Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

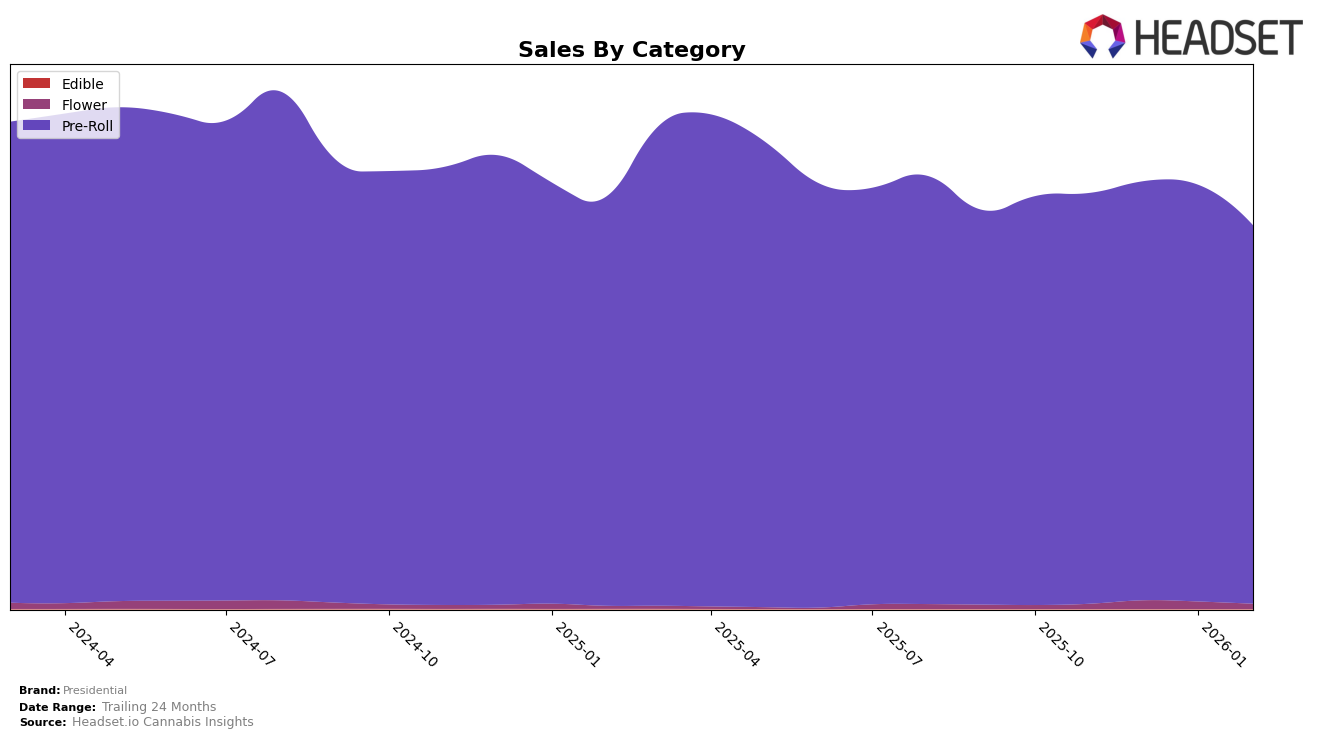

Presidential has shown varied performance across different states, particularly in the Pre-Roll category. In California, the brand has maintained a strong position, consistently ranking 4th or 5th from November 2025 to February 2026, reflecting its stable presence in this key market. However, in Arizona, the brand experienced fluctuations, dropping from 14th to 19th in January 2026 before recovering to 16th in February 2026. This indicates some volatility in consumer preference or competitive dynamics in the state. Meanwhile, in Nevada, Presidential has been a top contender, consistently ranking in the top 3 before slipping to 4th place in February 2026, suggesting a slight shift in market dynamics or consumer behavior.

In Michigan, Presidential has shown significant improvement, climbing from 71st in November 2025 to 49th in January 2026, before slightly falling back to 51st in February 2026. This upward trend, despite the minor setback, indicates growing traction in the Michigan market. Conversely, in New York, the brand has struggled to break into the top 30, consistently hovering around the 39th and 40th positions. This suggests a challenging competitive landscape or potential areas for strategic improvement. The data reveals a mixed performance for Presidential, highlighting both strongholds and opportunities for growth across these diverse markets.

Competitive Landscape

In the competitive landscape of the California Pre-Roll category, Presidential has shown notable resilience and growth. From November 2025 to February 2026, Presidential improved its rank from 5th to 4th, indicating a positive trend in its market position. This advancement is significant given the consistent performance of competitors like Kingpen, which maintained a steady 3rd place, and STIIIZY, which held a strong 2nd place throughout the same period. Meanwhile, Sluggers Hit experienced a slight decline, dropping from 4th to 5th, which may have contributed to Presidential's rise. Additionally, CannaBiotix (CBX) fluctuated in rank, dropping to 8th in January 2026 before recovering to 6th in February 2026. This dynamic environment highlights Presidential's ability to capitalize on market shifts and enhance its competitive standing, despite the challenges posed by well-established brands.

Notable Products

In February 2026, the top-performing product from Presidential was the Waui Moon Rock Infused Blunt (1.5g) in the Pre-Roll category, maintaining its number one rank consistently since November 2025, with sales of 8,818 units. The Presidential x THC Design - Pink Cookies Moonrock Infused Blunt (1.5g) rose to second place, a notable jump from its fourth-place ranking in December 2025. Cherry Gelato Moonrock Infused Pre-Roll (1g) secured the third position, marking its debut in the top rankings. Grape Moonrock Infused Pre-Roll (1g) experienced a slight decline, moving from second place in November 2025 to fourth in February 2026. Lastly, the XXX Infused Pre-Roll (1g) ranked fifth, having previously peaked at second place in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.