Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

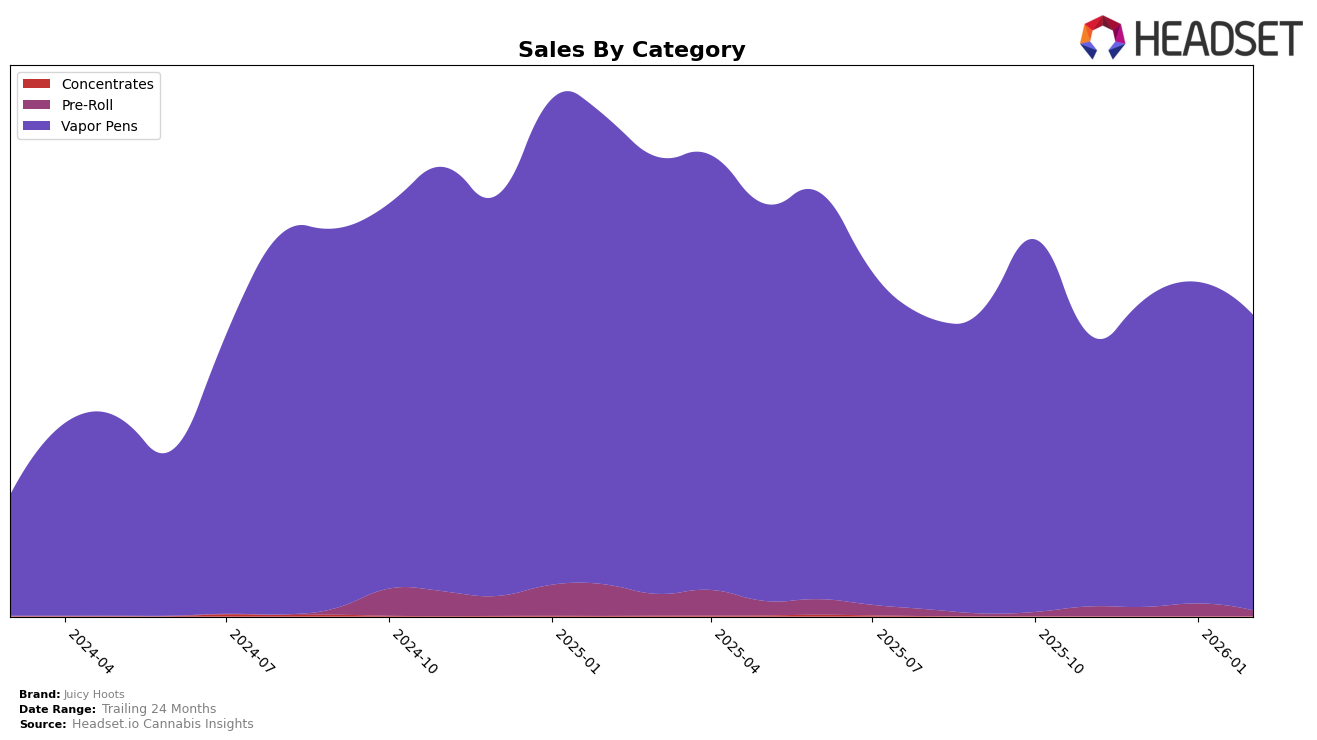

Juicy Hoots has shown varied performance across different Canadian provinces, particularly in the Vapor Pens category. In Ontario, the brand has maintained a stable presence, consistently ranking within the top 30, with a slight improvement from 29th to 25th position between November 2025 and February 2026. This indicates a steady demand and possibly effective brand positioning in the province. Meanwhile, in Saskatchewan, Juicy Hoots experienced some fluctuations, dropping from 11th in November 2025 to 14th in January 2026, before rebounding back to 11th in February 2026. This volatility could suggest competitive pressures or seasonal demand shifts impacting their ranking.

In British Columbia, Juicy Hoots has shown a positive trajectory, improving from 61st in December 2025 to 46th by February 2026, which might reflect successful marketing efforts or a growing consumer base. Conversely, in Alberta, Juicy Hoots did not make it into the top 30 rankings during the observed months, which could be a concern for their market penetration in this region. The absence from the top 30 in Alberta suggests that the brand may need to reassess its strategy or offerings to better compete in this market. Overall, while Juicy Hoots has seen successes in certain regions, there are opportunities for growth and improvement in others.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Juicy Hoots has shown a consistent presence, maintaining a rank within the top 30 brands from November 2025 to February 2026. Despite facing stiff competition, Juicy Hoots improved its rank from 29th in November and December 2025 to 25th in January and February 2026, indicating a positive trend in market positioning. Notably, Ness, which consistently ranked higher than Juicy Hoots, experienced a decline from 21st in December 2025 to 27th in February 2026, suggesting potential market share opportunities for Juicy Hoots. Meanwhile, The Loud Plug and Nugz (Canada) have shown fluctuating ranks, with The Loud Plug slightly improving from 26th to 23rd and Nugz dropping from 24th to 26th over the same period. These dynamics highlight Juicy Hoots' potential to capitalize on the shifting competitive landscape and further enhance its market share in Ontario's vapor pen category.

Notable Products

In February 2026, the top-performing product from Juicy Hoots was the Double Blue Cherry Distillate Disposable (1g) from the Vapor Pens category, maintaining its first-place ranking for the fourth consecutive month with sales of 4579 units. The Double Blue Cherry Distillate Cartridge (1g) also held steady in second place, showing consistent performance over the past months. The Double Berry Punch Distillate Cartridge (1g) rose to third place, improving from its fifth position in January 2026. Meanwhile, the Double Melon Gulp Mochi CO2 Cartridge (1g) dropped one spot to fourth place compared to its ranking in January. The Double Grape Giggles Distillate Cartridge (1g) was newly ranked in fifth place, indicating a significant entry into the top five for February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.