Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

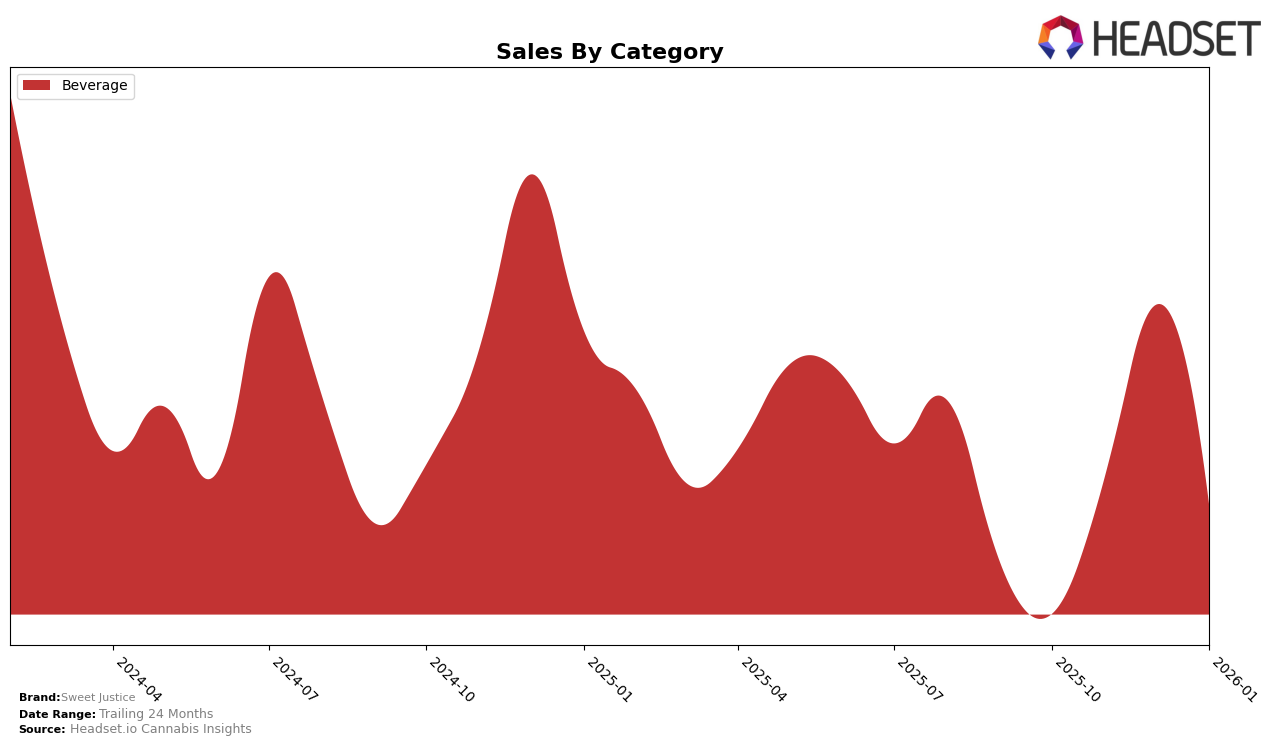

Sweet Justice has shown a consistent presence in the Canadian beverage market, particularly in Alberta and Ontario. In Alberta, the brand maintained a strong position, holding steady at rank 2 in three out of the four months analyzed, despite a slight dip to rank 3 in November 2025. The sales figures in Alberta reflect this stability, with a notable peak in December 2025. Meanwhile, in Ontario, Sweet Justice consistently held the 4th position across all months, indicating a stable market presence. The sales data from Ontario also demonstrate a peak in December, suggesting a seasonal increase in consumer demand during the holiday season.

In contrast, the brand's performance in British Columbia and Michigan presents a more varied picture. In British Columbia, Sweet Justice experienced a drop from the top position in October 2025 to rank 3 in the subsequent months, indicating increased competition or shifting consumer preferences. On the other hand, Michigan shows a different trend, where the brand emerged in the rankings in December 2025 at position 14 and improved slightly to 13 in January 2026, suggesting a growing presence in the market. The absence of Sweet Justice from the top 30 in Michigan prior to December could indicate a recent entry or a strategic shift in market focus.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Sweet Justice consistently maintained its position at rank 4 from October 2025 to January 2026. Despite this steady ranking, Sweet Justice faces intense competition from brands like Mollo and Versus, which have consistently occupied higher ranks at 3 and 2, respectively, throughout the same period. Notably, Versus has shown robust sales performance, consistently outperforming Sweet Justice by a significant margin. Meanwhile, Ray's Lemonade and Phresh Cannabis Beverages have fluctuated in their rankings, indicating a more volatile market presence. Sweet Justice's stable rank suggests a loyal customer base, but the brand may need to innovate or adjust its strategies to climb higher in the rankings and close the sales gap with leading competitors.

Notable Products

In January 2026, Sweet Justice's top-performing product was OG Cola Free (10mg THC, 355ml), maintaining its consistent first-place rank from previous months with a sales figure of 16,173. The THC/CBG 1:1 OG Root Beer Free Soda (10mg THC, 10mg CBG, 355ml) also held steady in second place, closely following the top product. Cherry Cola (10mg THC, 355ml) continued its third-place streak, although its sales dipped slightly compared to December 2025. Cranberry Ginger Ale (10mg THC, 355ml) secured the fourth position, showing stability after its introduction in December. The THC/CBG 1:1 OG Cola (5mg THC, 5mg CBG 355ml) remained in fifth place, with its rank unchanged since December 2025 despite a slight decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.