Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

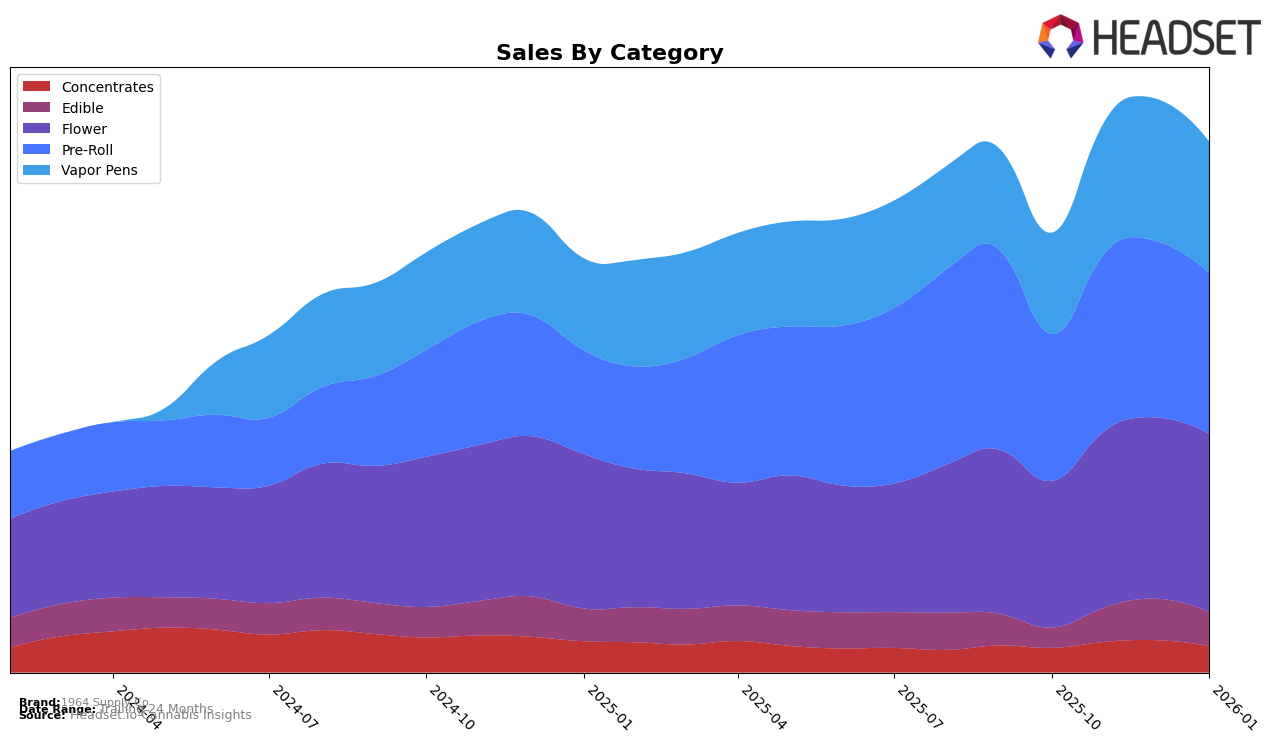

1964 Supply Co has demonstrated varied performance across different categories and regions, with notable movements in rankings. In Alberta, the brand's Flower category showed a consistent improvement, moving from rank 17 in October 2025 to rank 14 by January 2026. This indicates a positive reception and growing market presence. However, in the Pre-Roll category, a slight fluctuation was observed as the brand moved from rank 11 in October to rank 11 again in January after a brief improvement. In the Vapor Pens category, a significant leap from rank 16 to 8 between October and November showcases a strong competitive edge, although it slightly dipped to rank 10 by January 2026.

In British Columbia, 1964 Supply Co has maintained a steady presence in the Edible category, consistently holding the 6th rank from November 2025 through January 2026. The Flower category saw an upward trend, improving from rank 17 in November to rank 14 by January, indicating increased consumer preference. The Vapor Pens category also showed impressive growth, climbing from rank 9 in October to a commendable rank 4 by January. Meanwhile, in Ontario, the brand's presence in the Edible category emerged in December 2025 at rank 14, indicating a new entry into the top 30. However, their Vapor Pens category saw a slight decline, moving from rank 18 in October to rank 20 by January, suggesting a competitive challenge in that segment.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, 1964 Supply Co consistently maintained its position, fluctuating slightly between the 14th and 15th ranks from October 2025 to January 2026. Despite this stability, it faces stiff competition from brands like Good Supply, which consistently ranked higher, peaking at 12th place in October 2025. Meanwhile, Tenzo demonstrated notable upward momentum, climbing from 19th to 13th place over the same period, potentially threatening 1964 Supply Co's position. On the other hand, FIGR and MTL Cannabis remained stable in lower ranks, indicating less immediate threat. The sales figures reflect these rankings, with 1964 Supply Co showing a steady increase in sales, although still trailing behind Good Supply and Tenzo, suggesting a need for strategic initiatives to enhance market share and climb the rankings.

Notable Products

In January 2026, Comatose Pre-Roll 5-Pack (2.5g) maintained its top rank as the leading product from 1964 Supply Co, despite a slight dip in sales to 18,468 units. Stinky Pinky Pre-Roll 5-Pack (2.5g) consistently held the second position, with sales figures showing a minor decrease compared to previous months. The CBG/THC 1:1 Blue Raspberry Live Rosin Gummies 2-Pack (10mg CBG, 10mg THC) remained in third place, continuing its stable performance from December. Comatose (3.5g) improved slightly, moving up to fourth place, while Blue Dream Pre-Roll 5-Pack (2.5g) dropped to fifth position, indicating a slight decline in its popularity. Overall, the rankings for January 2026 show a stable trend for the top three products, with minor shifts in the lower ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.