Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

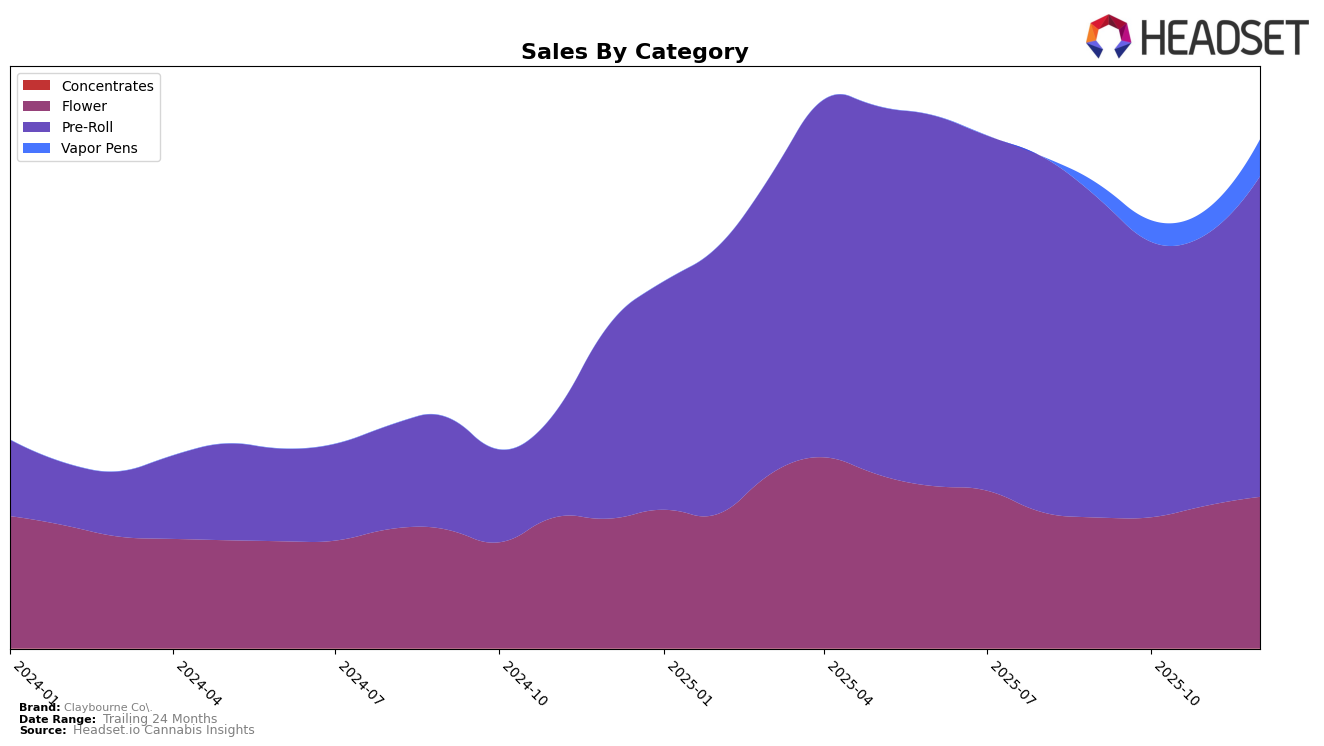

Claybourne Co. has demonstrated notable performance in various categories across multiple regions. In Alberta, their Pre-Roll category has seen a steady climb, maintaining a consistent rank of 6th from September to November 2025, before jumping to 4th in December. This improvement is supported by a significant increase in sales, indicating a strong market presence and consumer preference. Meanwhile, in British Columbia, Claybourne Co. experienced a slight dip in the Pre-Roll category, dropping out of the top 30 in October but quickly recovering to 7th and then 6th place by December. This fluctuation highlights potential challenges in maintaining consistent market visibility.

In California, Claybourne Co. has maintained a stable position in the Flower category, consistently ranking 5th from September through December 2025. This stability suggests a strong foothold in the competitive Californian market. However, the Pre-Roll category saw more variability, with rankings fluctuating from 5th to 9th, before settling at 7th in December. This indicates a competitive landscape where Claybourne Co. is working to solidify its standing. Additionally, the Vapor Pens category in California shows positive momentum, moving from 51st in September to 35th by December, reflecting growing consumer interest. In Ontario, their Pre-Roll category remains robust, consistently ranking within the top 5, showcasing strong brand loyalty and market penetration.

Competitive Landscape

In the competitive landscape of the California flower category, Claybourne Co. has maintained a steady position, consistently ranking 5th from September to December 2025. This stability in rank suggests a strong brand presence and customer loyalty, despite the dynamic shifts seen among competitors. For instance, Alien Labs experienced fluctuations, moving from 8th to 6th, then dropping to 11th before climbing back to 7th. Meanwhile, Blem showed a positive trajectory, improving from 9th to 6th over the same period. Notably, CAM and Allswell consistently held higher ranks, at 3rd and 4th respectively, indicating a competitive edge in sales volume. Despite these challenges, Claybourne Co.'s consistent rank and increasing sales figures reflect a resilient market strategy, positioning them as a reliable choice for consumers in California's competitive flower market.

Notable Products

In December 2025, Claybourne Co.'s top-performing product was Frosted Flyers - Variety Pack Infused Pre-Roll 5-Pack (2.5g), maintaining its number one rank consistently since September, with sales of 56,188 units. Flyers - Blue Dream Frosted Liquid Diamond Infused Pre-Roll 3-Pack (1.5g) held steady in second place, showing consistent performance over the past months. Flyers - Grape Gasolina Liquid Diamond Infused Pre-Roll 3-Pack (1.5g) also retained its third position, reflecting stable demand. Frosted Flyers - Pineapple Express Infused Pre-Roll 3-Pack (1.5g) remained fourth, indicating a strong preference for infused pre-rolls. Notably, Mule Fuel (3.5g), a new entry in December, debuted at fifth place, suggesting a positive reception in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.