Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

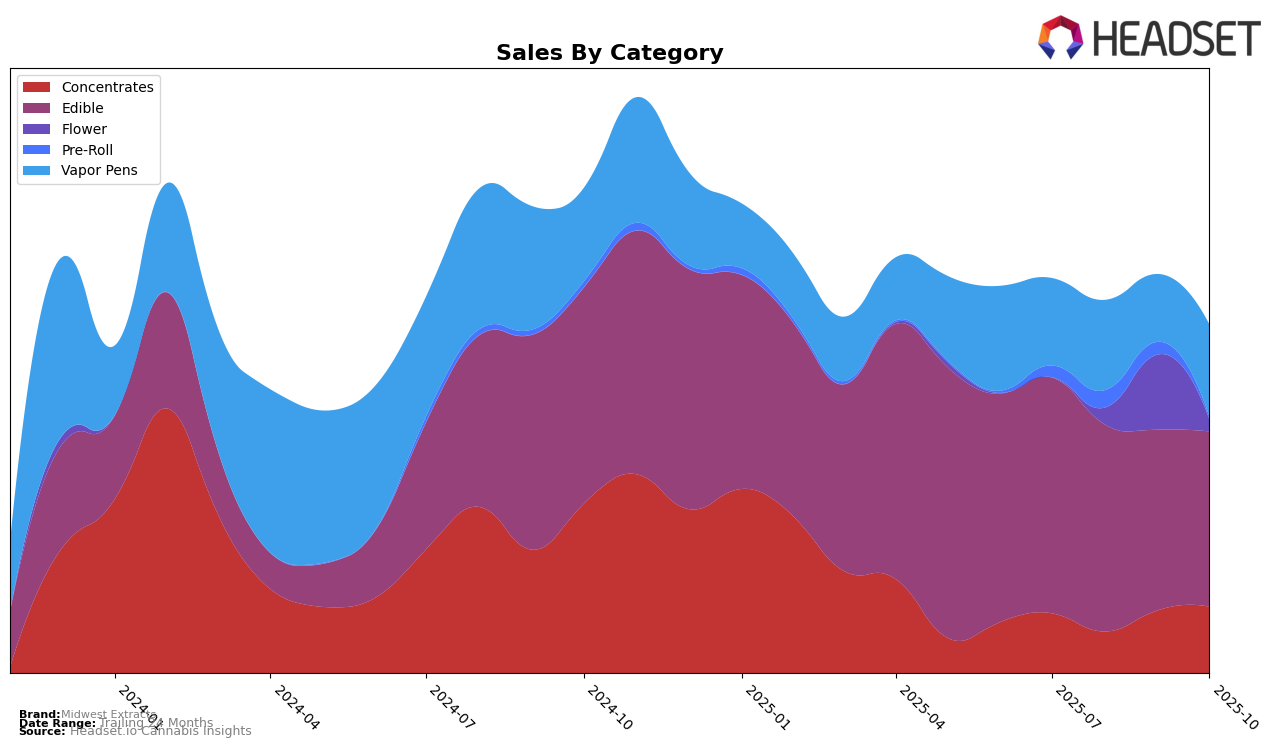

Midwest Extracts has shown varied performance across different categories and states, with notable movements in the Michigan market. In the Concentrates category, the brand achieved a consistent improvement, moving from rank 62 in August to 45 by September and maintaining that position in October. This upward trend indicates a strengthening presence, despite not being in the top 30. In contrast, their Vapor Pens category displayed volatility, fluctuating between ranks 67 and 77 over the months, suggesting a competitive landscape. The brand's sales figures for October in Vapor Pens, however, indicate a positive trajectory, reaching over 109,000, which could suggest potential for future growth.

