Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

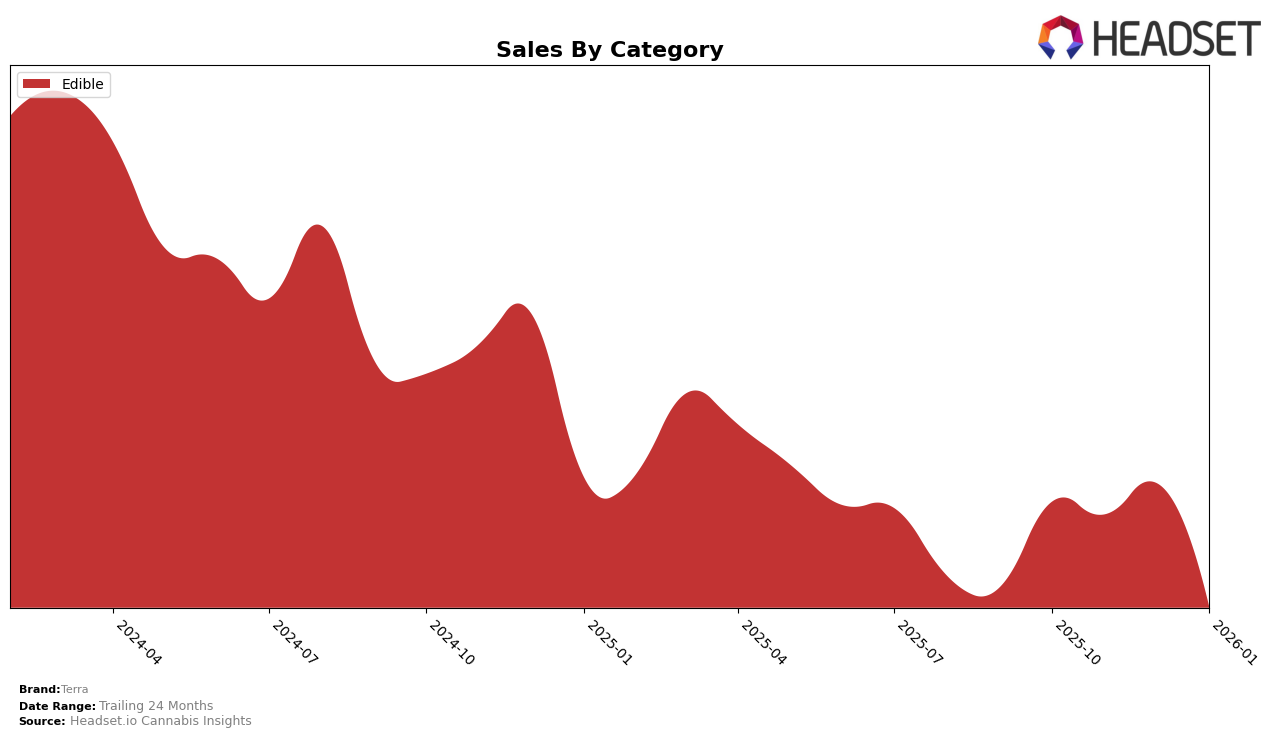

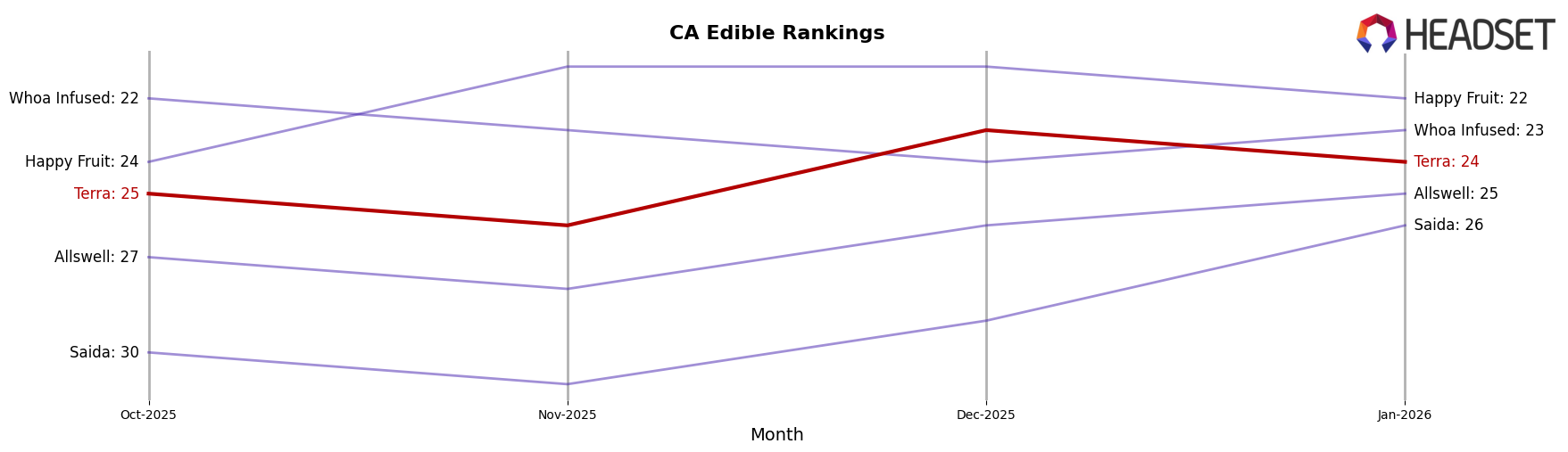

In California, Terra's performance in the edibles category has shown some fluctuations over the observed months. Starting from a rank of 25 in October 2025, the brand experienced a slight dip in November, moving to rank 26, before climbing back to 23 in December. By January 2026, Terra settled at rank 24. This upward movement in December could be indicative of a successful marketing strategy or a favorable consumer trend during the holiday season. The brand's sales figures in California also reflect this trend, with a notable peak in December, which suggests a temporary boost in consumer interest or promotional activity. However, the overall ranking positions indicate that Terra remains a mid-tier player in the California edibles market, with room for growth.

In contrast, Terra's performance in other states such as Illinois and Michigan paints a different picture. In Illinois, Terra consistently did not make it into the top 30 rankings, maintaining positions in the 40s, which signals a challenging market presence. Similarly, in Michigan, the brand's rank steadily declined from 49 in October 2025 to 60 by January 2026, highlighting a downward trend in consumer preference or competitive pressures. This decline in Michigan, coupled with the absence from the top 30 in Illinois, suggests that Terra might need to reassess its strategies in these regions to improve its market penetration and consumer engagement.

Competitive Landscape

