Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

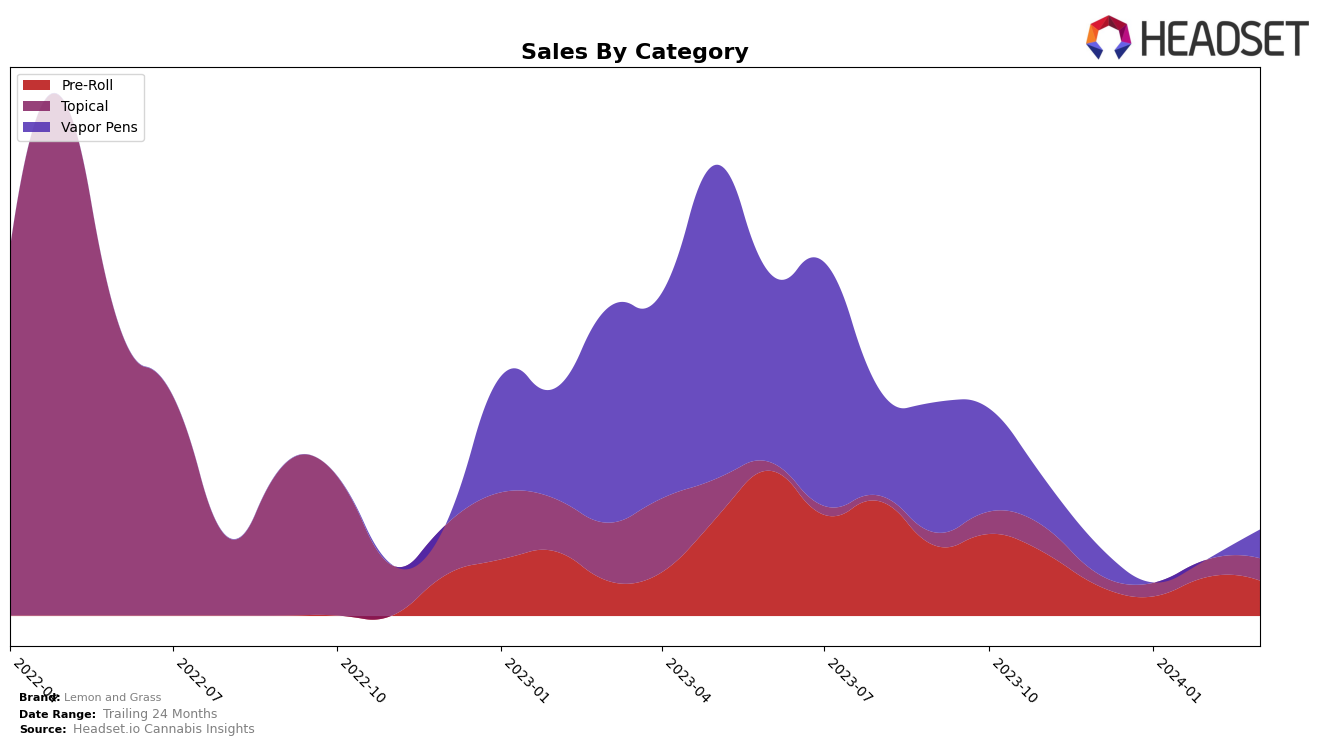

In the ever-evolving cannabis market, Lemon and Grass has shown a notable presence, especially within the Topical category across different states and provinces. In British Columbia, the brand made a significant leap into the rankings in January 2024, starting at 14th and slightly dipping to 15th in February, with no rank in December 2023 indicating a new or improving presence in this market. This movement suggests a growing interest or increased distribution efforts in British Columbia, although the lack of sales data for March leaves some uncertainty about its current trajectory. Conversely, in Ontario, Lemon and Grass showcased a more dynamic performance within the same category, initially ranking 27th in December 2023, disappearing from the rankings in January 2024, and then making a strong comeback in February and March, improving to 23rd and 17th respectively. This indicates a volatile yet overall positive trend, with March 2024 sales spiking to 792 units, highlighting a significant consumer interest peak or potentially successful marketing efforts.

However, the brand's venture into the Vapor Pens category in Saskatchewan tells a different story. Here, Lemon and Grass appeared in the rankings in December 2023 at a distant 74th place, with no subsequent rankings or sales data available for the following months. This absence from the top 30 brands in the category after December suggests a decline in market presence or consumer interest within this specific category and province. Such a stark contrast from its topical category performance in British Columbia and Ontario may reflect regional consumer preferences, the competitive landscape, or possibly the brand's strategic focus areas. While Lemon and Grass seems to be gaining traction and possibly capturing market share in the topicals sector, its venture into vapor pens in Saskatchewan appears to be facing challenges, underscoring the importance of brand adaptability and market-specific strategies in the cannabis industry.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Ontario, Lemon and Grass has shown a notable upward trajectory in rankings from not being in the top 20 in December 2023 to securing the 17th position by March 2024. This movement is significant, especially when considering the performance of its competitors. Pura Earth (Canada) has maintained a steady presence in the top 15, indicating a strong hold on the market with no fluctuations in rank during this period. On the other hand, Apothecary Labs and Emprise Canada have experienced slight declines in their positions, with Apothecary Labs moving from 15th to 15th again, showing a minor recovery in March, and Emprise Canada dropping from 16th to 18th. Assuage has seen a volatile journey, initially not in the top 20, peaking at 16th, and then dropping to 19th. Lemon and Grass's recent rise in rank, despite not having sales data for January 2024, suggests a growing consumer interest and market share, positioning it as a brand to watch amidst its fluctuating competitors.

Notable Products

In March 2024, Lemon and Grass saw consistent top performance from their CBD:THC 2:1 Full Spec Infused Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number 1 rank with 80 sales. The CBD:THC 1:3 Whole Plant Relief Balm (150mg CBD, 450mg THC, 50ml) in the Topical category also held its second place without any fluctuations in ranking, showcasing a stable demand in the market. A new entrant, the Sunset Gelato x OG Kush Live Terpene Cartridge 2-Pack (1g) in the Vapor Pens category, made a significant debut at rank 3, indicating a growing interest in vapor products. Notably, the Mango Kush Live Terpenes Cartridge (1g), previously a strong contender in the Vapor Pens category, did not make it to the top ranks in March, highlighting shifting consumer preferences. These rankings reflect Lemon and Grass's ability to maintain leadership in certain categories while also adapting to changes in market demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.