May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

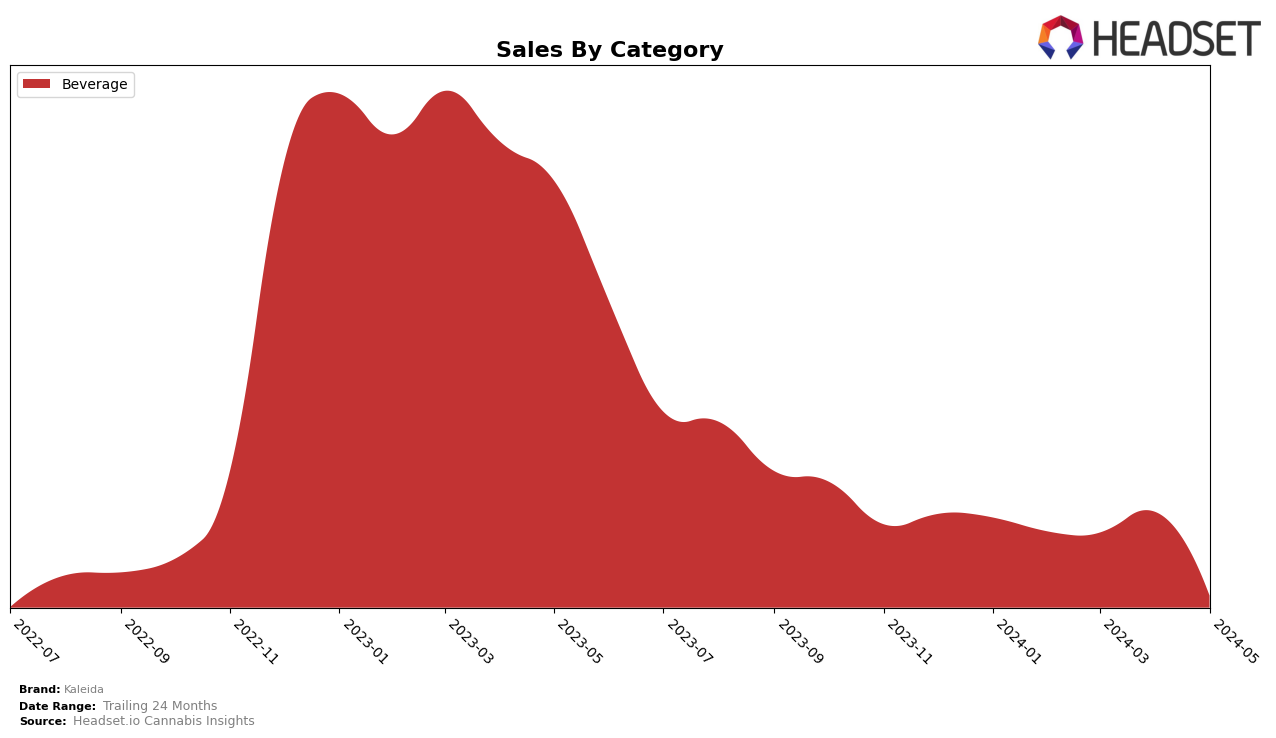

Kaleida has shown a notable performance in the Beverage category within Saskatchewan. While the brand was not ranked in the top 30 for February, March, or April 2024, it made a significant leap to secure the 7th position in May 2024. This upward movement indicates a strong market penetration and growing consumer preference for Kaleida's beverage products in the region. Such a rise in ranking within a single month is a positive indicator of the brand's potential to further climb the ranks in the upcoming months.

The absence of Kaleida from the top 30 rankings in the earlier months could be seen as a slow start or initial market entry challenges. However, the significant jump to 7th place in May suggests that the brand has successfully addressed these challenges and is gaining traction. This improvement in ranking is a promising sign for stakeholders and could imply a robust marketing strategy or a well-received product launch. Further analysis would be required to understand the specific factors driving this growth and to forecast future performance across other categories and states.

Competitive Landscape

In the competitive landscape of the Beverage category in Saskatchewan, Kaleida has shown a notable presence, particularly in April 2024 when it secured the 7th rank. This is a significant improvement, considering it was not in the top 20 in the preceding months of February and March 2024. This upward movement indicates a positive trend in consumer preference and market penetration for Kaleida. In contrast, Sweet Justice has consistently performed well, holding the 4th and 2nd ranks in February and March 2024, respectively, but did not appear in the top 20 in April and May 2024. This fluctuation could suggest a temporary dip in sales or market strategy adjustments. Meanwhile, Summit (Canada) re-entered the top 20 in May 2024 at the 8th position after being absent in the earlier months. These dynamics highlight the competitive and volatile nature of the beverage market in Saskatchewan, with Kaleida's recent ranking suggesting a growing consumer base and potential for further market share gains.

Notable Products

In May-2024, the top-performing product from Kaleida was Blue Beverage (10mg THC, 355ml) in the Beverage category, maintaining its number one rank from the previous month with sales of 886 units. Orange Beverage (10mg THC, 355ml) held steady at the second position, consistent with its ranking in April-2024, with notable sales as well. Red Beverage (10mg THC, 355ml) remained in the third spot, showing a slight increase in sales compared to April-2024. The rankings of these products have been stable over the past few months, indicating strong and consistent consumer preference. The overall sales figures for May-2024 reflect a slight decline compared to previous months, but the top products continue to perform well within their category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.