Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

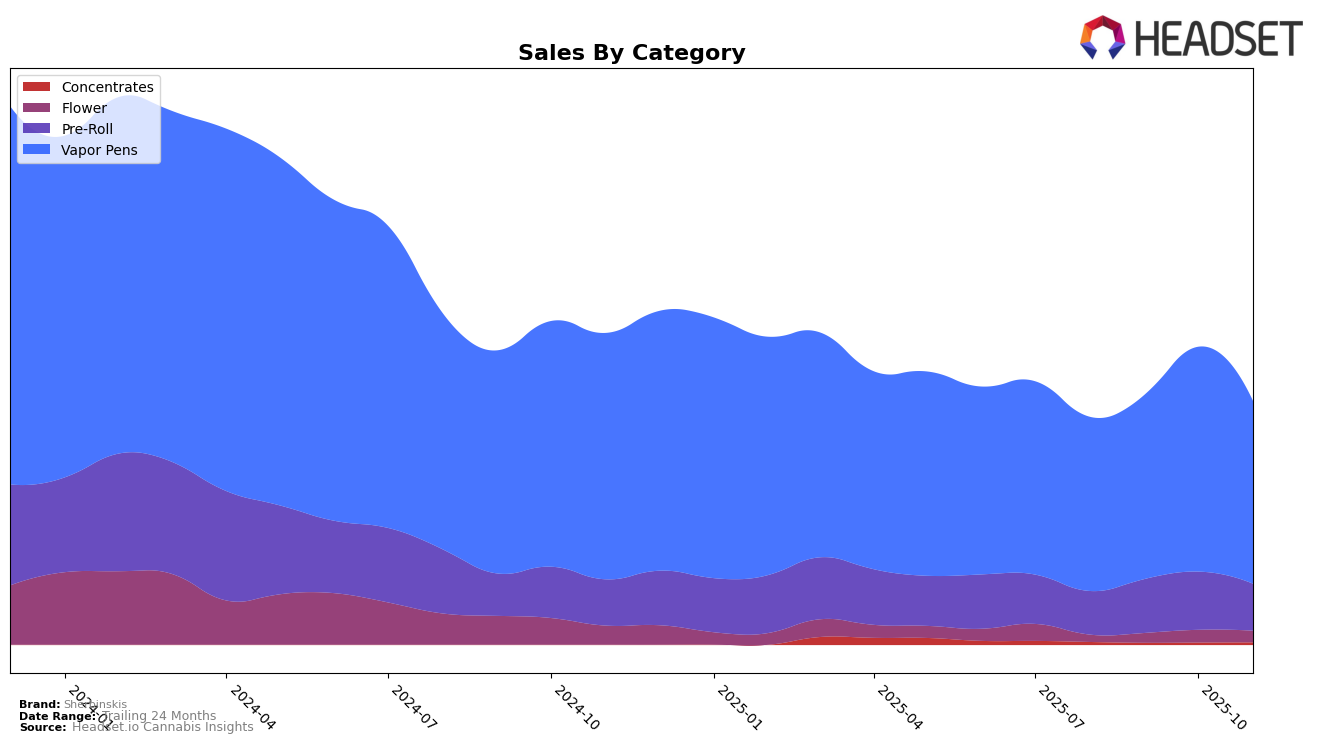

In the realm of vapor pens, Sherbinskis has demonstrated varying performance across different regions. In British Columbia, the brand saw a resurgence in November 2025, climbing back to the 29th position after a dip in October when it fell out of the top 50. This fluctuation in rankings was accompanied by a noticeable increase in sales, suggesting a potential recovery or a successful promotional effort. Meanwhile, in Ontario, Sherbinskis maintained a consistent presence in the rankings, hovering around the 30th position over the four-month period, which indicates a stable market presence. Interestingly, Saskatchewan saw Sherbinskis enter the top 30 for vapor pens in November, marking a significant entry into this market segment.

In California, Sherbinskis' performance in the pre-roll category has been more volatile. Starting from the 92nd position in August, the brand improved its standing to 73rd by October but slightly declined to 79th in November. This movement suggests that while there is growing interest, competition remains fierce. In the vapor pen category, the brand showed a promising upward trajectory from 77th in August to 50th in October, although it dipped slightly in November. This indicates a potential peak in consumer interest or market saturation. These trends highlight the importance of strategic positioning and market adaptation to sustain growth in competitive landscapes like California.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Sherbinskis has shown a consistent presence, although it remains outside the top 20 brands, with rankings fluctuating between 28th and 31st from August to November 2025. Despite this, Sherbinskis has demonstrated a positive sales trend, peaking in October 2025. Notably, Juicy Hoots maintains a stronger market position, consistently ranking in the top 30, although its sales have decreased over the months. Meanwhile, Foray and GREAZY have shown fluctuations in rank, with GREAZY surpassing Sherbinskis in November. The competition from Papa's Herb is also notable, as it closely trails Sherbinskis in sales, indicating a competitive pressure that could influence Sherbinskis' market strategy moving forward. These dynamics suggest that while Sherbinskis is holding steady, there is room for strategic adjustments to enhance its competitive edge in the Ontario vapor pen market.

Notable Products

In November 2025, the top-performing product from Sherbinskis was the True GLTO 33 Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking consistently since August, with a sales figure of 2511 units. The True Gelato 33 Live Resin Disposable (0.5g) also held steady in second place, demonstrating strong and stable performance. The Orange Sherbs Live Resin Disposable (0.5g) climbed back to third place after a dip to fifth in October, showing a significant recovery in sales. The Orange Sherbs Live Resin Cartridge (1g) remained in fourth place, while the Pink Sherbs Live Resin Disposable (0.5g) re-entered the rankings in fifth place after being unranked in previous months. Overall, Sherbinskis' product rankings have shown consistency with some notable recoveries in their disposable lines.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.