Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

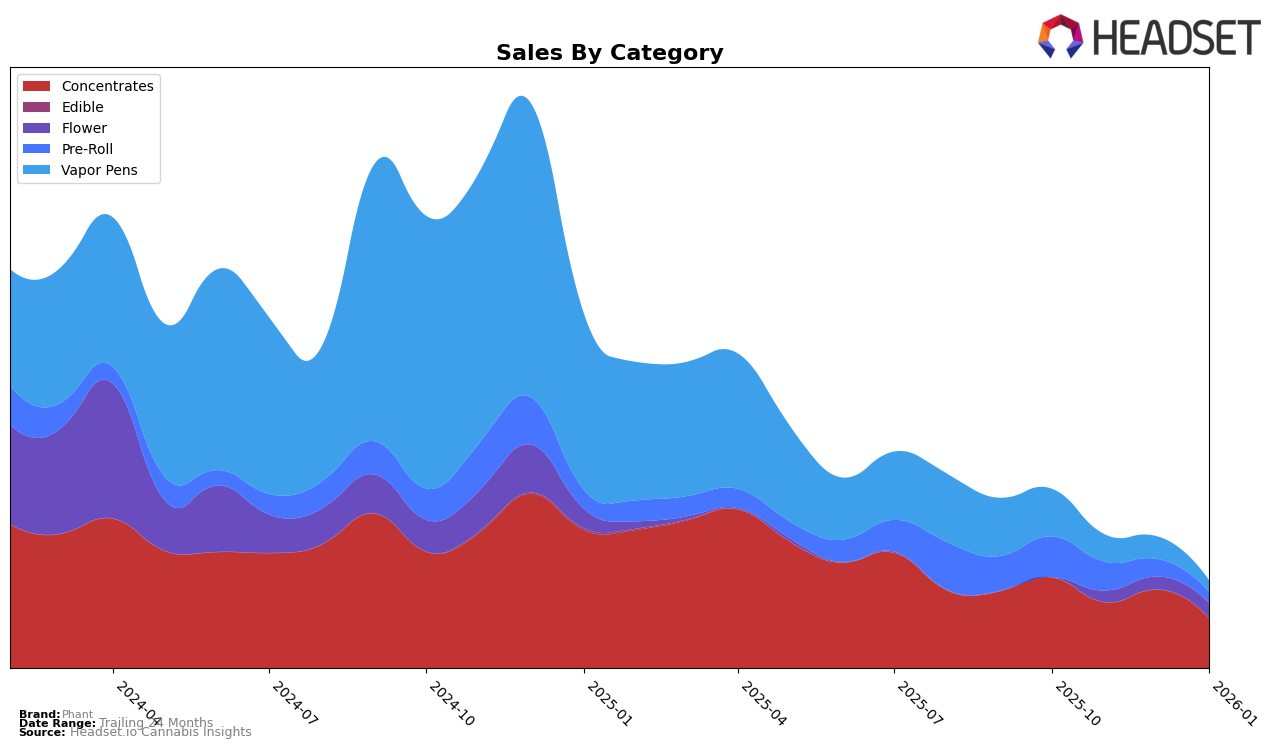

Phant's performance across Canadian provinces reveals a varied landscape of success and challenges. In Alberta, Phant's presence in the concentrates category has seen a re-entry into the top 30, moving from an absence in November and December to 31st position in January 2026. However, their vapor pen category did not make it into the top 30 during the last quarter of 2025, which could be a point of concern for the brand. In British Columbia, Phant's performance in concentrates fluctuated, experiencing a drop to 32nd position in November before climbing back up to 30th by January. The flower category, however, saw a notable absence from the top 100, indicating potential room for improvement in this segment.

In Ontario, Phant maintained a steady, albeit modest, presence in the concentrates category, hovering just outside the top 50 throughout the final quarter of 2025. Meanwhile, in Saskatchewan, Phant demonstrated strong performance in concentrates, consistently ranking within the top 15, although there was a noticeable drop from 7th in December to 15th in January. Interestingly, the pre-roll category saw Phant enter the top 60 in December, suggesting a growing foothold in this market segment. These movements across categories and provinces highlight both the strengths and opportunities for Phant in the evolving cannabis landscape.

Competitive Landscape

In the Alberta concentrates market, Phant has experienced fluctuating rankings, indicating a dynamic competitive landscape. In October 2025, Phant ranked 33rd but dropped out of the top 20 in November and December, only to reappear at 31st in January 2026. This suggests a volatile performance compared to competitors like Tremblant Cannabis, which maintained a more stable presence, ranking between 27th and 36th during the same period. Meanwhile, Thrifty showed a notable upward trend, climbing from 42nd in October to 29th in January, potentially capturing market share with increasing sales. Syrup (Canada) consistently outperformed Phant, maintaining a top 30 position, albeit with declining sales, which might suggest a shift in consumer preferences or market saturation. These insights highlight the need for Phant to strategize effectively to improve its market position amidst strong competition.

Notable Products

In January 2026, the top-performing product from Phant was Snowball Diamond Hash (2g) in the Concentrates category, which rose to the number one rank with notable sales of 717 units. The Gingerbread Flavored Diamond Infused Pre-Roll (1g) held strong in the Pre-Roll category, maintaining a second-place ranking after being first in December 2025. Tropical Breeze Diamonds (1g) slipped from second to third place in the Concentrates category, indicating a decline in its sales momentum. Meanwhile, Orange Cream THCA Diamonds (1g) remained stable in fourth place, showing consistent performance across the months. New to the rankings in January, Apes In Space (7g) entered the Flower category at fifth place, demonstrating promising initial sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.