Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

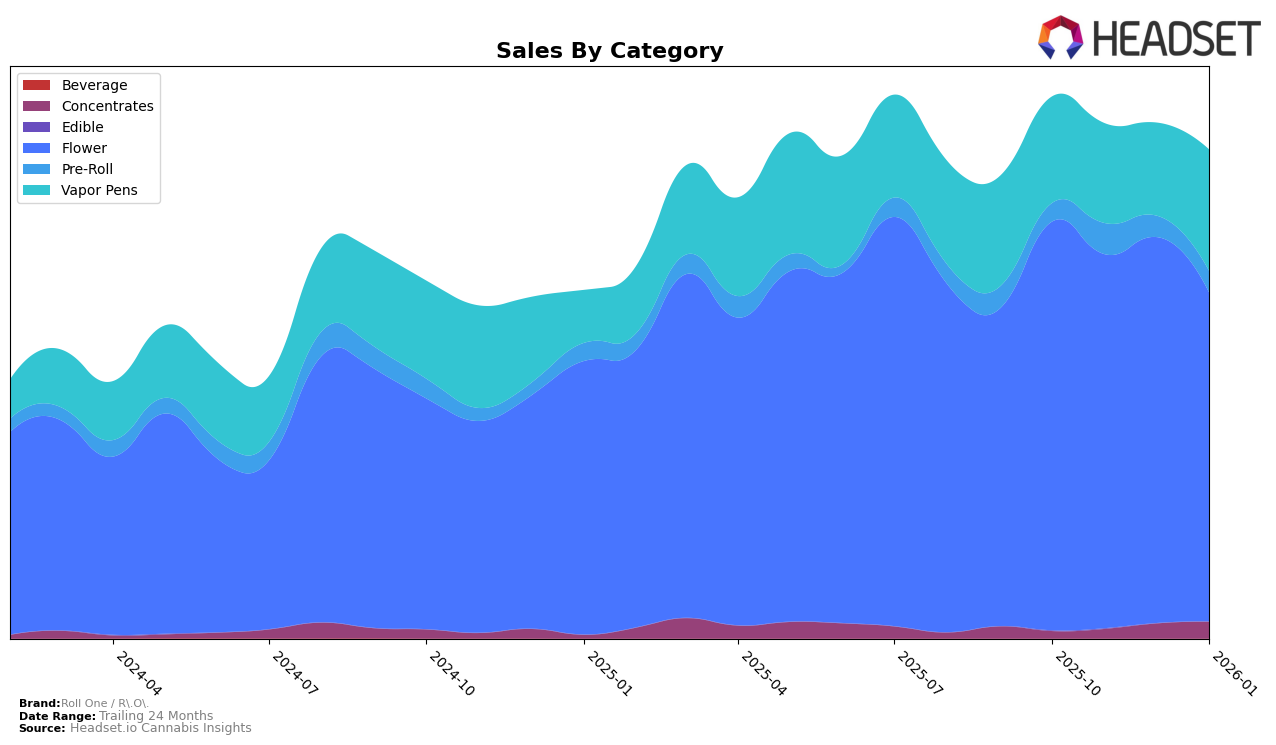

Roll One / R.O. has demonstrated varied performance across different states and product categories, highlighting both opportunities and challenges. In Arizona, the brand's Flower category shows a significant upward movement, climbing from a rank of 40 in December 2025 to 33 in January 2026. This improvement is coupled with a notable increase in sales, suggesting a positive reception in the market. Conversely, in Colorado, the Vapor Pens category saw a gradual rise from 48 in October 2025 to 38 in January 2026, indicating a steady gain in market traction. However, in Ohio, the Flower category's ranking fluctuated, ending at 39 in January 2026 after peaking at 30 in October 2025, which may point to competitive pressures or shifting consumer preferences.

In Maryland, Roll One / R.O. shows a strong presence, particularly in the Concentrates category, where it consistently held the 16th rank in the last two months of the observed period. Additionally, their performance in the Vapor Pens category improved notably, moving up to the 13th position in January 2026, reflecting a successful strategy or product appeal. However, the Pre-Roll category in Maryland only appeared in the rankings in January 2026 at 34, indicating either a late entry or previously lower market penetration. The brand's absence from the top 30 in several categories and states suggests areas where they might need to enhance their market strategies or product offerings to gain a stronger foothold. Such insights underline the dynamic nature of the cannabis market and the need for brands like Roll One / R.O. to continuously adapt and innovate.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Roll One / R.O. has experienced a relatively stable performance in terms of rank, holding positions between 13th and 15th from October 2025 to January 2026. Despite a slight dip in January 2026, Roll One / R.O. has maintained a consistent presence in the top 20, unlike &Shine, which was absent from the top 20 in October and November 2025 but made a notable comeback to 15th place by January 2026. Meanwhile, Modern Flower and CULTA have shown more dynamic movements, with Modern Flower climbing from 15th to 12th place and CULTA dropping from 6th to 13th place over the same period. These shifts highlight the competitive pressures and opportunities for Roll One / R.O. to capitalize on its steady market position, especially as it competes against brands like Find., which also showed an upward trend from 20th to 16th place. The overall stability of Roll One / R.O.'s ranking suggests a solid customer base, but the brand may need to strategize to improve its sales figures, particularly as competitors like CULTA continue to generate higher sales volumes.

Notable Products

In January 2026, Jack Herer (3.5g) from Roll One / R.O. rose to become the top-performing product with sales reaching 5,362 units, marking its debut in the rankings. Member Berry (3.5g), previously ranked first in December 2025, slipped to second place, although it maintained strong sales figures. Echoberry (3.5g) emerged as a new contender, securing the third spot, while Jet Fuel (3.5g) re-entered the rankings at fourth place after being unranked in previous months. Legendary GMO (3.5g), which was third in December, fell to fifth position in January. The Flower category dominated the top rankings, indicating a consistent preference for these products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.