Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

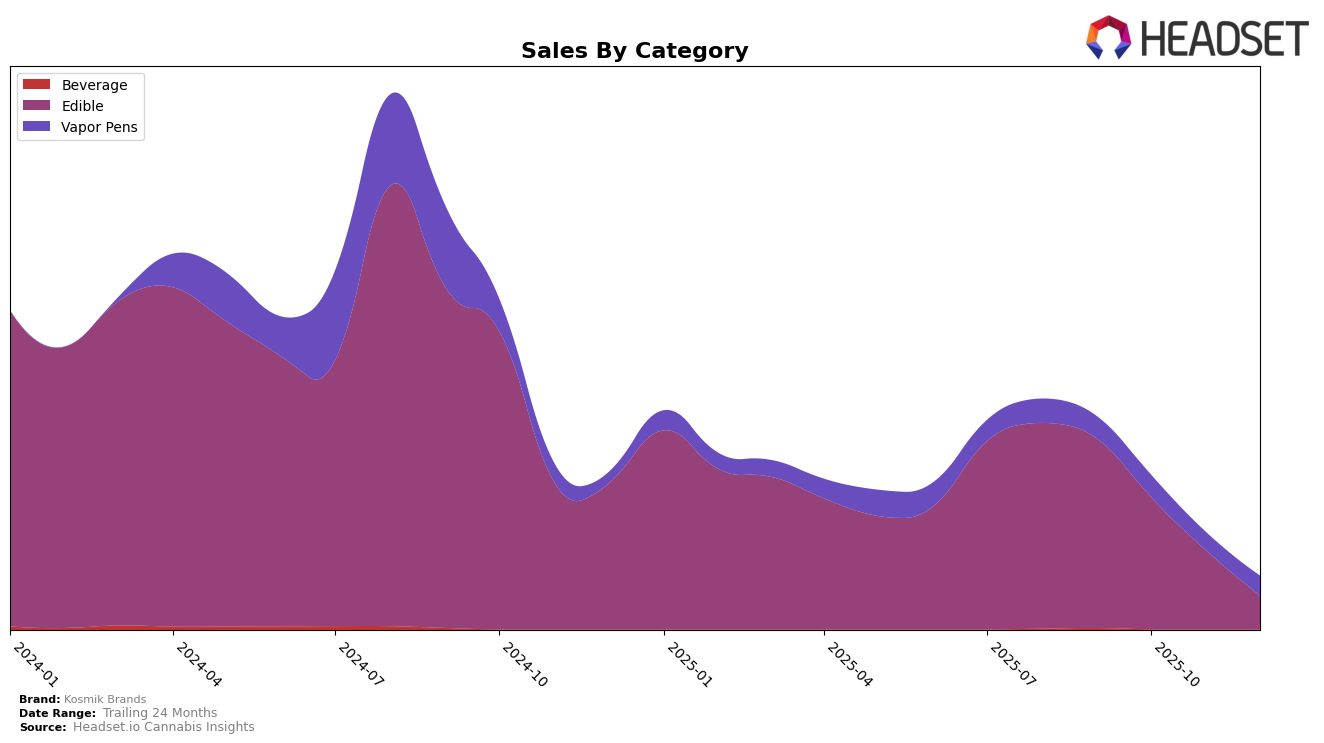

In the state of Massachusetts, Kosmik Brands has shown a fluctuating performance in the Edible category. After climbing to the 26th rank in November 2025, it slipped to the 39th position by December, despite a notable increase in sales during October and November. This suggests a potential challenge in maintaining consistent market presence or consumer interest. Meanwhile, in the Vapor Pens category, Kosmik Brands didn't make it to the top 30, peaking at 69th in September and declining further in subsequent months. This indicates a struggle to establish a strong foothold in the Vapor Pens market within Massachusetts.

In Missouri, Kosmik Brands has experienced a significant decline in the Edible category, where they fell from 13th place in September to 46th by December 2025. This downward trajectory is reflected in their sales, which saw a substantial drop over the same period. The absence of Kosmik Brands within the top 30 in any other category in Missouri highlights their limited market penetration beyond edibles. This performance could be indicative of either increased competition or a shift in consumer preferences within the state.

Competitive Landscape

In the Massachusetts edible market, Kosmik Brands experienced notable fluctuations in its ranking throughout the last quarter of 2025. Starting strong in September with a rank of 33, Kosmik Brands climbed to 30 in October and reached its peak at 26 in November, indicating a positive trend in consumer preference and market penetration. However, December saw a sharp decline to rank 39, suggesting a potential seasonal impact or increased competition. During this period, competitors like Freshly Baked maintained a more stable position, consistently ranking around the mid-30s, while Beboe showed a gradual improvement from rank 46 in September to 42 by December. Theory Wellness also demonstrated significant growth, moving from rank 50 to 41, which may have contributed to the competitive pressure on Kosmik Brands. These dynamics highlight the competitive nature of the Massachusetts edible market and underscore the importance for Kosmik Brands to strategize effectively to regain and sustain its upward momentum.

Notable Products

In December 2025, the top-performing product from Kosmik Brands was the Black Hole- Orange Slices Gummy 10-Pack (1000mg), maintaining its number one rank for four consecutive months despite a sales drop to 654 units. The Hubba Bubba Liquid Diamond Disposable (2g) emerged as a strong contender, ranking second in its first recorded month. The Blasters Planetary Punch Gummies 20-Pack (100mg) debuted at third place, while the Black Hole - Red Tropical Fruit Punch Gummies 10-Pack (1000mg) slipped to fourth from its previous second position in October. Finally, the Black Hole - Peach Mango Gummies 10-Pack (100mg) entered the rankings at fifth place, indicating a growing interest in the brand's diverse edible offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.