Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

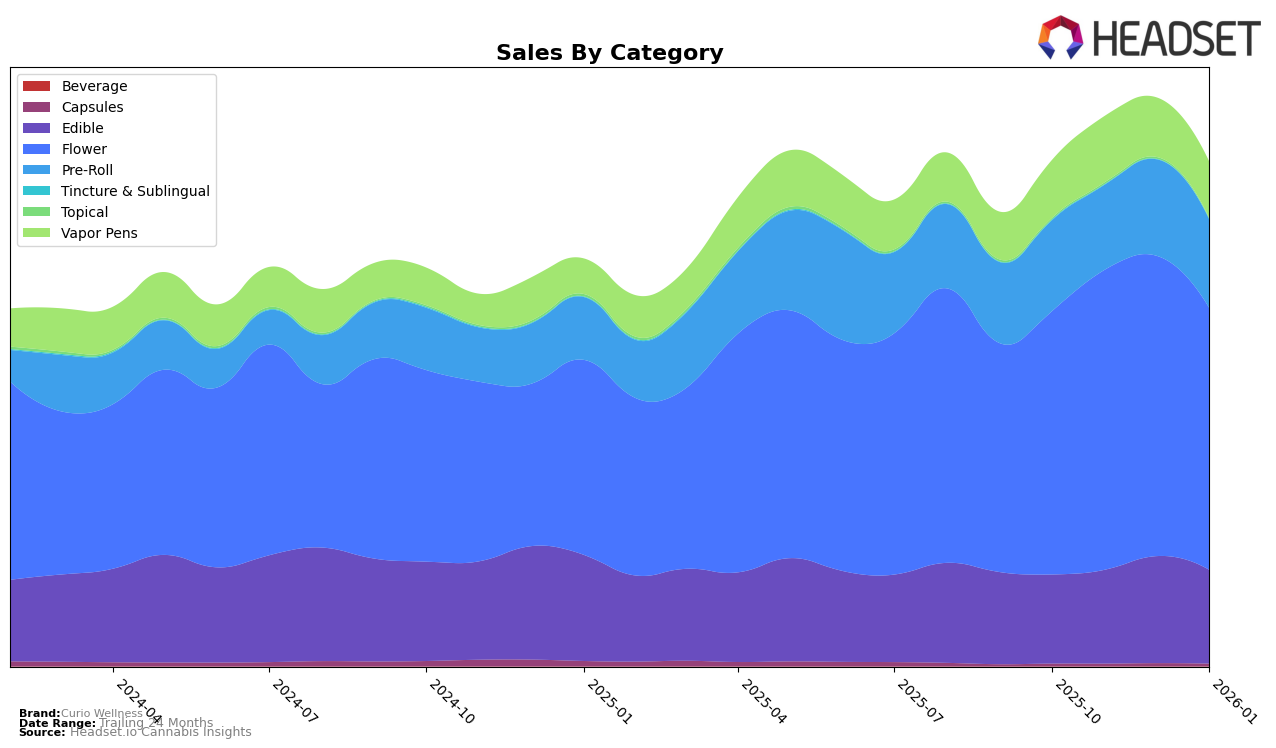

Curio Wellness has demonstrated a robust presence in the Maryland market, particularly in the Edible and Pre-Roll categories. Notably, the brand has consistently maintained a top 5 ranking in Edibles, peaking at the 3rd position in November 2025, before stabilizing at 4th in the subsequent months. This indicates a strong consumer preference for their edible products. In the Pre-Roll category, Curio Wellness has shown remarkable consistency, holding a steady 4th place ranking from October 2025 through January 2026. However, the performance in the Vapor Pens category has been more volatile, with rankings fluctuating between 12th and 16th, which suggests a potential area for growth or strategic adjustment.

