Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

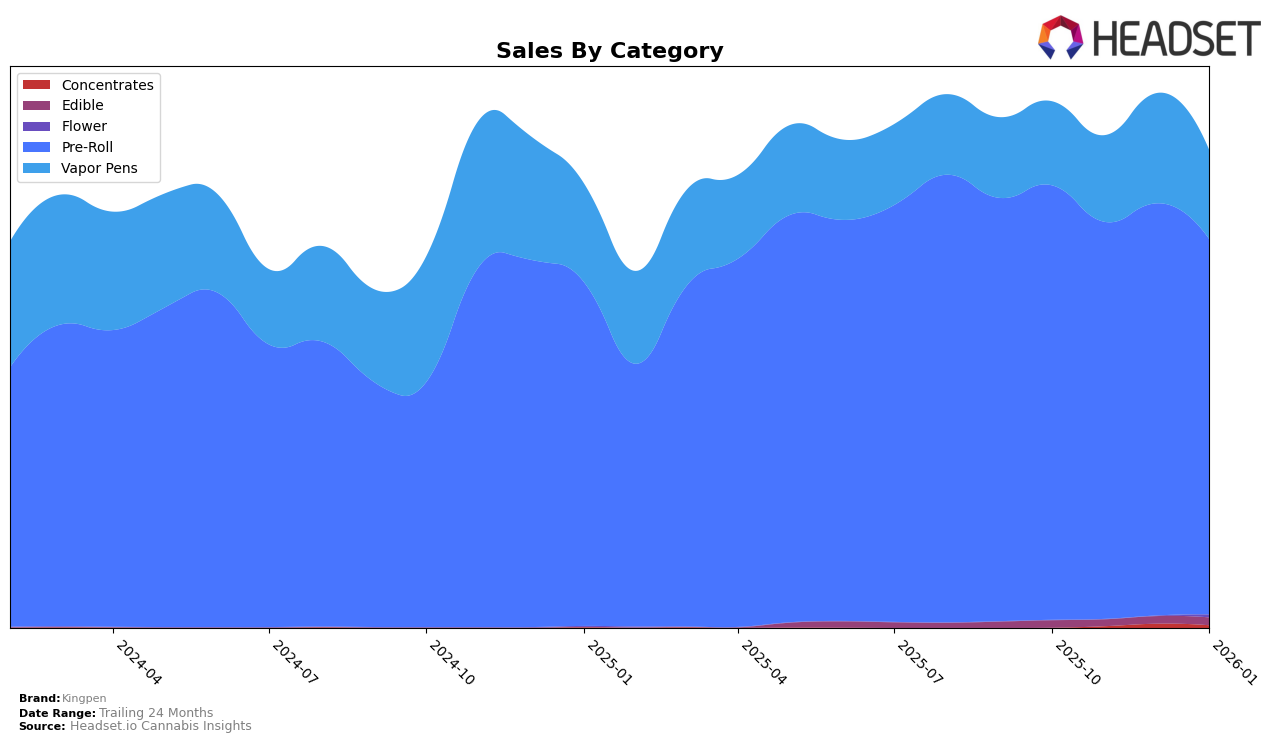

Kingpen has shown a consistent performance in the California market, particularly in the Pre-Roll category where it has maintained a steady rank at number 3 from October 2025 through January 2026. This stability suggests a strong foothold in the Pre-Roll segment, even though there was a slight decline in sales from October to January. In contrast, the Vapor Pens category presents a different story. Kingpen's ranking improved from 34 in October to 31 in December, before slightly dropping to 32 in January. Despite not breaking into the top 30, this upward movement in rank indicates a potential for growth, as evidenced by the peak sales in December.

The performance of Kingpen across these categories in California highlights the brand's varied market presence. While it remains a top contender in Pre-Rolls, its position in the Vapor Pens category suggests room for improvement and potential market expansion. The brand's ability to maintain a top 3 position in Pre-Rolls while gradually climbing the ranks in Vapor Pens indicates a solid strategy in place. Observing these trends could provide insights into Kingpen's future market maneuvers and potential shifts in consumer preference within the state.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Kingpen consistently held the third rank from October 2025 to January 2026, demonstrating stability amidst fluctuating sales figures. Despite a decline in sales from October to January, Kingpen maintained its position, indicating strong brand loyalty or effective marketing strategies. In contrast, Jeeter and STIIIZY dominated the top two spots, with Jeeter leading the pack. Notably, Jeeter experienced a sales dip in January 2026, yet retained its number one rank, highlighting its substantial lead over competitors. Meanwhile, Presidential and Sluggers Hit swapped positions in January, with Sluggers Hit dropping to fifth, emphasizing the competitive nature of the market. This data underscores Kingpen's resilience in maintaining its rank despite sales challenges, while also pointing to opportunities for growth by analyzing the strategies of higher-ranked competitors.

Notable Products

In January 2026, the top-performing product from Kingpen was Kingroll Jr - Cannalope Ak x Cannalope Kush Infused Pre-Roll 4-Pack (3g), maintaining its leading position from December 2025 with notable sales of 9,866 units. Kingroll - Cannalope Ak x Cannalope Kush Oil Infused Pre-Roll (1.3g) climbed to the second spot, showing a consistent ranking improvement from November 2025. Kingroll Jr - Grandi Guava x Grapefruit Romulan Infused Pre-Roll 4-Pack (3g) rose to third place, marking a significant jump from its fifth position in December. Kingroll Jr - White Rhino x Cannalope Kush Infused Pre-Roll 4-Pack (3g) slightly declined to fourth, while Kingroll Jr - Mango Kush x Cannalope Kush Oil & Kief Infused Pre-Roll 4-Pack (3g) entered the top five, despite a drop in sales. Overall, January 2026 saw a reshuffling in rankings, with Kingroll Jr products dominating the top spots.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.