Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

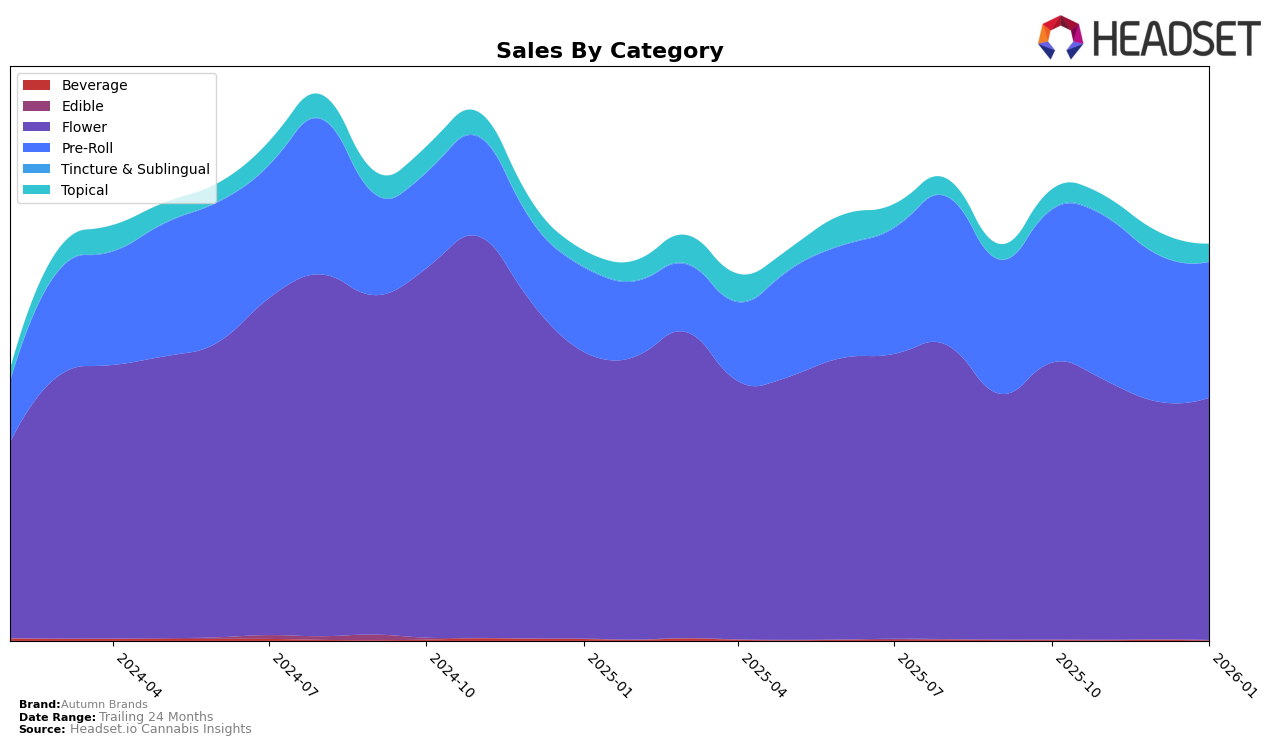

Autumn Brands has shown a varied performance across different product categories and states, particularly in California. In the Flower category, the brand consistently ranked outside the top 30, maintaining a position in the 70s throughout the reported months. Despite this, the sales figures show a slight decline from October 2025 to January 2026, indicating some market challenges. Conversely, in the Pre-Roll category, there was a notable improvement in rank from 64th in October to 57th by January, pointing towards a positive reception of their products in this segment. The Topical category stands out as a stronghold for Autumn Brands, with a stable 8th place ranking over the months, suggesting a loyal customer base and consistent demand.

The performance of Autumn Brands in California highlights the brand's strengths and areas for potential growth. While the Flower category did not break into the top 30, the consistent ranking suggests room for improvement and potential strategies to boost sales. The Pre-Roll category's upward trend in ranking could be indicative of successful marketing or product innovation, which may be worth exploring further to capitalize on this momentum. The Topical category's steady position in the top 10 is a testament to the brand's strong presence and reliability in this niche market. These insights suggest that while there are challenges, there are also significant opportunities for Autumn Brands to enhance its market position across these categories.

Competitive Landscape

In the competitive landscape of the California flower category, Autumn Brands has experienced fluctuations in its rank over the past few months, indicating a dynamic market environment. In October 2025, Autumn Brands held the 71st position, which it maintained in November before slipping to 78th in December. However, by January 2026, it regained its 71st rank, showcasing resilience amidst competitive pressures. Notably, 710 Labs consistently ranked just below Autumn Brands, maintaining a stable position at 72nd and 74th, while Pure Beauty showed a similar pattern of fluctuation, dropping to 79th in December before climbing to 72nd in January. Meanwhile, Cookies and Gramlin demonstrated more significant rank changes, with Cookies descending from 36th to 65th and Gramlin experiencing a dramatic fall from 7th to 60th over the same period. These shifts suggest that while Autumn Brands faces stiff competition, particularly from brands like Pure Beauty, its ability to recover its rank indicates potential stability and customer loyalty in a volatile market.

Notable Products

In January 2026, the top-performing product from Autumn Brands was the Purple Carbonite Pre-Roll (1g) in the Pre-Roll category, which rose to the first rank with sales reaching 1287 units. The Cousin Walk Pre-Roll (1g) maintained its rank at second place, showing a consistent performance from the previous month. Grape Escape Pre-Roll (1g), previously ranked first in December 2025, fell to third place in January. The Blue Dream Infused Pre-Roll (1g) entered the rankings at fourth, while the Blue Dream (3.5g) in the Flower category debuted at fifth. This shift indicates a strong preference for pre-rolls, with Purple Carbonite showing significant growth over previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.