In Missouri, Curio Wellness is making strides, especially in the Flower category, where it has maintained a consistent 11th place ranking. This stability in the Flower category indicates a solid foothold within this segment, though there remains room to break into the top 10. The Edible category has seen some positive movement, with the brand climbing from 20th in October 2025 to 15th in December 2025, before slightly dipping to 17th in January 2026. Interestingly, Curio Wellness has managed to break into the top 30 for Vapor Pens by January 2026, suggesting a growing acceptance and potential for further expansion in this category. Despite these advances, the brand's position in Pre-Rolls, hovering around the 17th to 20th range, highlights a need for strategic focus to enhance its competitive edge in Missouri.

Competitive Landscape

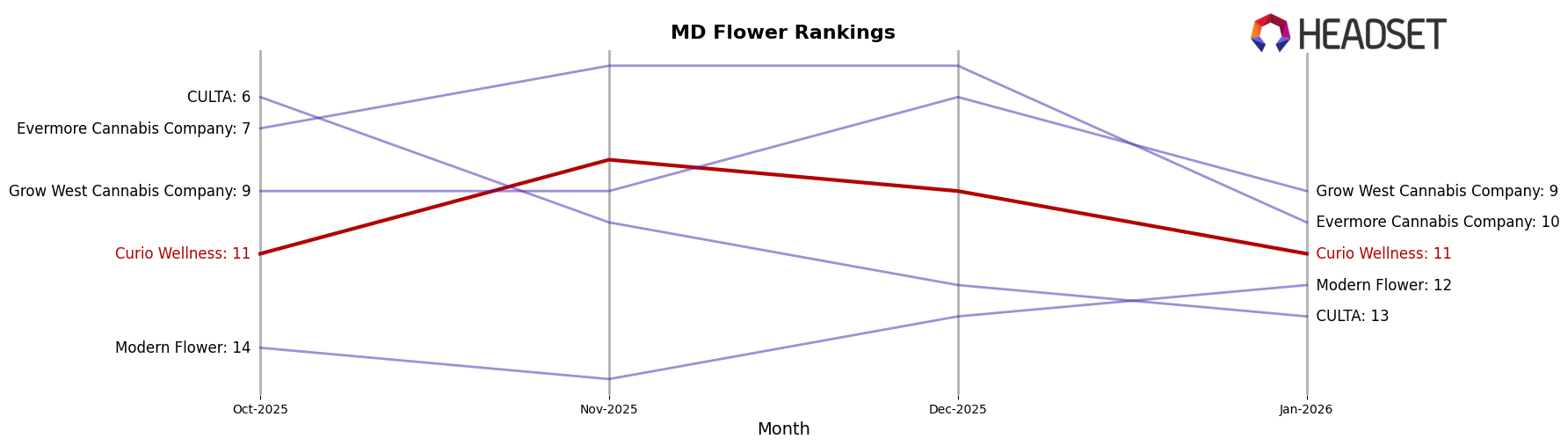

In the Maryland flower category, Curio Wellness has experienced fluctuating rankings over the past few months, indicating a competitive landscape. Starting at 11th place in October 2025, Curio Wellness improved to 8th in November, but then slipped to 9th in December and back to 11th in January 2026. This volatility contrasts with competitors like Evermore Cannabis Company, which maintained a strong position, ranking consistently in the top 5 until a drop to 10th in January. Meanwhile, Grow West Cannabis Company showed a more stable performance, peaking at 6th place in December. Despite the challenges, Curio Wellness's sales figures remained robust, though slightly lower than Evermore Cannabis Company and Grow West Cannabis Company. The competitive dynamics suggest that Curio Wellness needs to strategize effectively to regain and sustain higher rankings in this competitive market.

Notable Products

In January 2026, Curio Wellness's top-performing product was Opals and Banonoze Pre-Roll 2-Pack (1g), maintaining its top rank from October 2025 with sales increasing to 10,345 units. Blissful Wizard Pre-Roll 2-Pack (1g) held steady in the second position, despite a fluctuating rank in previous months. Midnight Climax Pre-Roll 2-Pack (1g) dropped to third place after leading in November and December 2025. Juicy Watermelon Chews 10-Pack (100mg) secured the fourth spot, consistent with its position in November 2025. Morning Wood Pre-Roll 2-Pack (1g) entered the top five in January 2026, a notable rise from its previous absence in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.