Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

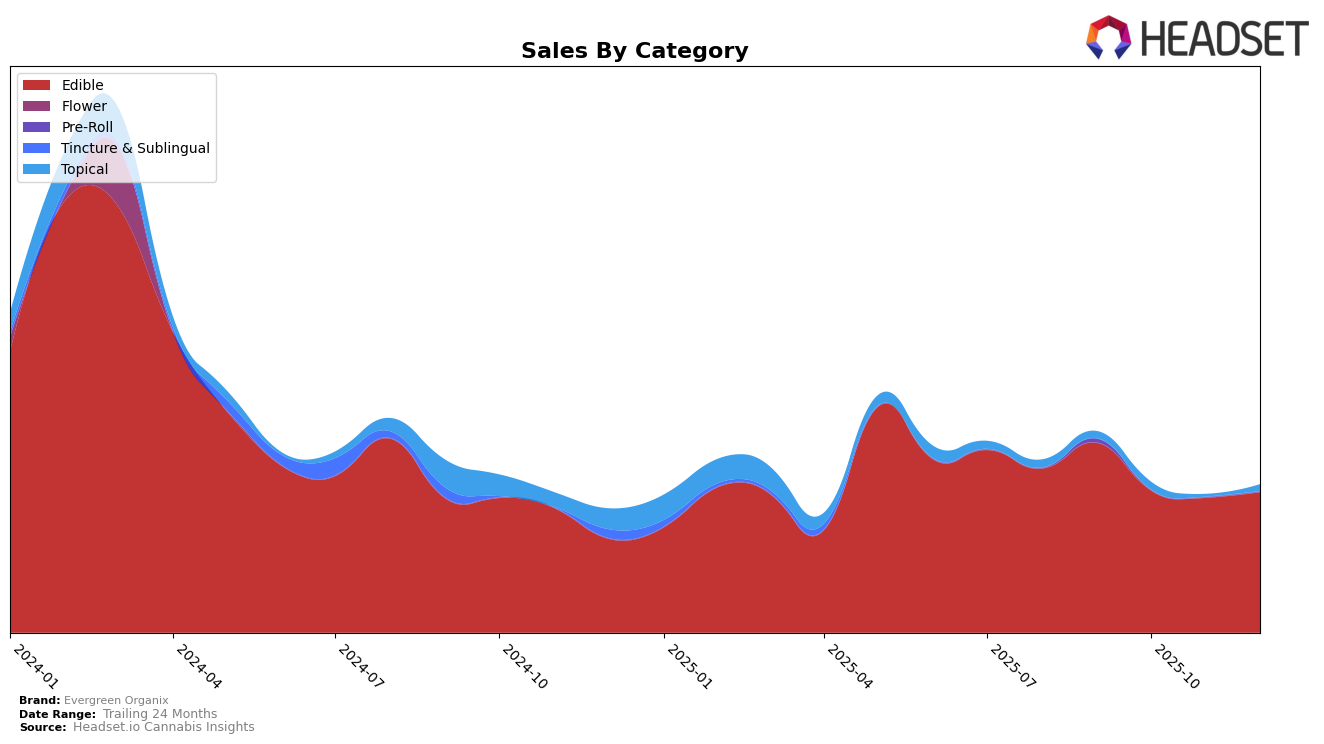

In the state of Nevada, Evergreen Organix has shown a consistent presence in the Edible category, maintaining a rank within the top 30 brands throughout the last quarter of 2025. Despite a slight dip in November, where they fell to the 22nd position, they managed to recover slightly by December, moving back up to the 21st position. This indicates a stable yet slightly fluctuating performance. The sales figures also reflect a downward trend from September to November, with a slight recovery in December, suggesting potential seasonal factors or market dynamics impacting their performance.

It's notable that Evergreen Organix has maintained its visibility in the Nevada market, as not all brands consistently rank within the top 30. However, the absence of their ranking in other states or categories could suggest a more focused strategy in Nevada or potentially limited distribution elsewhere. This lack of presence in other states' rankings could be a point of concern or an opportunity for future expansion, depending on the brand's strategic goals. The Edible category remains competitive, and Evergreen Organix's ability to sustain its position in Nevada might be indicative of a strong brand loyalty or product appeal within this specific market.

Competitive Landscape

In the Nevada edibles market, Evergreen Organix has experienced a slight decline in its ranking from September to December 2025, moving from 19th to 21st place. This shift is notable given the competitive landscape, where brands like CAMP (NV) have consistently outperformed, maintaining a strong position and even climbing to 16th place in October. Meanwhile, High Heads has shown impressive growth, jumping from being unranked in September to 16th in November, indicating a significant increase in market presence. Despite Evergreen Organix's sales remaining relatively stable, the brand faces pressure from competitors like Vert and Cheeba Chews, which have shown fluctuations but ended December with a stronger rank. The competitive dynamics suggest that Evergreen Organix needs strategic adjustments to regain its footing and improve its market position amidst these rising competitors.

Notable Products

In December 2025, Evergreen Organix's top-performing product was Chocolate Chip Cookies 5-Pack (100mg) in the Edible category, maintaining its first-place ranking from the previous month with sales of 261.0 units. The Snickerdoodle Cookie 5-Pack (100mg) rose to second place, improving from fifth place in November, reflecting a steady increase in popularity. The Rice Cereal Treat (100mg) held a consistent position at third place, although its sales showed a slight decline. Milk Chocolate Crunch Bar (100mg) dropped to fourth place from its previous top position in October, indicating a decrease in consumer interest. The Espresso Dark Chocolate Bar 10-Pack (100mg) entered the rankings at fifth place, suggesting a growing interest in this new product addition.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.