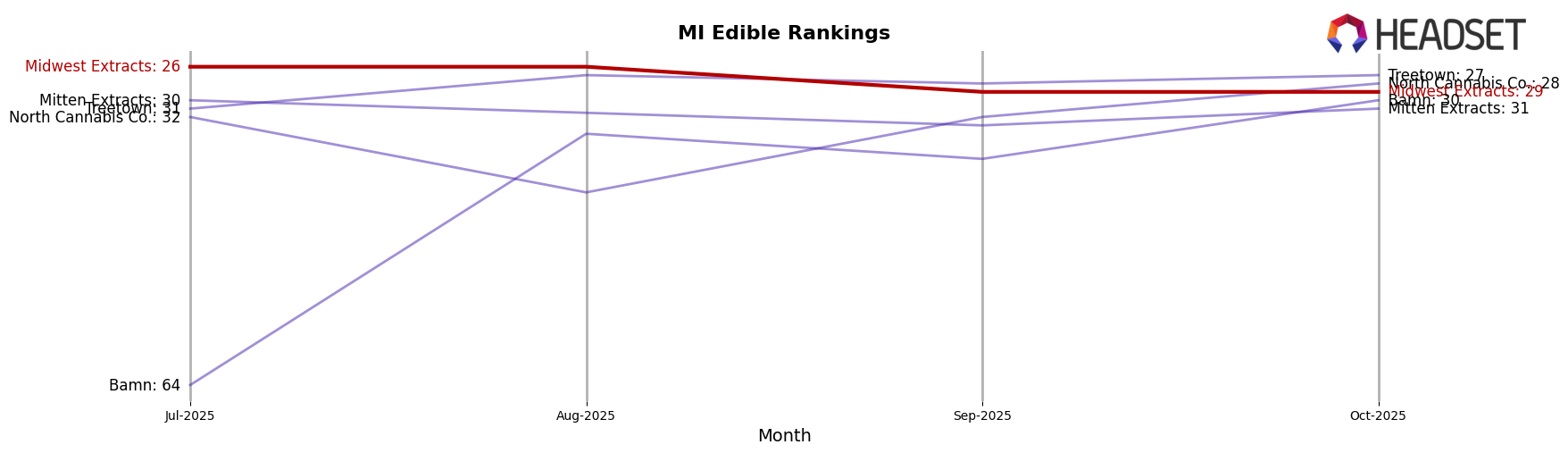

In the Edible category, Midwest Extracts has maintained a position within the top 30 in Michigan, although there was a slight decline from rank 26 in July and August to 29 in September and October. This decline might be concerning, but the brand's ability to stay within the top 30 suggests a stable consumer base. The sales trend, however, shows a gradual decrease from July through October, which might require strategic adjustments to regain momentum. Despite not being listed in the top 30 for other states, the brand's consistent presence in Michigan's Edibles category highlights an area of strength that could be leveraged for expansion.

Competitive Landscape

In the competitive landscape of the Edible category in Michigan, Midwest Extracts has experienced a slight decline in its market position, maintaining a rank of 26th in July and August 2025, before dropping to 29th in September and October 2025. This downward trend in rank coincides with a decrease in sales, which may be attributed to the rising competition from brands such as Treetown and North Cannabis Co., both of which have shown resilience and improvement in their rankings. Notably, Bamn has made significant strides, climbing from 64th in July to 30th in October, potentially capturing market share from Midwest Extracts. Meanwhile, Mitten Extracts has shown volatility, missing the top 20 in August but recovering to 31st by October. These dynamics suggest that Midwest Extracts may need to strategize effectively to regain its competitive edge and stabilize its sales trajectory amidst a shifting market environment.

Notable Products

In October 2025, Apple Gummies 10-Pack (200mg) emerged as the top-performing product from Midwest Extracts, securing the number one rank with impressive sales of 7,730 units. Strawberry Gummies 8-Pack (200mg) climbed to the second position, showing a slight improvement from its third-place ranking in September. Yuzu Gummies 8-Pack (200mg) entered the rankings for the first time at the third spot, indicating a growing popularity. Midwest Berry Gummies 10-Pack (200mg) followed closely in fourth place, maintaining a consistent presence in the top ranks. Exotic Oasis Gummies 8-Pack (200mg) experienced a drop from first in August to fifth in October, suggesting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.