Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

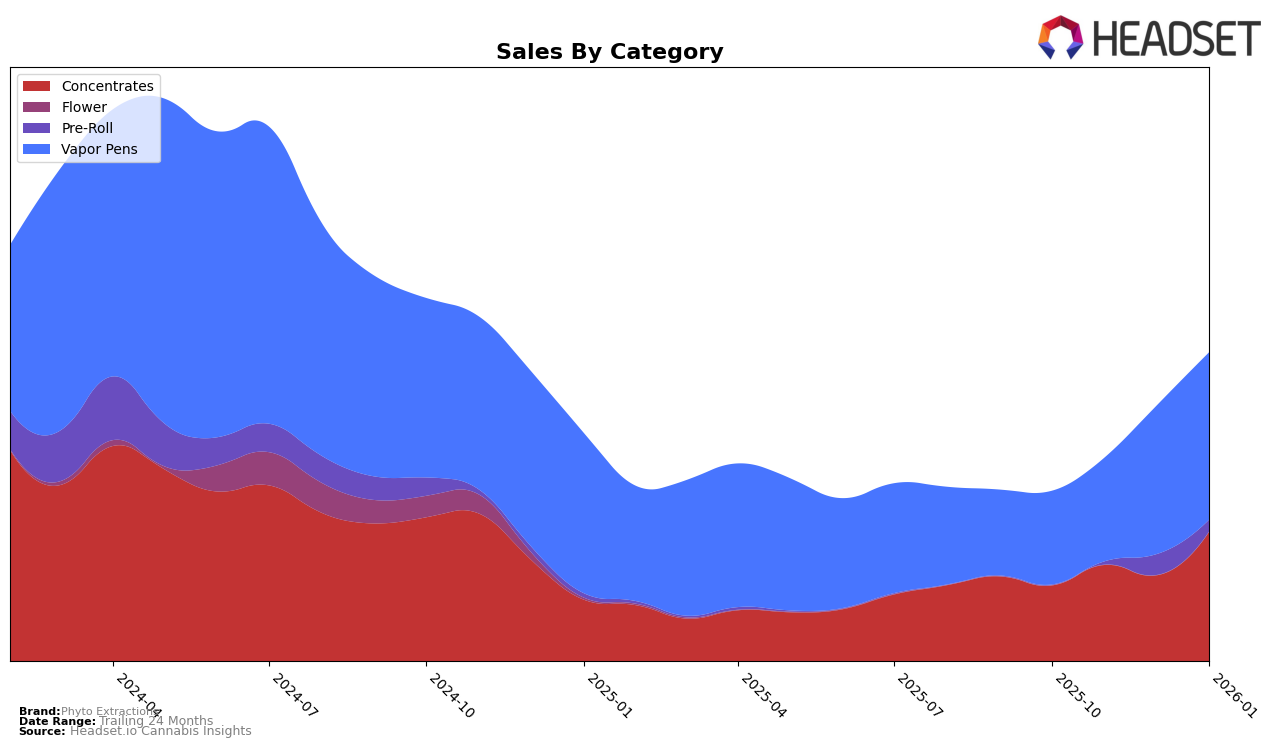

Phyto Extractions has demonstrated a varied performance across different Canadian provinces and product categories. In Alberta, the brand has maintained a steady presence in the concentrates category, fluctuating between ranks 18 and 23 over the last few months. This stability is accompanied by a notable increase in sales from October to January, indicating a growing consumer interest. Meanwhile, in Ontario, Phyto Extractions has shown significant upward movement in the concentrates category, climbing from rank 47 in October to 33 by January, with sales more than doubling during this period. This suggests a strengthening market position in Ontario's concentrates segment.

In Saskatchewan, Phyto Extractions has made a remarkable entry into the concentrates category, securing the 14th rank in January, which is a noteworthy achievement given their absence in the previous months. The vapor pens category also shows promising growth, with the brand climbing from the 36th rank in November to 18th by January, reflecting a strong upward trend. However, the pre-roll category presents a challenge, as Phyto Extractions entered the top 30 only in December at rank 40 and slipped to rank 50 by January, indicating potential areas for improvement. These movements highlight the brand's varying performance across categories and provinces, offering insights into their strategic positioning and market dynamics.

Competitive Landscape

In the competitive landscape of vapor pens in Saskatchewan, Phyto Extractions has demonstrated a notable upward trajectory in brand rank and sales, particularly from November 2025 to January 2026. Initially absent from the top 20 in October 2025, Phyto Extractions climbed to 36th in November, 24th in December, and achieved 18th by January 2026. This upward movement is significant when compared to competitors such as Kolab, which fluctuated between 19th and 21st, and JC Green Cannabis Company, which saw a decline from 12th to 20th. Meanwhile, DEBUNK maintained a relatively stable position, slightly improving from 17th to 15th. Phyto Extractions' sales growth is particularly impressive, with a significant leap from November to January, indicating a strong market response and positioning it as a rising contender in the Saskatchewan vapor pen market. For more detailed insights and data trends, consider exploring advanced analytics.

Notable Products

In January 2026, Dragon Fruit Distillate Cartridge (1g) emerged as the top-performing product for Phyto Extractions, climbing from third place in December 2025 and achieving impressive sales of 4204 units. Ice Wreck Shatter (1g) maintained a strong position, consistently ranking second, with sales increasing to 3661 units from the previous month. Fire Stick - Slurriking Distillate Cartridge (1g) dropped to third place, experiencing a decline in sales to 2451 units from its peak in December. Alien Trufflez Shatter (1g) re-entered the rankings in fourth place with 1147 units sold after being unranked in December. Pink Snowman Cured Resin (1g) made its debut in the rankings at fifth place with 645 units sold, indicating a positive reception since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.