Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

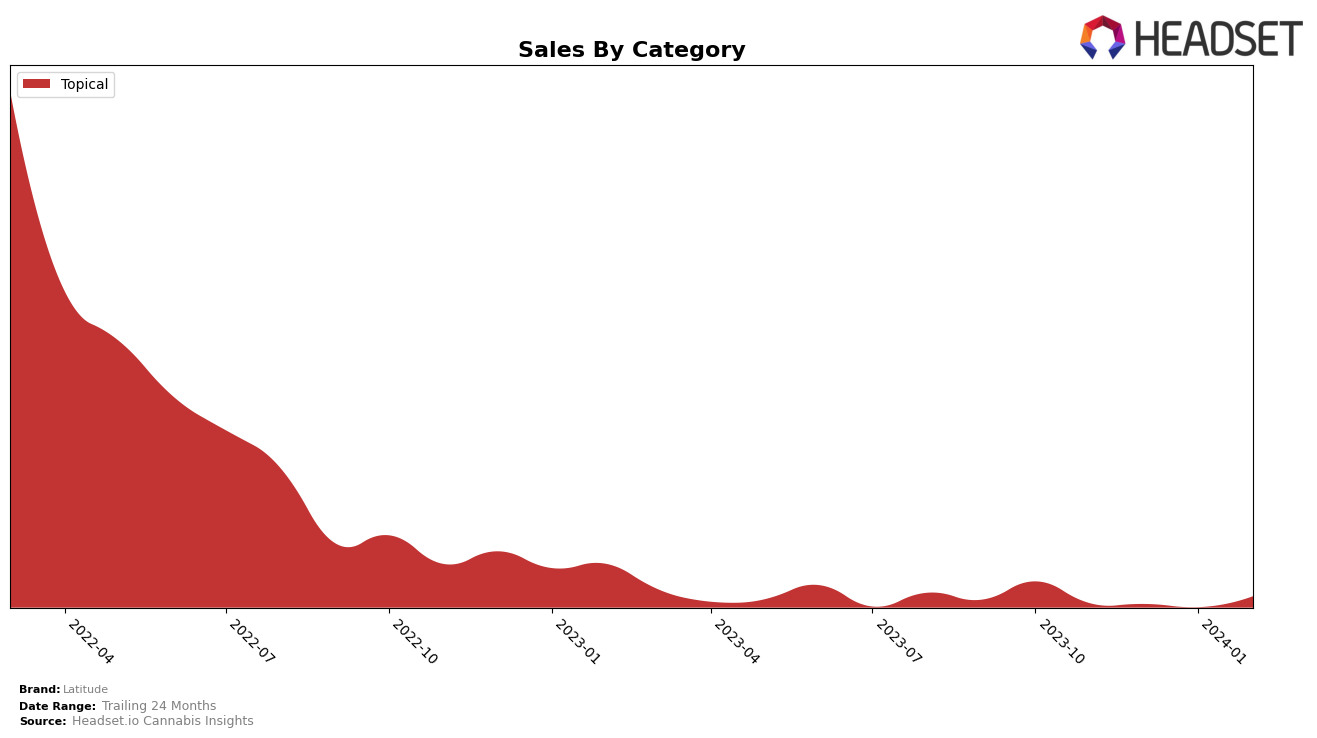

In the competitive landscape of cannabis topicals, Latitude has shown a varied performance across different states and provinces, reflecting its fluctuating market presence. In Alberta, the brand made a notable entrance in January 2024, securing the 16th rank, and improved its position to 13th by February 2024, with sales jumping from 506 units in January to 1,538 units in February, indicating a strong upward trajectory in this market. Conversely, in British Columbia, Latitude's presence was only marked in November 2023 with an 18th rank, but it failed to maintain a spot in the top 20 for the following months, suggesting a challenge in maintaining its market share or possibly strategic shifts in focus.

Looking at Ontario, Latitude's journey reflects a struggle to consistently capture consumer interest, with its ranking fluctuating from 24th in November 2023 to 20th in December, disappearing from the top 20 in January, and then reappearing at 32nd in February 2024. This inconsistency might hint at competitive pressures or varying consumer preferences impacting its performance. Meanwhile, in Saskatchewan, the brand's ranking also showed variability, being ranked 16th in November 2023, not appearing in December, climbing to 14th in January 2024, but without sales data for November and December, it's challenging to gauge the full context of its performance. This mixed picture across regions underscores the dynamic nature of the cannabis market, with Latitude experiencing both growth opportunities and challenges in different areas.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Alberta, Latitude has shown a notable entry and improvement in rank over the recent months, despite not being ranked in the top 20 brands in November and December 2023. Starting from not being in the top 20, Latitude made a significant leap to the 16th position in January 2024 and further improved to the 13th position by February 2024. This upward trajectory is particularly impressive when considering the performance of its competitors. For instance, Dosecann fluctuated in rank but remained in the top 15, indicating a strong presence in the market. Similarly, Emprise Canada showed a decline from 6th to 12th position, suggesting a potential opportunity for Latitude to capture more market share. Other brands like Apothecary Labs and Wildflower also experienced changes in their rankings, but Latitude's rapid rise in the ranks, coupled with a significant increase in sales from January to February 2024, underscores its growing influence and potential in the Alberta topical cannabis market.

Notable Products

In February 2024, Latitude's top-performing product was Sex Pot Intimacy Oil (400mg THC, 25ml) within the Topical category, maintaining its number one rank from the previous two months with a notable sales figure of 42 units. The Night Shift - CBD/THC 1:1 Ylang-Ylang Charcoal Bath Salts (100mg CBD, 100mg THC, 400g), also in the Topical category, previously held the top positions in November and December 2023 but did not make the sales list in February 2024. The consistent performance of Sex Pot Intimacy Oil indicates a strong consumer preference and loyalty towards this product. The absence of Night Shift Bath Salts from the February sales data suggests a change in consumer interest or possibly stock issues. Overall, Latitude's product rankings in February highlight the importance of maintaining product availability and understanding consumer trends to sustain top performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.