Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

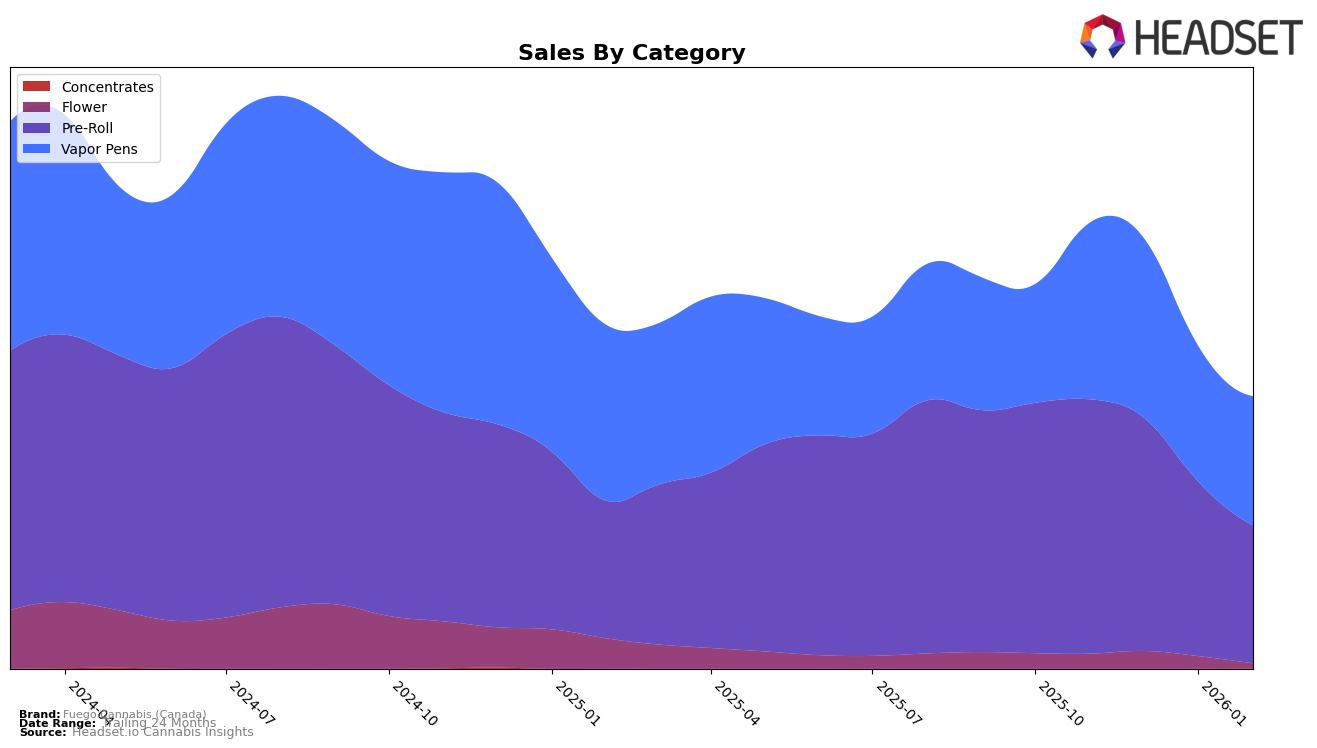

Fuego Cannabis (Canada) has shown varied performance across different provinces and categories, reflecting both challenges and opportunities. In Alberta, the brand's presence in the Pre-Roll category has been outside the top 30, with a rank of 68 in February 2026, indicating a struggle to capture significant market share. Conversely, in British Columbia, Fuego has maintained a more stable position in the Vapor Pens category, holding ranks between 14 and 18 over the observed period. This consistency suggests a stronger foothold and potential for growth in the British Columbia market, even though sales figures have fluctuated.

In Ontario, Fuego Cannabis has demonstrated a robust performance in the Pre-Roll category, consistently ranking within the top 10, though it has experienced a slight decline from 7th to 10th place by February 2026. The Vapor Pens category in Ontario also reflects a stable presence with ranks around the mid-teens. However, in the Flower category, the brand's absence from the top 30 after November 2025 suggests challenges in maintaining competitiveness. Meanwhile, in Saskatchewan, the brand has experienced notable volatility, particularly in Vapor Pens, where it dropped from 5th to 14th place, highlighting a need for strategic adjustments to regain market share.

Competitive Landscape

In the competitive landscape of the Ontario Pre-Roll category, Fuego Cannabis (Canada) has experienced a notable shift in its market position over recent months. While maintaining a steady rank of 7th in November and December 2025, Fuego Cannabis (Canada) saw a decline to 9th in January 2026 and further to 10th by February 2026. This downward trend in rank coincides with a significant decrease in sales, suggesting potential challenges in maintaining its market share. In contrast, brands like PIFF have shown resilience, consistently ranking 8th or better throughout the same period, while Carmel improved its position to 9th by February 2026. Meanwhile, FIGR maintained a stable presence around the 10th position, indicating a competitive environment where Fuego Cannabis (Canada) must strategize to regain its earlier standing and counteract the sales decline.

Notable Products

In February 2026, Fuego Cannabis (Canada) saw Sunny Daze Pre-Roll (1g) rise to the top spot in the Pre-Roll category, achieving sales of 26,335 units, marking a significant climb from its consistent fourth position in previous months. Sunny Daze Pre-Roll 2-Pack (2g), which had been the leader from November 2025 to January 2026, slipped to second place. Night Rider Pre-Roll (1g) maintained its third position, while Night Rider Pre-Roll 2-Pack (2g) dropped from second to fourth. Galactic Fire Pre-Roll 2-Pack (2g) remained in the fifth position throughout the observed period. These shifts indicate a dynamic change in consumer preferences within the Pre-Roll category for Fuego Cannabis (Canada).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.