Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

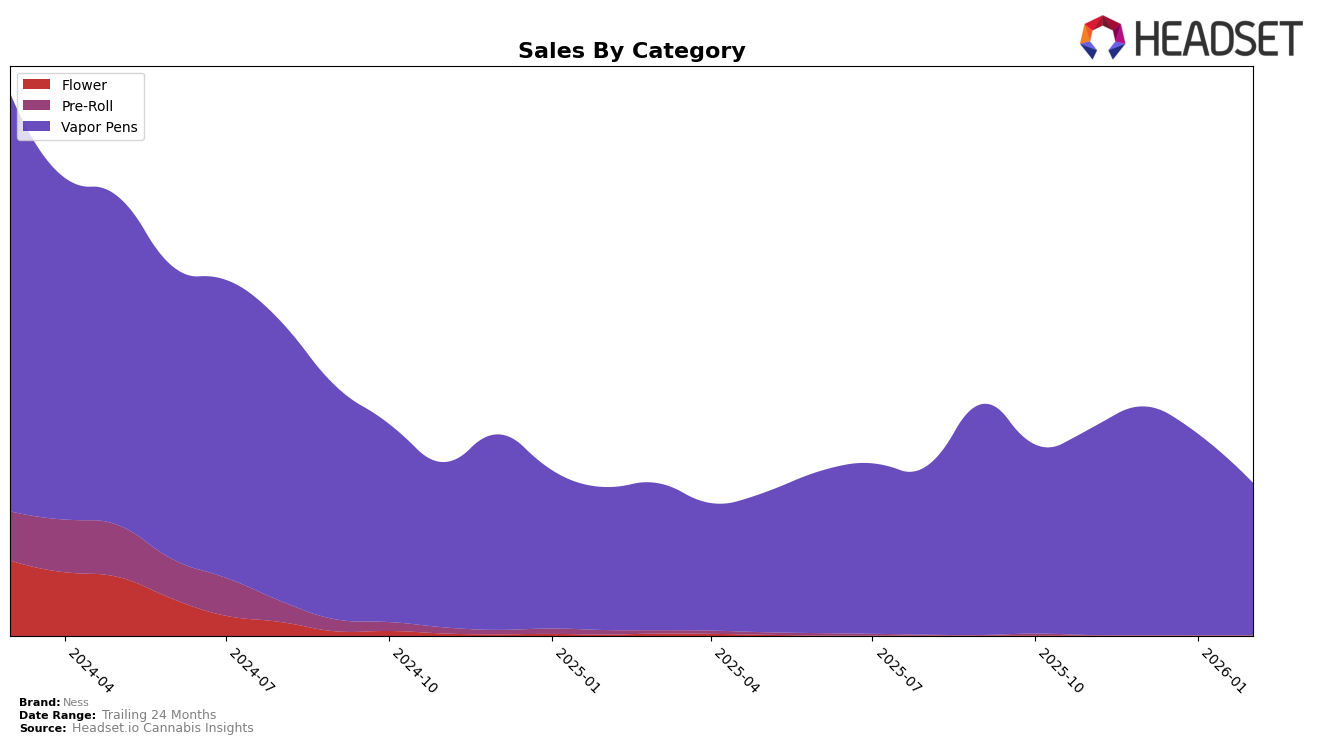

In the realm of Vapor Pens, Ness has shown notable movements across Canadian provinces. In Alberta, the brand has made a commendable upward trajectory from a rank of 60 in December 2025 to 43 by February 2026, indicating a strengthening position in this market. Conversely, in British Columbia, Ness experienced a dip in its rank from 34 in January 2026 to 38 in February 2026, though it had previously climbed from 50 in November 2025. This oscillation suggests a competitive landscape where Ness is striving to maintain its foothold. In Ontario, the brand consistently held a rank around the early twenties, though it slipped slightly to 27 by February 2026, which might be a point of concern for maintaining its competitiveness in this populous market.

The sales figures reflect some intriguing trends as well. In Alberta, Ness's sales increased steadily, culminating in a notable gain by February 2026. This growth aligns with their improved ranking and suggests effective market penetration strategies. However, in Ontario, there was a significant drop in sales from December 2025 to February 2026, which might be indicative of shifting consumer preferences or increased competition. Meanwhile, British Columbia saw a peak in sales in January 2026, followed by a decline in February, which mirrors their ranking changes. These movements across provinces highlight the dynamic nature of the cannabis market and the challenges brands like Ness face in maintaining and growing their market share.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ontario, Ness has experienced a notable decline in rank, slipping from 21st in November and December 2025 to 27th by February 2026. This downward trend in rank is mirrored by a decrease in sales, indicating potential challenges in maintaining market share. Meanwhile, competitors like Nugz (Canada) and Juicy Hoots have shown more stability, with Nugz maintaining a consistent rank around 24th to 26th and Juicy Hoots improving from 29th to 25th. EastCann has also shown a positive trajectory, moving up from 44th to 29th, suggesting a growing consumer preference. Additionally, Standard Issue, although not in the top 20 initially, has made significant strides by February 2026, reaching 28th place. These shifts highlight the competitive pressures Ness faces, emphasizing the need for strategic adjustments to regain its footing in the Ontario Vapor Pens market.

Notable Products

In February 2026, Ninja Fruit Distillate Cartridge (1g) maintained its top position in Ness's product lineup, leading the sales in the Vapor Pens category with a notable sales figure of 4391 units. Blue Kiwi Distillate Cartridge (1g) held steady in second place, consistent with its rank from the previous two months. Pink Pineapple Liquid Diamonds Disposable (1g) continued to secure the third spot, despite a gradual decline in sales. Squish'd Berry Distillate Cartridge (1g) entered the rankings for the first time, debuting at fourth place. Iced Peachy Mango Liquid Diamonds Disposable (1g) saw a drop to fifth position, reflecting a decrease in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.