Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

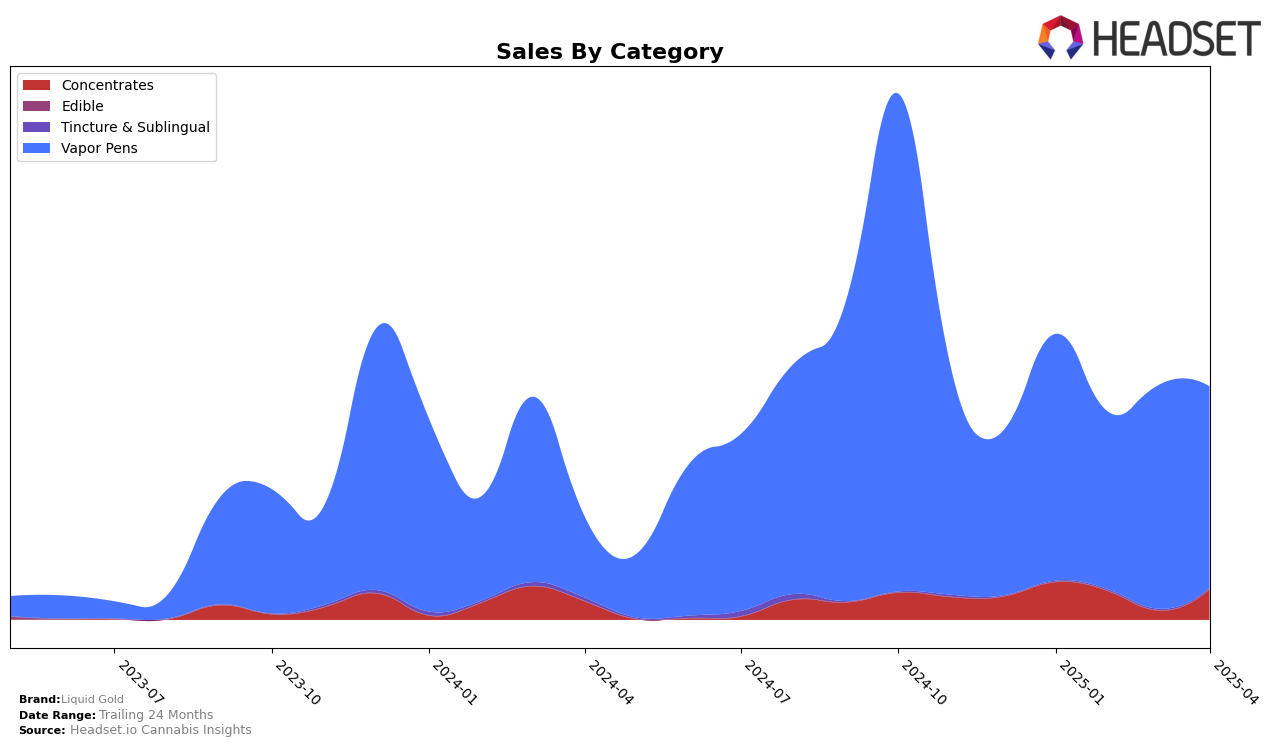

Liquid Gold's performance in the Vapor Pens category has shown some interesting trends across different states. In Massachusetts, the brand has consistently stayed out of the top 30 rankings from January to April 2025, with rankings fluctuating slightly between 79th and 89th place. Despite this, the sales figures indicate a peak in March with a noticeable increase to $31,619, suggesting some underlying factors that may have driven sales during that period. Meanwhile, in Michigan, Liquid Gold also did not break into the top 30, with rankings ranging from 67th to 77th. The sales figures in Michigan show a similar pattern, with a peak in March followed by a decline in April. This pattern might indicate seasonal trends or promotional activities that temporarily boosted sales.

While Liquid Gold's absence from the top 30 in both states might seem concerning, it's important to note the brand's resilience in maintaining a presence in these competitive markets. The sales trend in Massachusetts suggests a capacity for recovery, with a dip in February followed by a rebound in March. In Michigan, the brand's performance also highlights some volatility, with a significant drop in February but a subsequent recovery in March. These movements hint at potential strategies that could be explored to enhance market penetration and brand visibility. Understanding these dynamics can offer valuable insights into the brand's market positioning and potential growth opportunities in the Vapor Pens category.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Liquid Gold has experienced fluctuating rankings from January to April 2025, indicating a dynamic market presence. Despite not breaking into the top 20, Liquid Gold's sales have shown resilience, with a notable increase in March before a slight dip in April. This fluctuation is contrasted by competitors such as Midwest Extracts, which consistently improved its rank, reaching 72nd in April, and The Limit, which entered the rankings strongly in April at 71st. Meanwhile, Ice Kream Hash Co. showed a steady climb, peaking at 79th in April. These trends suggest that while Liquid Gold maintains a stable sales volume, competitors are gaining traction, potentially impacting Liquid Gold's market share and necessitating strategic adjustments to enhance its competitive positioning in Michigan's vapor pen category.

Notable Products

In April 2025, Blue Razz Distillate Cartridge (1g) emerged as the top-performing product for Liquid Gold, maintaining its number one rank from March with impressive sales of 1603 units. Apple Fritter Distillate Cartridge (1g) climbed to second place, improving from its fourth-place position in March. OG Distillate Cartridge (1g) ranked third, showing a slight decline from its second-place standing in February. Fruity Distillate Cartridge (1g) dropped to fourth place, while Sour Pebbles Distillate Cartridge (1g) rounded out the top five, both experiencing a decrease in sales compared to March. Overall, the Vapor Pens category continues to dominate the rankings, with notable shifts in product positions from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.