Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

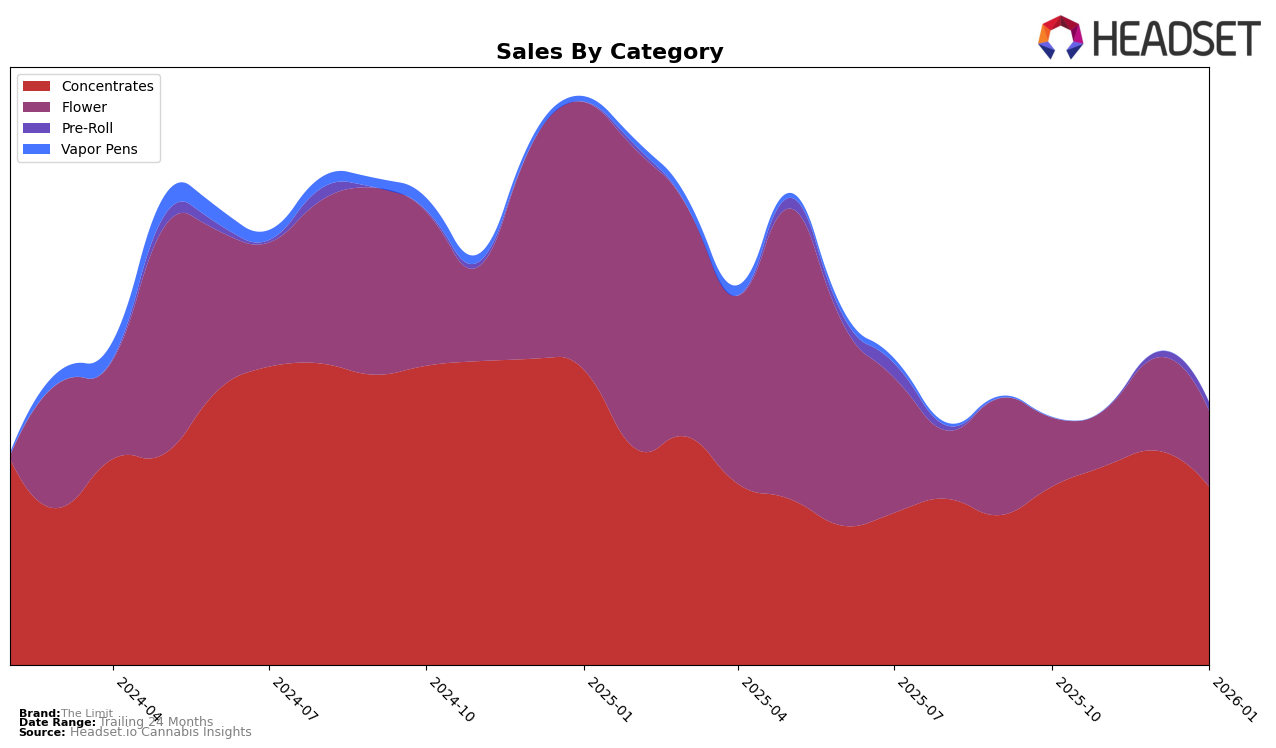

The Limit has demonstrated a strong and consistent performance in the Concentrates category in Michigan, maintaining the number one rank from October 2025 through January 2026. This stability at the top of the rankings is indicative of the brand's dominance and consumer preference in this category. However, despite this leading position, there was a noticeable dip in sales from December 2025 to January 2026, suggesting potential seasonal fluctuations or market saturation that could be worth monitoring in the upcoming months.

In contrast, The Limit's performance in the Flower category in Michigan has been more volatile, with rankings fluctuating between 41st and 79th place over the same period. While the brand experienced a significant improvement in rank from November to December 2025, moving up to 41st place, it did not manage to break into the top 30, indicating challenges in capturing market share in this highly competitive category. The brand's ability to improve its standing in December suggests potential strategies or product offerings that resonated with consumers, but sustaining and building on this momentum will be crucial for future growth in the Flower segment.

