Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

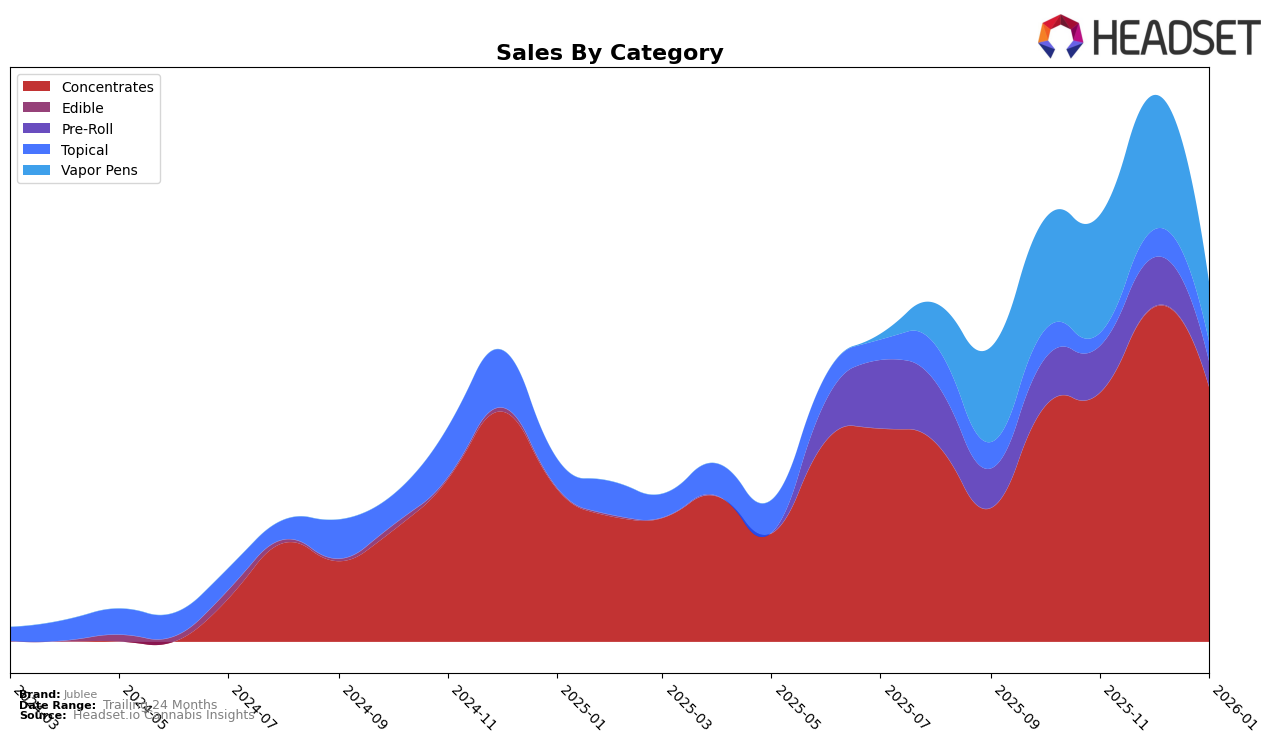

Jublee's performance in the Ontario market shows distinct trends across different categories. In the Concentrates category, Jublee maintained a consistent ranking of 43rd in October and November 2025, before improving slightly to 39th in December 2025 and January 2026. This upward movement, coupled with a noticeable increase in sales from $28,171 in October to $46,428 in December, suggests a growing presence and consumer interest in this category. However, the slight drop in sales to $35,078 in January indicates potential volatility or seasonal factors affecting demand. These dynamics highlight the brand's capacity to climb the ranks, although maintaining this momentum could be challenging.

In contrast, Jublee's performance in the Vapor Pens category in Ontario reflects a different narrative. The brand remained at the 100th position in both October and November 2025, with a modest improvement to 97th in December. However, it failed to secure a spot in the top 30 by January 2026, suggesting that while there was some growth, it wasn't enough to make a significant impact. This absence from the top rankings could indicate a highly competitive market or a need for strategic adjustments to enhance visibility and consumer appeal. The sales figures, while showing a gradual increase from $16,737 in October to $20,266 in December, underline the challenge of breaking into higher ranks in this category.

Competitive Landscape

In the Ontario concentrates market, Jublee has shown a notable improvement in its ranking, moving from 43rd in October 2025 to 39th by January 2026. This upward trend indicates a positive reception and growing consumer interest, despite the competitive landscape. Brands like Roilty Concentrates and Lord Jones have experienced fluctuations in their rankings, with Roilty dropping from 20th to 35th and Lord Jones consistently ranking outside the top 30. Tuck Shop and Syrup (Canada) also show variability, with Tuck Shop's rank declining to 44th and Syrup (Canada) maintaining a close competition with Jublee. Jublee's sales increase in December 2025 suggests a strong holiday season performance, which could be leveraged for sustained growth. This competitive analysis highlights Jublee's potential to climb further in the ranks if it continues to capitalize on its current momentum and market trends.

Notable Products

In January 2026, Montreal Style Aged Hash (2g) from Jublee maintained its position as the top-selling product in the Concentrates category, continuing its four-month streak as the number one product with sales of 829 units. Hybrid Full Spectrum (1g) saw an impressive rise to the second spot, climbing from fifth place in October and November 2025. CBG Sweet Citrus Bright Mind Distillate Broad Spectrum Disposable (1.2g), a Vapor Pens product, experienced a drop from its consistent second place in previous months to third place in January 2026. Aged Sticky Hash (2g) held steady at the fourth position, while CBG Bright Mind Full Spectrum Kief Infused Pre-Roll 4-Pack (2g) remained in fifth place. These shifts highlight the dynamic nature of product popularity within Jublee's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.