) were new entrants, securing the fourth and fifth positions, respectively. Notably, Pina Grande (3.5g) showed significant growth from previous months, moving from third place in December 2025 to the top spot in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.