Competitive Landscape

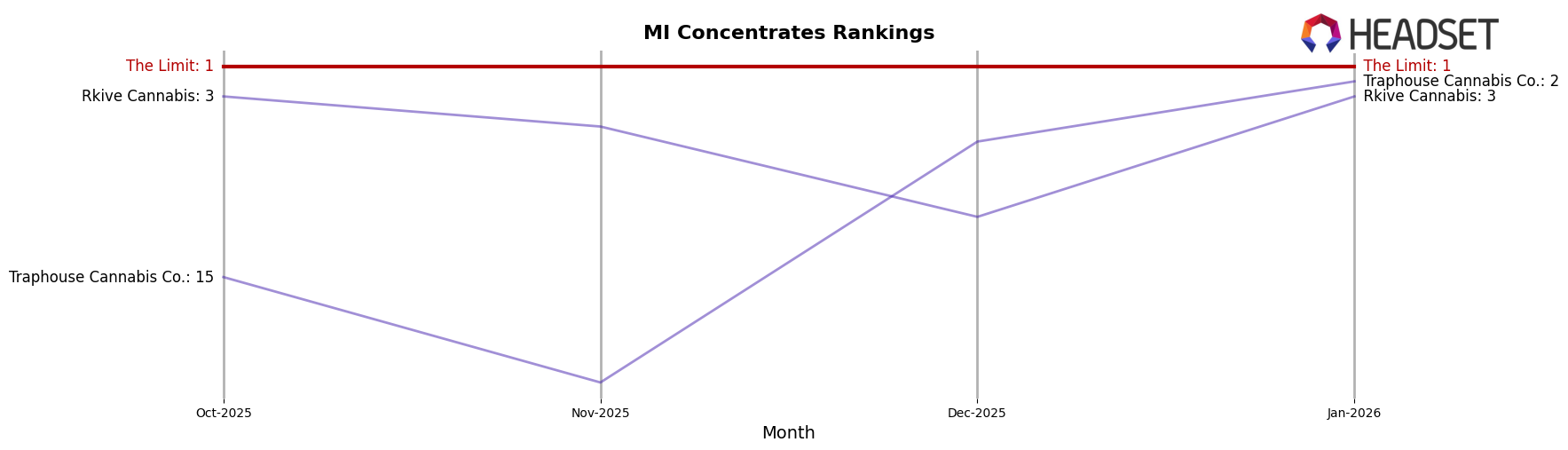

In the Michigan concentrates market, The Limit has consistently maintained its top position from October 2025 through January 2026, showcasing its dominance and stability in the category. Despite fluctuations in sales, The Limit's leadership remains unchallenged, even as competitors like Rkive Cannabis and Traphouse Cannabis Co. experience notable rank changes. Rkive Cannabis has seen a decline from 3rd to 11th place in December 2025 before rebounding to 3rd in January 2026, indicating potential volatility. Meanwhile, Traphouse Cannabis Co. has made a remarkable climb from 15th in October 2025 to 2nd by January 2026, suggesting a strong upward trend in sales and market presence. These shifts highlight the competitive landscape where The Limit continues to excel, but also underscore the dynamic nature of the market where competitors are making significant strides.

Notable Products

In January 2026, Banana Runtz Live Resin (1g) emerged as the top-performing product for The Limit, achieving the number one rank in the Concentrates category with sales of 5646 units. Pink Sherb Live Resin (5g) moved up to the second position from the third in December 2025, showing a notable increase in sales to 5545 units. Berry Gelato Live Resin (5g) entered the rankings at third place, demonstrating strong market entry with significant sales. Bixcotti Live Resin (5g) and Bixcotti Live Resin (1g) secured the fourth and fifth positions, respectively, highlighting their consistent demand. This month saw a reshuffling in the top ranks, with Banana Runtz Live Resin (1g) making a remarkable debut at the top.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.