In the competitive landscape of the edible cannabis category in California, Terra has shown a fluctuating performance from October 2025 to January 2026. Starting at rank 25 in October, Terra's position slightly improved to 23 in December but dipped to 24 by January. Despite these rank changes, Terra's sales trajectory reveals a significant peak in December, indicating a strong seasonal performance or successful marketing efforts during that period. Compared to competitors like Happy Fruit, which consistently maintained a rank around 21-22, and Whoa Infused, which hovered around the 22-24 range, Terra's rank volatility suggests a need for strategic adjustments to stabilize its market position. Meanwhile, Saida experienced a notable climb from rank 30 to 26, reflecting a significant upward trend that could pose a future threat. These dynamics highlight the competitive pressure in the California edibles market and underscore the importance for Terra to leverage its peak sales periods to enhance its overall market standing.

Notable Products

In January 2026, Terra's top-performing product was the Dark Chocolate Espresso Bean Bites 20-Pack (100mg), maintaining its number one rank from previous months, despite a sales decrease to 6519 units. The Blueberry Milk Chocolate Bites 20-Pack (100mg) held steady in second place, followed by the Milk Chocolate Sea Salt Caramel Bites 20-Pack (100mg) in third, both consistent with their rankings from October to December 2025. The THC/CBN 5:2 Milk And Cookies Chocolate Bites 20-Pack (100mg THC, 40mg CBN) remained in fourth place, showing stability in its position. Notably, the Dark Chocolate Espresso Bean Bites 2-Pack (10mg) entered the rankings at fifth place, suggesting a growing interest in smaller pack sizes. Overall, the product rankings for Terra's edibles remained unchanged from the previous months, indicating consistent consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.