Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

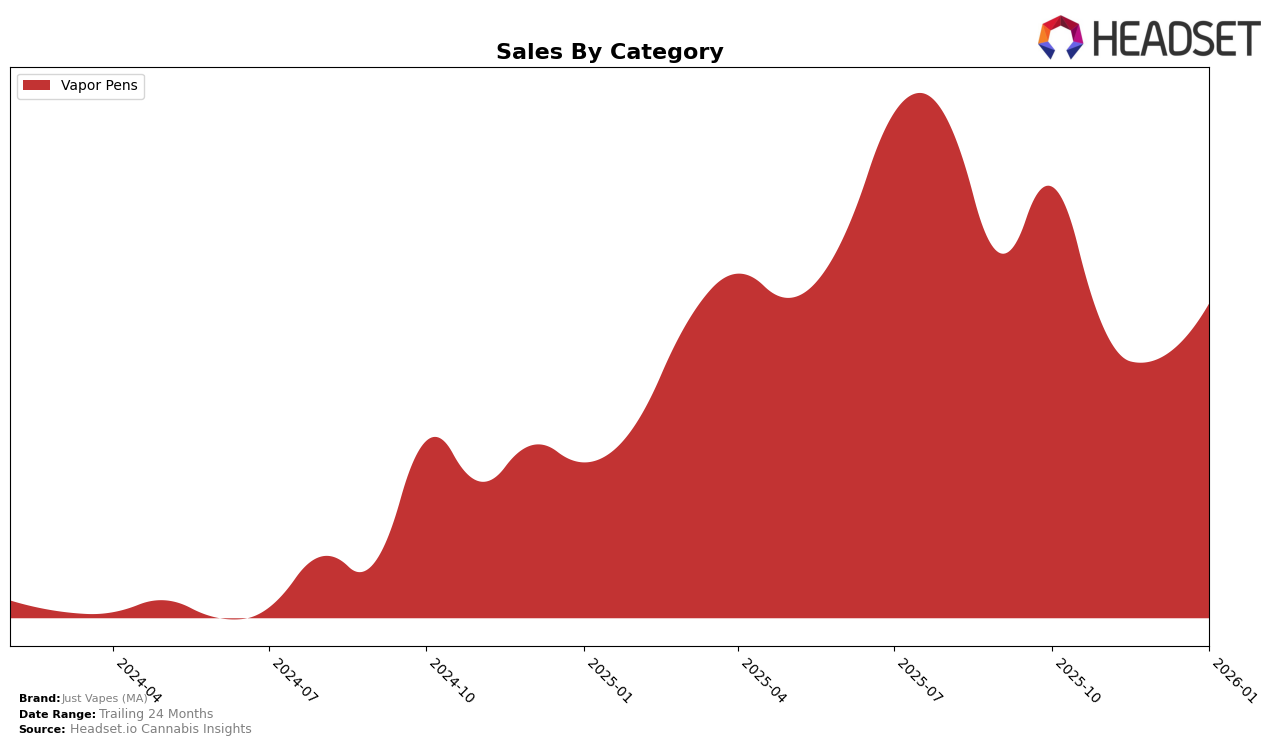

In the state of Massachusetts, Just Vapes (MA) has shown a fluctuating performance in the Vapor Pens category. Starting from a rank of 72 in October 2025, the brand improved its position to 51 in November but then experienced a slight decline, ending up at rank 58 by January 2026. Despite the ups and downs in rankings, the sales figures tell a story of growth, with a significant jump from October to November, although there was a subsequent decrease in December and January. This suggests that while the brand is gaining traction, there are challenges in maintaining consistent upward momentum in this competitive market.

In contrast, Just Vapes (MA) has maintained a stronger presence in the Maryland market for Vapor Pens. The brand consistently ranked within the top 20, starting at 13 in October 2025 and closing at 14 in January 2026. This stability indicates a solid foothold in the Maryland market, although there was a noticeable dip in sales from October to November, followed by a recovery in January. The ability to remain in the top tier suggests effective brand recognition and customer loyalty, making Maryland a key market for Just Vapes (MA) to focus on for sustained growth.

Competitive Landscape

In the competitive landscape of vapor pens in Maryland, Just Vapes (MA) has experienced notable fluctuations in its market position over recent months. Starting from a rank of 13 in October 2025, Just Vapes (MA) saw a decline to 17 by November and further down to 18 in December, before recovering slightly to 14 in January 2026. This volatility contrasts with the more stable performance of competitors like Beezle Extracts, which improved its rank from 14 to 12 between October and January, and Curio Wellness, which maintained a relatively consistent presence within the top 15. Meanwhile, Roll One / R.O. demonstrated a strong upward trajectory, moving from 18 to 13 over the same period. The entry of Bloom into the rankings in December at 22, climbing to 16 by January, indicates increasing competition in the market. These dynamics suggest that while Just Vapes (MA) remains a significant player, it faces pressure from both established and emerging brands, necessitating strategic adjustments to maintain and enhance its market share.

Notable Products

In January 2026, the Strawberry Cough Distillate Cartridge (1g) from Just Vapes (MA) emerged as the top-performing product, climbing from fourth place in December 2025 to take the number one spot with impressive sales of 1,447 units. The Clementine Distillate Cartridge (1g) maintained a strong performance, securing the second position, an improvement from its fifth-place ranking in December 2025. The Green Crack Distillate Disposable (1g), a new entry in the rankings, achieved third place, highlighting its growing popularity. Do-Si-Do Distillate Cartridge (1g) experienced a decline, dropping from second in December 2025 to fourth in January 2026. The Blackberry Champagne Distillate Disposable (1g) rounded out the top five, maintaining a consistent presence in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.