Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

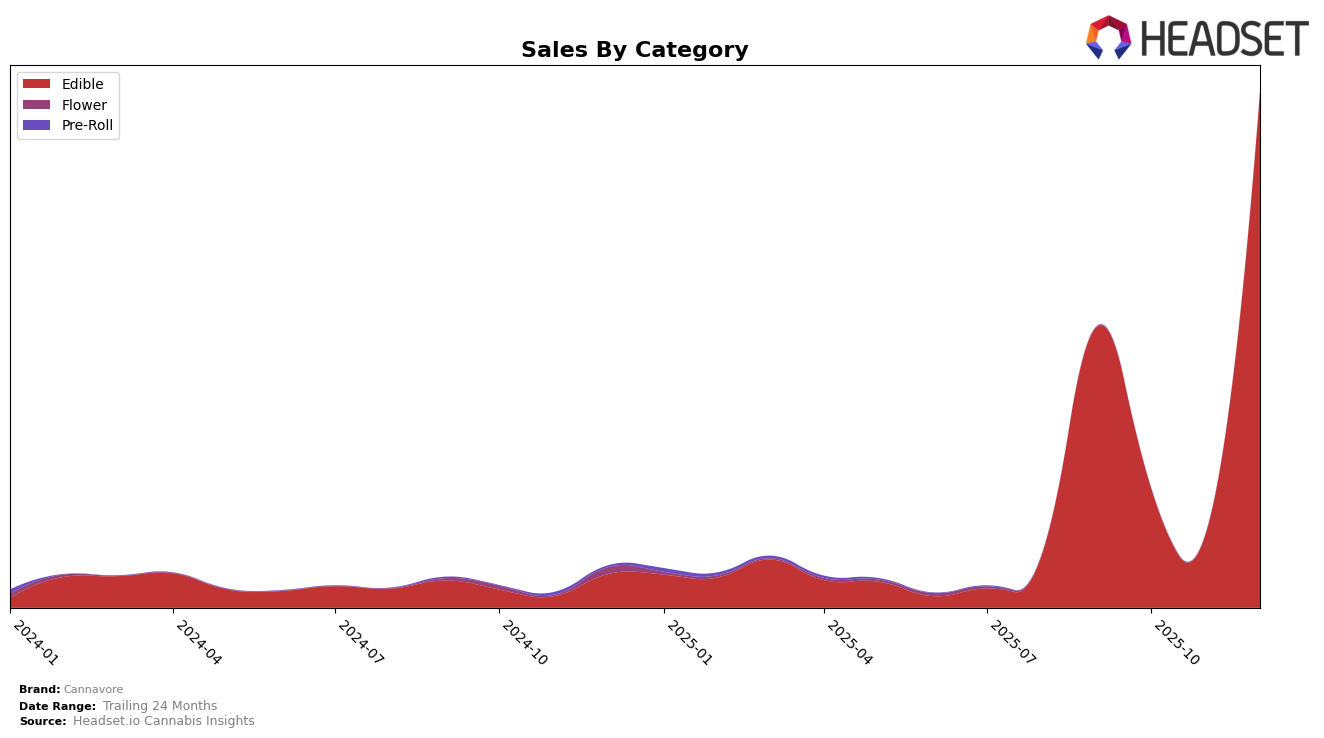

In the state of Nevada, Cannavore's performance in the Edible category has shown significant fluctuations over the last few months of 2025. Starting at rank 16 in September, the brand experienced a decline in October and November, dropping to ranks 23 and 25, respectively. However, December marked a notable improvement as Cannavore climbed to rank 11, indicating a strong recovery and increased consumer interest. This upward movement suggests that Cannavore may have implemented successful strategies or benefited from seasonal demand shifts, driving their December sales to a considerably higher level compared to the previous months.

It's worth noting that Cannavore's absence from the top 30 rankings in certain months could be seen as a challenge for the brand to maintain consistent visibility and market presence. The fluctuations in their ranking highlight the competitive nature of the Edible category in Nevada, where consumer preferences can shift rapidly. Nevertheless, the brand's ability to rebound and secure a higher position by the end of the year demonstrates resilience and potential for future growth. Observing how Cannavore continues to perform in the coming months could provide further insights into their market strategies and consumer engagement efforts.

Competitive Landscape

In the competitive landscape of the Nevada edible cannabis market, Cannavore has experienced significant fluctuations in its ranking over the last few months, indicating a dynamic shift in its market position. Starting from a rank of 16 in September 2025, Cannavore saw a dramatic drop to 23 and 25 in October and November, respectively, before making a strong comeback to rank 11 in December. This volatility suggests potential challenges in maintaining consistent sales performance, possibly due to competitive pressures or internal factors. In contrast, Kanha / Sunderstorm has shown a steady upward trend, climbing from rank 10 in September to 7 by December, reflecting robust sales growth and market penetration. Meanwhile, Smokiez Edibles and Jams have maintained relatively stable positions, with minor fluctuations. Cannavore's December resurgence suggests potential strategic adjustments or successful marketing efforts, but the brand must continue to innovate and adapt to sustain its competitive edge against these consistently performing rivals.

Notable Products

In December 2025, the top-performing product for Cannavore was the CBG/THC 3:1 Cherry Pineapple Gummies, which ranked 1st with sales of 1117 units. The CBD/CBN/THC 1:1:1 Melon Medley Gummies followed closely in 2nd place, showing strong performance despite not being ranked in previous months. The CBD/THC 2:1 Passion Fruit Guava Gummies maintained a consistent 3rd place ranking from September through December, with sales increasing to 753 units. The CBG/THC 1:1 Strawberry Watermelon Lemonade Gummies, previously holding the top spot, dropped to 3rd place in December, aligning in sales with the Passion Fruit Guava Gummies. Meanwhile, the THC/CBN 1:2 Grape Lemonade Gummies experienced a slight decline, moving from 2nd to 4th place over the same period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.